Is the US headed right into a recession beneath Trump?

Getty Photos

Getty PhotosThroughout his election marketing campaign final 12 months, Donald Trump promised People he would usher in a brand new period of prosperity.

Now two months into his presidency, he is portray a barely completely different image.

He has warned that it will likely be exhausting to carry down costs and the general public must be ready for a “little disturbance” earlier than he can carry again wealth to the US.

In the meantime, analysts say the percentages of a downturn are growing, pointing to his insurance policies.

So is Trump about to set off a recession on this planet’s largest financial system?

Markets fall and recession dangers rise

Within the US, a recession is outlined as a protracted and widespread decline in financial exercise usually characterised by a soar in unemployment and fall in incomes.

A refrain of financial analysts have warned in latest days that the dangers of such a situation are rising.

A JP Morgan report put the prospect of recession at 40%, up from 30% at first of the 12 months, warning that US coverage was “tilting away from progress”, whereas Mark Zandi, chief economist at Moody’s Analytics, upped the percentages from 15% to 35%, citing tariffs.

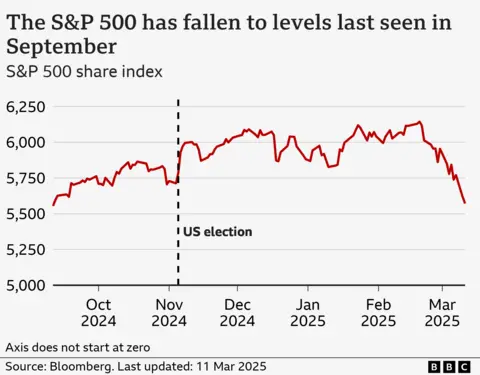

The forecasts got here because the S&P 500, which tracks 500 of the largest firms within the US sank sharply. It has now fallen to its lowest stage since September in an indication of fears in regards to the future.

The market turmoil is being pushed partly by issues about new taxes on imports, known as tariffs, which Trump has launched since he took workplace.

He has hit merchandise from America’s three largest commerce companions with the brand new duties, and threatened them extra extensively in strikes that analysts imagine will improve costs and curb progress.

Trump and his financial advisers have been warning the general public to be ready for some financial ache, whereas showing to dismiss the market issues – a marked change from his first time period, when he continuously cited the inventory market as a measure of his personal success.

“There’ll at all times be adjustments and changes,” he mentioned final week, in response to pleas from companies for extra certainty.

The posture has elevated investor worries about his plans.

Goldman Sachs final week raised its recession bets from 15% to twenty%, saying it noticed coverage adjustments as “the important thing threat” to the financial system. Nevertheless it famous that the White Home nonetheless had “the choice to drag again if the draw back dangers start to look extra critical”.

“If the White Home remained dedicated to its insurance policies even within the face of a lot worse information, recession threat would rise additional,” the agency’s analysts warned.

Tariffs, uncertainty and slowing progress

For a lot of companies, the largest query mark is tariffs, which increase prices for US companies by placing taxes on imports. As Trump unveils tariff plans, many firms at the moment are going through decrease revenue margins, whereas holding off on investments and hiring as they struggle to determine what the long run will appear like.

Buyers are additionally anxious about huge cuts to the federal government workforce and authorities spending.

Brian Gardner, chief of Washington coverage technique on the funding financial institution Stifel, mentioned companies and traders had thought Trump meant tariffs as a negotiating software.

“However what the president and his cupboard are signalling is definitely an even bigger deal. It is a restructuring of the American financial system,” he mentioned. “And that is what’s been driving markets within the final couple of weeks.”

The US financial system was already present process a slowdown, engineered partially by the central financial institution, which has stored rates of interest greater to attempt to cool exercise and stabilise costs.

In latest weeks, some information suggests a extra fast weakening.

Retail gross sales fell in February, confidence – which had popped after Trump’s election on a number of surveys of shoppers and companies – has fallen, and firms together with main airways, retailers reminiscent of Walmart and Goal, and producers are warning of a pullback.

Some analysts are anxious a drop within the inventory market might set off an additional clampdown in spending, particularly amongst greater revenue households.

That might ship a serious hit to the US financial system, which is pushed by shopper spending and has grown more and more depending on these richer households, as decrease revenue households face strain from inflation.

The pinnacle of the US central financial institution, Jerome Powell, provided assurances in a speech final week, noting that sentiment had not been a superb indicator of behaviour in recent times.

“Regardless of elevated ranges of uncertainty, the US financial system continues to be in a superb place,” he mentioned.

However the US financial system is at present deeply linked to the remainder of the world, warned Kathleen Brooks, analysis director at XTB.

“The truth that tariffs might disrupt that on the similar time that there have been indicators that the US financial system was weakening anyway .. is absolutely fuelling recession fears,” she says.

Inventory market in tech ripe for correction

The unease within the inventory market is not all about Trump.

Buyers have been already jittery about the potential of a correction, after huge features over the past two years, pushed by the sharp run-up in tech shares fuelled by investor optimism about synthetic intelligence (AI),

Chipmaker Nvidia, for instance, noticed its share worth soar from lower than $15 at first of 2023 to just about $150 in November of final 12 months.

That kind of rise had stirred debate about an “AI bubble” – with traders on excessive alert for indicators of it bursting, which might have a huge impact on the inventory market, whatever the dynamics within the wider financial system.

Now, with views of the US financial system darkening, optimism about AI is getting even more durable to maintain.

Tech analyst Gene Munster of Deepwater Asset Administration wrote on social media this week that his optimism had “taken a step again” as the prospect of a recession elevated “measurably” over the previous month.

“The underside line is that if we enter a recession, it will likely be extraordinarily troublesome for the AI commerce to proceed,” he mentioned.

&w=1200&resize=1200,0&ssl=1)