T+0 settlement: Extra shares added

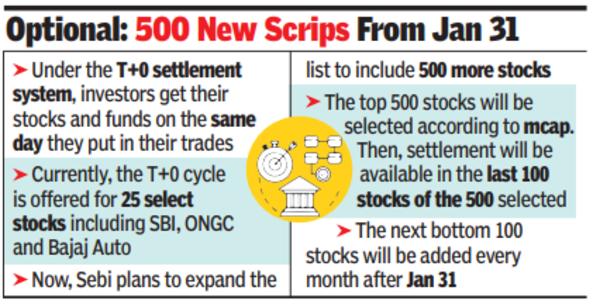

MUMBAI: Markets regulator Sebi has determined to broaden the listing of shares for the optionally available T+0 mode of buying and selling & settlement to incorporate 500 extra from Jan 31. Presently, the T+0 settlement cycle is obtainable for 25 choose shares that embrace SBI, ONGC and Bajaj Auto. The mechanism was began in March this yr.

A Sebi round mentioned that as a primary step, high 500 shares might be chosen based on market capitalisation on Dec 31. Within the first part, the T+0 settlement might be obtainable within the final 100 shares of the five hundred chosen. In every month thereafter, the following backside 100 shares might be added to the listing, it mentioned. The method would begin on Jan 31, 2025.

Beneath the T+0 (identical day) settlement system, traders will get their shares and funds on the finish of the day they put of their trades. India is the primary nation to maneuver into such a inventory buying and selling course of.

Globally, and in India too, the extra prevalent mode of settlement is the T+1 course of. Beneath the T+1 settlement system, patrons and sellers of shares get them of their demat accounts and the cash of their financial institution accounts a day after the day of commerce.

On Tuesday, Sebi mentioned that every one brokers can be allowed to supply the T+0 settlement system to their purchasers. From Might 2025, even custodians, who serve massive traders together with institutional ones, would be part of the system and block trades can be supplied below this course of too.

Sebi has requested certified inventory brokers with a minimal variety of lively purchasers as of Dec 31, 2024 to place in place techniques in order that their purchasers can take part within the T+0 settlement cycle. New QSBs will get three months to place in techniques compliant with the T+0 course of, it mentioned.

The regulator has additionally requested inventory exchanges, clearing firms, depositories and custodians to work on techniques in order that institutional traders can take part on this shorter mode of settlement.

Earlier, Sebi had mentioned that after the T+0 mode of settlement is absolutely carried out, it will transfer to an prompt settlement mode.