$1.4 trillion commerce struggle: How Trump tariffs might hit the world, could carry India barely

On April 2, in a Rose Backyard ceremony, US President Donald Trump will declare “Liberation Day.” However as an alternative of releasing the financial system, the tariffs he plans to unveil might slam the brakes on international progress, ignite inflation, and throw the world into an financial tailspin.

Driving the information

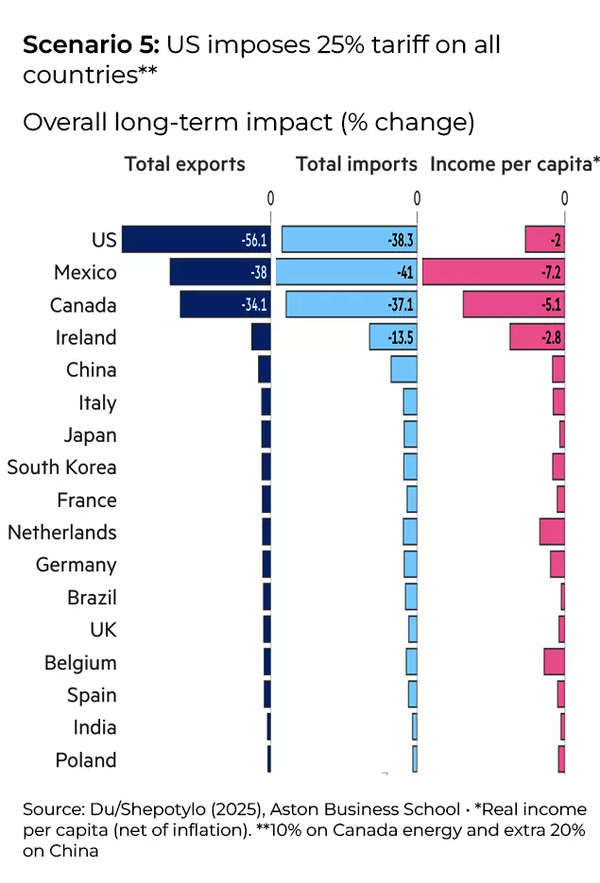

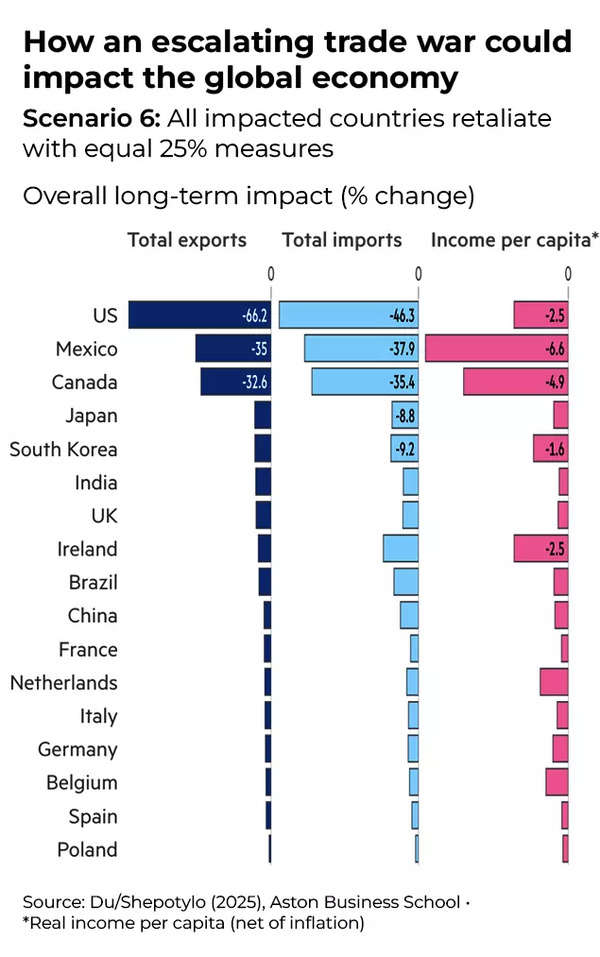

- In accordance with a Monetary Instances report that’s based mostly on econometric research by Aston College, a worst-case international retaliation to Trump’s proposed 25% tariffs might hammer the world financial system with a $1.4 trillion revenue hit and cripple international commerce.

- The analysis fashions six escalating eventualities based mostly on bilateral commerce knowledge from 132 international locations, exhibiting how a tit-for-tat tariff spiral would transfer from North America to Europe and past — destabilizing provide chains and inflating costs.

- As per a Washington Put up report, White Home adviser Peter Navarro stated Sunday that President Donald Trump’s new tariffs would generate greater than $6 trillion in federal income over the following ten years — a projection that, if realized, would quantity to the biggest peacetime tax enhance in fashionable US historical past, based on consultants.

