Blow to Chancellor Rachel Reeves after shock UK borrowing bounce

Getty Photographs

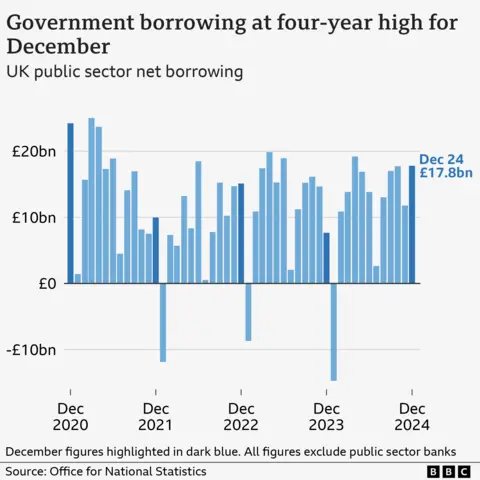

Getty PhotographsAuthorities borrowing rose greater than anticipated in December to hit its highest degree for the month for 4 years, piling extra strain on the UK’s funds.

Borrowing – the distinction between spending and tax income – was £17.8bn final month, £10.1bn greater than in December 2023, the Workplace for Nationwide Statistics (ONS) mentioned.

Spending on public providers, advantages, and debt curiosity have been all up on the yr, the ONS mentioned, whereas a rise in tax take was offset by a lower to Nationwide Insurance coverage by the earlier authorities.

The spike in borrowing prices threatens the federal government’s financial plans, with Chancellor Rachel Reeves going through strain after figures final week confirmed the UK financial system had flatlined.

The federal government has mentioned rising the financial system is its fundamental precedence with a purpose to enhance residing requirements, however the newest information revealing well being of the UK financial system provides to hypothesis that Reeves may lower public spending on providers.

The overall £17.8bn borrowed by the federal government was a lot greater than the £14.6bn forecast Workplace for Funds Duty, the UK’s official forecaster.

Curiosity charged on authorities debt in the meantime was £8.3bn, which was £3.8bn greater than it was the yr earlier than. The quantity marked the third-highest December debt curiosity repayments since month-to-month data started in January 1997.

Rates of interest paid on authorities debt surged earlier this month earlier than falling again.

Following the discharge of the borrowing figures on Wednesday, Ms Reeves performed down the affect the latest market turbulence would have on her assembly her self-imposed borrowing guidelines, which purpose to take care of credibility with monetary markets and taxpayers.

On Wednesday, the rate of interest charged on UK authorities debt a 10-year interval retreated to 4.5%, close to to the place it was at first of the yr and down from its 4.9% peak final week.

However Alex Kerr, UK economist at Capital Economics, mentioned in opposition to the backdrop of sluggish financial development and excessive rates of interest, “December’s overshoot in borrowing is additional disappointing information for the chancellor”.

He added that whereas borrowing prices had fallen again, they have been nonetheless greater than on the time of the Funds.

Mr Kerr mentioned weak financial development steered that Reeves “may have to boost taxes and/or lower spending” in March with a purpose to meet her personal guidelines.

Elliott Jordan-Doak, senior UK economist at Pantheon Macroeconomics, mentioned he additionally anticipated the chancellor to stipulate public spending reductions in March, including that “additional tax will increase on the subsequent Funds in October can be a very good wager”.

Reeves has beforehand mentioned that she wouldn’t be “coming again with extra borrowing or extra taxes” following her first Funds in October, which suggests she is left with few choices.

Enterprise are set to reveal the brunt of tax rises coming into have an effect on in April, with hikes within the Nationwide Insurance coverage price and a discount to the brink for employers.

Corporations have repeatedly warned the additional prices, together with minimal wages rising and enterprise charges reduction being decreased, may affect UK financial development, with employers anticipating to have much less money to offer pay rises and create new jobs.

Darren Jones, Chief Secretary to the Treasury, mentioned the federal government’s borrowing guidelines have been “non-negotiable” with a purpose to preserve financial stability and development.

He added the federal government would “root out waste to make sure each penny of taxpayer’s cash is spent productively”.

The quantity borrowed was the third-highest for a December since month-to-month data started in 1993. It included a one-off £1.7bn fee from the federal government to the personal sector to repurchase army lodging.

The upper borrowing means, with a lot of the monetary yr gone, the distinction between what the federal government has spent and what it earns in taxes is £4bn greater than official forecasts.

Nevertheless, that determine contains a number of estimates which are sometimes revised at a later date.

January’s borrowing determine may also be a lot completely different to December’s on account of a number of folks submitting self-assessment tax returns, which will increase the federal government’s income.