Cost Aggregators Innovate with Anti-Fraud Know-how to Enhance Revenues, ETCFO

Massive on-line merchant-focused cost aggregators (PAs) are constructing software program platforms for fraud detection and deploying them in banks and different fintech firms. It comes at a time when income technology from core funds enterprise has turn into harder owing to extreme competitors and pricing rules by the federal government.

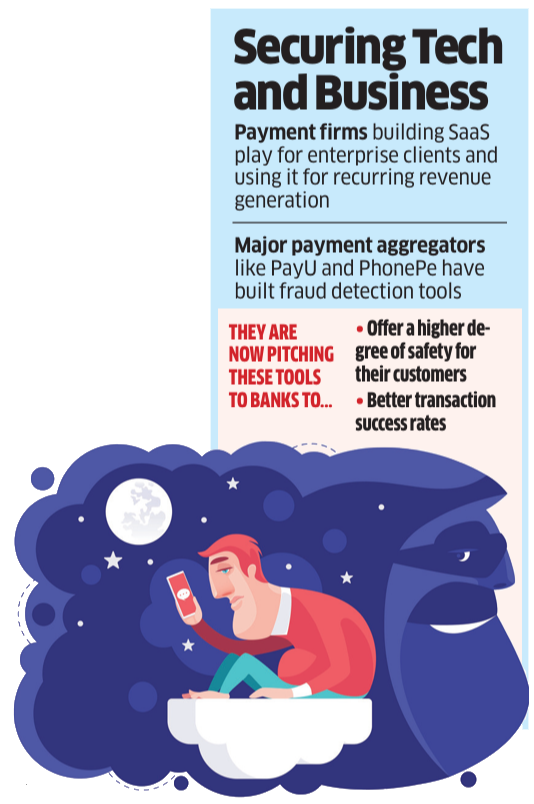

Cost firms are constructing software-as-a-service play for his or her enterprise purchasers and utilizing it for recurring income technology.

Main PAs reminiscent of PayU, Razorpay and PhonePe have constructed fraud detection instruments to guard their prospects and stop frauds of their techniques. Now they’re pitching these instruments to banks, providing them a better diploma of security for his or her prospects in addition to higher transaction success charges.

A senior trade government advised ET that globally companies reminiscent of Visa and Mastercard provide superior fraud detection companies for card funds and that India cost firms are shifting on this course together with mobile-based funds.

“The regulator has licensed some 50 on-line Pas. Now all of them are chasing the big ecommerce retailers to seize a big chunk of the funds worth. However income technology has been a problem, therefore they’re specializing in constructing value-added companies,” mentioned the manager, who didn’t want to be recognized.

Apart from, given that nearly each group financial institution, cooperative financial institution and mid-sized personal sector lender now provides digital cost options reminiscent of debit playing cards and Unified Funds Interface (UPI) to their prospects, know-how service suppliers for superior fraud detection.

“There are 668 banks stay on UPI, as per the NPCI’s newest depend. Smaller banks can not construct know-how on their very own and we’re already doing this for our personal cost processing, therefore we will simply assist them,” the founding father of a digital funds startup mentioned on situation of anonymity.

Via the know-how stack, cost firms can guarantee transactions are being undertaken by the precise buyer, un-natural cost behaviour is stopped and real beneficiaries really get the funds. They’ll additionally provide service provider verification companies, which ensures that real retailers course of transactions.

“Whereas we already work with giant banks to handle their cost fraud wants, there are various mid and small-sized monetary establishments that want sturdy know-how options to combat cost fraud. We’re additionally concentrating on this section and the chance is critical,” mentioned Anirban Mukherjee, chief government officer, PayU.

PayU provides fraud detection companies to banks by Wibmo, which it acquired in 2019.

Walmart-backed PhonePe, which is a frontrunner in UPI-based funds, can be doubling down on service provider funds. Fraud detection can be a serious focus for the Bengaluru-based firm now. It’s concentrating on giant enterprises as potential prospects.

PhonePe’s platform provides real-time detection and likewise permits banks to construct their very own rule engines which may detect irregular patterns round digital funds.

PhonePe didn’t reply to ET’s queries.

Razorpay, one other giant funds processor, can be growing its personal fraud detection software and is within the means of pitching to banks. The funds main is working with two of India’s prime six card-issuing banks, together with a number of mid-sized banks and fintechs.

Responding to ET’s queries Arif Khan, Chief Innovation Officer, Razorpay mentioned the corporate has constructed a white-labelled answer for banks.

“It’s an authentication engine that enhances transaction success charges whereas guaranteeing sturdy safety—serving to companies stop fraud and provide a secured cost expertise,” he added.

India’s digital funds ecosystem has grown exponentially over the previous few years — in April alone, round 600 million card transactions and round 11 billion UPI-based transactions had been reported — however so have the circumstances of fraud. This has necessitated software program companies which may also help banks, fintechs and the complete ecosystem to remain forward of assaults from cybercriminals.

Whereas these cost companies are securing banks and enterprises from cost frauds, there are different fintechs that are constructing fraud detection for the bigger ecosystem. Gamers reminiscent of Bureau, Datasutram and Clari5, which just lately received acquired by Perfios, additionally provide a number of fraud detection instruments for digital lenders, wealth administration platforms and banks to assist in buyer onboarding and know-your-customer verification.