Nuclear-powered AI may make Rolls Royce UK’s largest agency, says boss

Enterprise editor

BBC

BBCRolls-Royce’s plan to energy synthetic intelligence (AI) with its nuclear reactors may make it the UK’s most dear firm, its boss has mentioned.

The engineering agency has signed offers to supply small modular reactors (SMRs) to the UK and Czech governments to energy AI-driven information centres.

AI has boomed in reputation since 2022, however the expertise makes use of numerous vitality, one thing which has raised sensible and environmental issues.

Rolls-Royce chief govt Tufan Erginbilgic informed the BBC it has the “potential” to turn out to be the UK’s highest-valued firm by overtaking the biggest corporations on the London Inventory Trade because of its SMR offers.

“There is no such thing as a personal firm on the earth with the nuclear functionality we have now. If we’re not market chief globally, we did one thing mistaken,” he mentioned.

Mr Erginbilgic has overseen a ten-fold improve in Rolls-Royce’s share worth since taking up in January 2023.

Nonetheless, he has dominated out the thought of Rolls-Royce in search of to checklist its shares in New York as British chip designer Arm has completed and the likes of Shell and AstraZeneca have thought of within the seek for greater valuations.

That is even though 50% of its shareholders and clients are US-based.

“It is not in our plan,” mentioned Mr Erginbilgic, a Turkish vitality business veteran. “I do not agree with the thought you may solely carry out within the US. That is not true and hopefully we have now demonstrated that.”

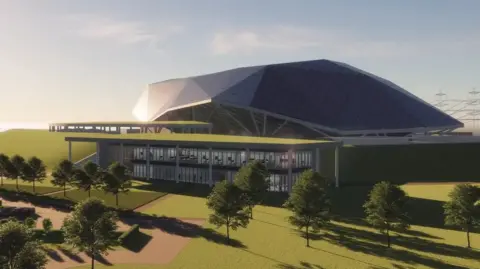

Rolls-Royce

Rolls-RoyceAI funding

Rolls-Royce already provides the reactors that energy dozens of nuclear submarines. Mr Erginbilgic mentioned the corporate has a large benefit sooner or later market of bringing that expertise on land within the type of SMRs.

SMRs should not solely smaller however faster to construct than conventional nuclear crops, with prices more likely to come down as models are rolled out.

He estimates that the world will want 400 SMRs by 2050. At a value of as much as $3bn (£2.2bn) every, that is one other trillion dollar-plus market he needs and expects Rolls-Royce to dominate.

The corporate has signed a deal to develop six SMRs for the Czech Republic and is growing three for the UK.

Nevertheless it stays an unproven expertise. Mr Erginbilgic conceded he couldn’t at the moment level to a working SMR instance however mentioned he was assured in its future potential.

There are additionally issues concerning the calls for on water provides from the information centre and SMR cooling techniques.

In response, firms together with Google, Microsoft and Meta have signed offers to take vitality from SMRs within the US when they’re accessible.

Subsequent technology plane

Rolls-Royce sees SMRs as key to its future, however its largest enterprise is plane engines.

Already dominant in supplying engines to wide-bodied plane like Boeing 787 and Airbus A350, it plans to interrupt into the following technology of narrow-bodied plane just like the Boeing 737 and Airbus A320. This market is value $1.6tn – 9 instances that of the wide-bodied .

Rolls-Royce is a bit participant in a market that has highly effective and profitable leaders, and that rival Pratt and Witney misplaced $8bn making an attempt and failing to interrupt into.

The market is dominated by CFM Worldwide – a three way partnership between US-based GE Aerospace and French firm Safran Aerospace Engines.

Business veterans informed the BBC that market leaders can and can drop costs to airline clients lengthy sufficient to see off a brand new assault on their market dominance.

However Mr Erginbilgic mentioned this isn’t simply the largest enterprise alternative for Rolls-Royce. Moderately, it’s “for industrial technique… the only largest alternative for the UK for financial development”.

“No different UK alternative, I problem, will match that,” he mentioned.

Share worth up ten-fold

Though Rolls-Royce offered its automobile making enterprise to BMW practically 30 years in the past, the title of the corporate remains to be synonymous with British engineering excellence.

However within the early a part of this decade that shine had worn off. The corporate was closely indebted, its revenue margins had been non-existent, and 1000’s of employees had been being laid off.

When Mr Erginbilgic took over in January 2023, he likened the corporate to “a burning platform”.

“Our price of capital was 12%, our return was 4% so each time we invested we destroyed worth,” he mentioned.

Two and a half years later, the corporate expects to make a revenue of over £3bn, its debt ranges have fallen and shares have risen over 1,000% – a ten-fold rise.

So how did that occur? And is Mr Erginbilgic proper to suppose that Rolls-Royce’s roll is simply simply beginning?

‘Grudging respect’

The timing of his appointment was lucky based on some business veterans.

Rolls-Royce’s largest enterprise – supplying engines to industrial airways – has rebounded strongly from the Covid pandemic.

The corporate’s most profitable product – the Trent sequence of plane engines – are on the candy spot of profitability because the returns on funding of their growth over a decade in the past start to pour into firm coffers.

Russia’s full-scale invasion of Ukraine in 2022 arguably made it virtually inevitable that its defence enterprise would see greater spending from European governments – which has been confirmed by latest bulletins.

Unions haven’t all the time been followers of Mr Erginbilgic’s hard-charging strategy.

In October 2023, certainly one of his first main transfer was reducing jobs, which drew criticism from Sharon Graham, the boss of the Unite union.

“This announcement seems to be about appeasing the markets and its shareholders whereas ignoring its employees,” she mentioned on the time.

Nonetheless, total international headcount has grown from 43,000 to 45,000 since 2023 and union sources say there may be “grudging respect” for Mr Erginbilgic.

These sources give him one third of the credit score for the turnaround round within the firm’s fortunes, with a 3rd credited to market situations and a 3rd to his predecessor Warren East for “steadying the ship”.

So does Mr Erginbilgic actually imagine that Rolls-Royce will be the UK’s most dear firm – overtaking the likes of AstraZeneca, HSBC, and Shell?

“We at the moment are quantity 5 within the FTSE. I imagine the expansion potential we created within the firm proper now, in our current enterprise and our new companies, truly sure – we have now that potential.”

Rolls-Royce is undoubtedly an organization with the wind at its again – and Tufan Ergenbilgic actually believes he has set the sails excellent.

Get our flagship publication with all of the headlines you’ll want to begin the day. Enroll right here.