Fewer US rate of interest cuts anticipated after job positive factors shock

Getty Pictures

Getty PicturesUS jobs development unexpectedly surged final month, suggesting the world’s largest’s financial system will not be about to surrender its declare to be the “envy of the world” anytime quickly.

Listed below are three issues we have discovered from the newest numbers.

1. The US financial system is stronger than anticipated

For years, there have been rumblings of concern a few potential downturn on this planet’s largest financial system.

It has constantly proved the doubters flawed and final month was no exception.

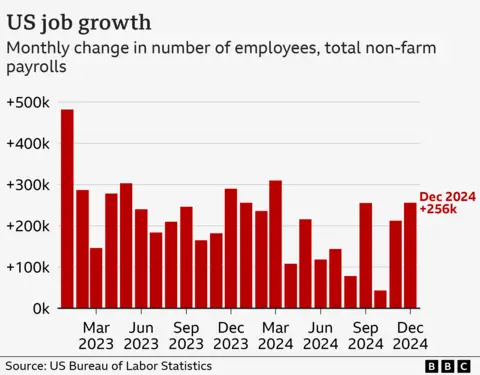

The job positive factors in December had been a lot greater than the roughly 160,000 analysts had anticipated: Employers added 256,000 jobs and the unemployment price dropped from 4.2% in November to 4.1%, the Labor Division stated.

General, 2.2 million jobs had been added final yr – a mean of 186,000 a month.

That marked a slowdown from a yr earlier, however remains to be a reasonably wholesome determine.

Common hourly pay was up 3.9% final month in contrast with December 2023. It is a stable achieve however not one so sturdy as to fret analysts that quick wage development will immediate value will increase to abruptly speed up.

Nathaniel Casey, funding strategist at wealth administration agency Evelyn Companions, known as it “the goldilocks of labour market releases”.

2. There could possibly be fewer rate of interest cuts

The US central financial institution, which is charged with holding each costs and employment secure, reduce rates of interest for the primary time in additional than 4 years in September, saying it needed to move off indicators of weak spot within the jobs market.

It boosted hopes of many would-be debtors within the US, who’ve been dealing with the best borrowing prices in roughly twenty years and had been wanting to see them come down.

However the energy of this month’s knowledge suggests fears in regards to the jobs market could have been untimely, eradicating strain on the financial institution to behave.

Rates of interest on 10 and 30-year authorities debt within the US jumped after the report, with the latter topping 5%.

Buyers had already been paring again bets on cuts this yr, anxious by indicators that the financial institution’s progress on stabilising costs was stalling.

There are additionally dangers insurance policies known as for by President-elect Donald Trump, corresponding to sweeping border taxes and migrant deportations, might increase costs or wages, placing strain on inflation.

Even when inflation knowledge due subsequent week reveals inflation – the speed of value will increase -cooling, Ellen Zentner, chief financial strategist for Morgan Stanley Wealth Administration, stated this jobs knowledge means she does not anticipate the Fed “to chop charges any time quickly.”

3. Larger US borrowing prices imply greater world charges too

The rates of interest set by the US central financial institution have a strong affect over borrowing prices for a lot of loans – and never solely in America.

Borrowing prices globally have elevated in latest months, responding to expectations that US rates of interest are more likely to stay greater for longer.

Within the UK, for instance, the rate of interest, or yield, on 30-year authorities debt hit the best stage in additional than 25 years earlier this week, placing strain on the federal government because it tries to work out its spending and borrowing plans.

Whereas the newest US jobs figures could be excellent news for the US financial system and its greenback, Seema Shah, chief world strategist at Principal Asset Administration, warned they might be “punishing information for world bond markets, significantly UK gilts”, referring to the title of presidency bonds, or debt.

“The height for yields has not but been reached, suggesting extra stresses that a number of markets, particularly the UK, can unwell afford,” she stated.