- Talking on Fox Information, Navarro stated the tariffs on auto imports would herald $100 billion yearly. He added {that a} broader set of still-unspecified tariffs would yield an extra $600 billion per yr, totaling $6 trillion over the following decade.

Why it issues

- Trump’s advisers argue the financial ache is price it. They envision a future the place American factories hum once more, imports shrink, and tariff income funds a brand new period of home tax cuts.

- “Entry to low-cost items isn’t the essence of the American Dream,” stated treasury secretary Scott Bessent. “The dream is rooted in upward mobility and financial safety.”

- However traders and economists aren’t satisfied. The S&P 500 dropped 4.6% in Q1, its worst begin since 2022.

- Goldman Sachs elevated the chance of a US recession to 35%, up from 20%.

- US allies, together with Canada, Japan, and Germany, have warned the White Home that indiscriminate tariffs might spark retaliatory spirals and injury international progress.

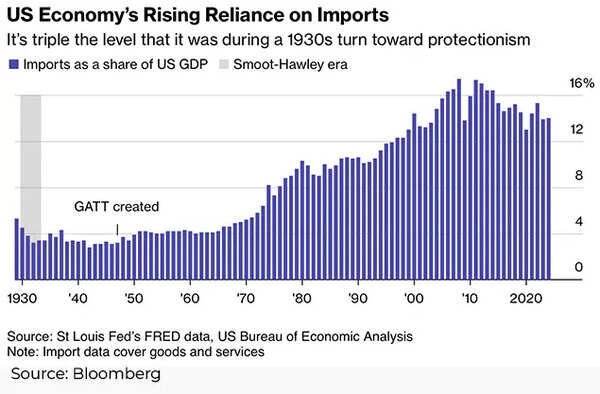

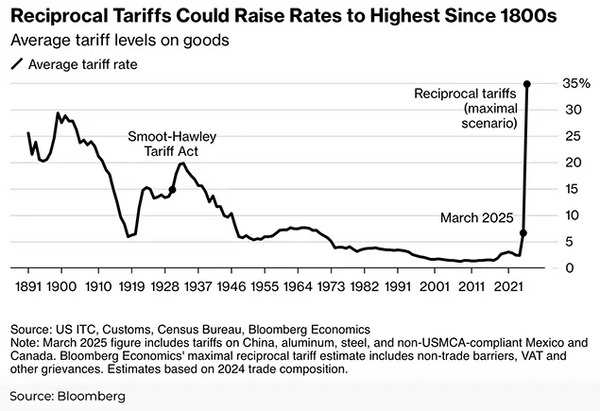

- “That is going to be a lot larger than Smoot-Hawley,” stated financial historian Douglas Irwin. “Imports are a a lot higher share of GDP now than they have been within the early Nineteen Thirties.”

We’re going to cost international locations for doing enterprise in our nation and taking our jobs, taking our wealth, taking a variety of issues that they’ve been taking through the years. They’ve taken a lot out of our nation, buddy and foe.

Donald Trump

Trump’s plan — concentrating on international locations that impose larger tariffs on US items — might considerably reshape the worldwide financial order. In accordance with the FT report, the analysis performed by economists at Aston College explores how a cycle of retaliatory tariffs triggers intricate modifications in international commerce, initially impacting North America—particularly the US, Mexico, and Canada—earlier than extending to Europe and ultimately affecting the remainder of the world.

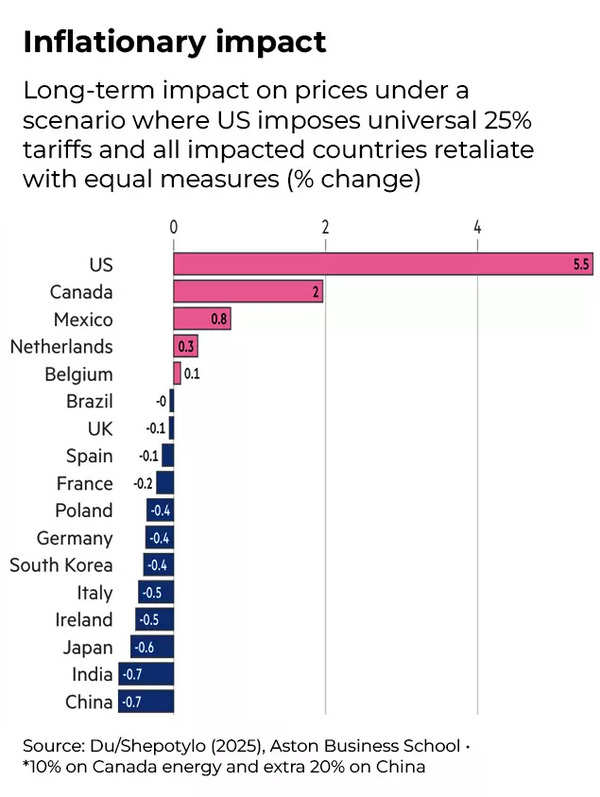

Whereas just a few nations like India could reap modest positive factors from diverted commerce, the larger image is grim:

- US exports fall over 46%, triggering steep home inflation of greater than 5%.

