India reserves proper to negate Britain’s CBAM affect, ETCFO

New Delhi: The India-UK free commerce settlement doesn’t embody a provision on Britain’s proposed Carbon Border Adjustment Mechanism (CBAM) but when such a tax is imposed sooner or later, India can have the suitable to take steps to mitigate its affect on home exports, officers mentioned Friday.

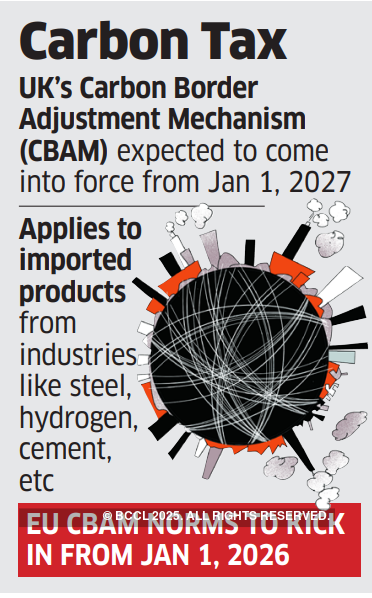

CBAM shouldn’t be within the pact as Britain has not but notified the tax.The UK had in December 2023 determined to implement CBAM from 2027.

The difficulty was flagged through the Complete Financial and Commerce Settlement (CETA) negotiations.

“Whether it is carried out and negates the commerce advantages of India underneath the settlement, India can have the liberty to rebalance it. We will take counterbalancing measures. This a lot understanding has been made within the type of word verbale,” mentioned an official.

A word verbale is a diplomatic communication between two nations.

“There may be an understanding that in case the UK make it efficient in opposition to India in future, then we will even have the suitable to take counterbalance measures… India can take away the concessions and there will likely be a mechanism for that,” the official added.

India can also be in talks with the EU, which additionally plans to place in a CBAM. The 2 sides are negotiating a commerce pact, which is prone to be concluded this yr. India has termed the CBAM a commerce barrier.