- Dwelling requirements decline globally, particularly in international locations closely depending on US commerce.

- Bloomberg Economics estimates US GDP might shrink by 4% if tariffs are broadly imposed and retaliated. Costs might bounce 2.5% over 2–3 years, hurting client buying energy.

- India, the UK, Japan, and South Korea may gain advantage briefly — however provided that escalation stays average.

India’s strategic alternative—and its limits

India seems, on paper, to be one of many few international locations with one thing to achieve. In eventualities the place commerce patterns shift to keep away from US-EU or US-China tariff boundaries, India, together with the UK, Japan, and South Korea, may gain advantage modestly from commerce diversion. These international locations would possibly see elevated demand for exports in sectors the place the US beforehand relied on extra tariff-encumbered suppliers.

For India, the chance lies in electronics, prescription drugs, and textiles—sectors already being nurtured underneath the “Make in India” initiative. The nation’s rising fame as a producing different to China, together with a impartial place exterior main commerce blocs just like the EU, might place it as a go-to provider in a time of uncertainty.

However the positive factors are marginal. And fleeting.

“India would possibly profit from just a few provide chain shifts,” stated a senior economist at a New Delhi-based assume tank, “but when the worldwide commerce atmosphere turns unstable, capital flows will develop into unstable, inflation will rise, and the ripple results will catch up.”

Certainly, India imports a lot of its power, equipment, and high-end elements. A broad-based commerce struggle would make many of those imports dearer. That might stoke inflation and squeeze the federal government’s fiscal room. The Reserve Financial institution of India, already cautious resulting from sticky meals costs, may be compelled to tighten coverage—probably dampening progress.

In brief: India would possibly catch a breeze within the early gusts, however it gained’t escape the storm.

Again to the longer term?

Curiously, Trump’s renewed tariff push comes at a time when the US financial system is extra reliant on imports than ever earlier than. Its imports now account for roughly 14–16% of US GDP — a determine practically triple what it was throughout the protectionist Smoot-Hawley period of the Nineteen Thirties. This underscores how deeply built-in the US is in international provide chains right this moment. A return to aggressive tariffs, like these Trump is proposing, dangers stunning a system constructed on many years of liberalized commerce coverage, a Bloomberg report stated.

Subsequent, if absolutely carried out, his “reciprocal tariff” technique would drive US common tariff ranges on items as much as round 35%—the very best because the late 1800s. This is able to far surpass even the degrees seen throughout the notorious Smoot-Hawley interval, which historians broadly blame for deepening the Nice Despair. Trump’s plan would reintroduce commerce boundaries at a scale unseen in over a century, regardless of a contemporary financial system way more uncovered to worldwide commerce.

The distinction between the 2 charts paints a stark image: whereas the construction of the US financial system has developed to rely closely on imports, Trump’s proposed commerce coverage seems rooted in an period when worldwide commerce was minimal. Economists warn this disconnect might gasoline inflation, disrupt industries, and result in retaliation that hobbles each international and home progress.

What’s subsequent?

Trump’s long-promised “Liberation Day” speech can be watched for 3 key particulars:

Common or reciprocal? The White Home stays break up.

Sectoral carveouts? Vehicles, metal, pharma, and semiconductors are in focus.

Period and adaptability. Will tariffs be negotiable or mounted for the long run?

Contained in the West Wing, factions are pushing totally different approaches. Some advocate a tough 20% common tariff to ship a sign. Others desire a versatile construction to open room for bilateral negotiations.

“With Trump, it’s all a negotiation,” stated Sen. James Lankford. “This is sort of a kitchen rework. It’s going to be noisy, however we all know the place we’re headed.”

However others warn, “You don’t rework the worldwide financial system with a hammer,” a European commerce official quipped off report.

The underside line

Trump’s tariff plan is a daring gamble that would remake the worldwide buying and selling system — or plunge it into extended uncertainty. India finds itself in a uncommon place: not the goal of the primary strike, and presumably in line for modest commerce positive factors.

However as historical past warns, and the info confirms, no nation is really secure when tariffs develop into the world’s financial weapon of selection.

&w=1200&resize=1200,0&ssl=1)