Does slicing advantages work?

BBC

BBCWork and Pensions Secretary Liz Kendall is about to unveil particulars of how the federal government plans to chop billions of kilos from the working-age welfare invoice.

The main focus can be on decreasing spending on health-related and incapacity advantages.

That invoice is rising quickly and lots of argue it must be curbed for the sake of the UK’s public funds – in addition to the financial and particular person advantages of getting folks again into work.

However this isn’t the primary authorities to hunt financial savings from the welfare finances, and to attempt to encourage extra folks into employment.

And charities are warning concerning the opposed affect on susceptible recipients.

There are three broad approaches which the federal government is believed to be inspecting:

- Slicing the extent of profit funds

- Tightening the eligibility for advantages

- Trying to get folks off advantages and into work

BBC Confirm has examined the previous 15 years of insurance policies on this space to see what could be efficient – and what dangers being counterproductive.

Slicing funds

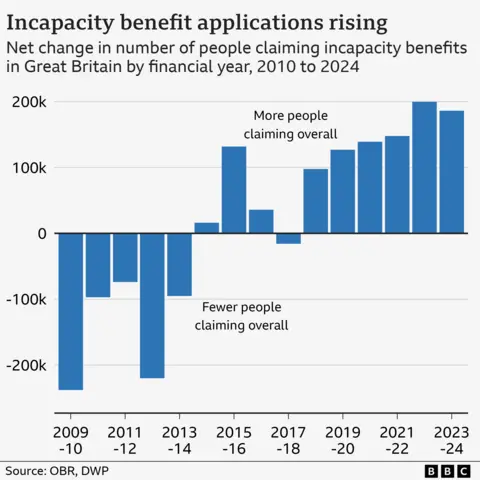

The working-age well being and incapacity advantages invoice has actually been growing in recent times, and is rising quickly.

The Workplace for Price range Duty (OBR), the official forecaster, has projected that complete state spending on these advantages for folks within the UK aged between 18 and 64 will enhance from £48.5bn in 2023-24 to £75.7bn in 2029-30.

That may signify a rise from 1.7% of the scale of the UK economic system to 2.2%.

By 2030, round half of the expenditure is projected to be on incapacity profit, which is designed to supply further earnings for folks whose well being limits their capacity to work.

The opposite half is projected to be on Private Independence Funds (PIP), that are meant to assist folks of working age with disabilities handle the extra day-to-day prices arising from their incapacity.

One simple approach for ministers to curb this projected rise could be to carry funds flat in money phrases, moderately than permitting them to rise in keeping with costs every year.

“Lowering award quantities is the best solution to get financial savings within the quick time period,” says Eduin Latimer of the Institute for Fiscal Research.

Freezing incapacity advantages in money phrases till 2030 would save £1bn a 12 months, in line with the Decision Basis.

However you possibly can solely obtain incapacity profit in case your earnings and financial savings are beneath a sure stage, so freezing funds would affect people who find themselves worse off.

Additionally, folks on incapacity advantages comparable to PIP are significantly extra more likely to be in poverty and materials deprivation.

Below earlier governments between 2014 and 2020, most working-age advantages didn’t rise in keeping with inflation – to economize.

And from 2015, increasingly folks claimed incapacity profit.

So slicing the worth of particular person funds may avoid wasting cash up entrance, however nonetheless not have a dramatic affect on the general invoice in the long run if claimants proceed to rise.

Tighten eligibility

Somewhat than slicing the worth of those advantages for all recipients, the federal government might search to economize by making it more durable for folks to say them within the first place.

As an illustration, the earlier authorities had proposed making it more durable for folks with psychological well being situations to say PIP, arguing that the month-to-month cost was not proportionate to the extra monetary wants created by their situations.

However you will need to observe that efforts to vary the eligibility standards for these advantages over the previous 15 years haven’t yielded the outcomes hoped for.

PIP was launched in 2013 to switch the previous Incapacity Residing Allowance, with the intention it will result in financial savings of £1.4bn a 12 months relative to the earlier system by decreasing the variety of folks eligible.

PIP was initially projected to scale back the variety of claimants by 606,000 (28%) in complete.

But the reform ended up saving solely £100m a 12 months by 2015 and the variety of claimants rose by 100,000 (5%).

One other try in 2017 to restrict entry to PIP was additionally reversed.

The explanation was that many individuals appealed towards refusals that had been triggered by the tightened eligibility standards. Additionally, the emergence of instances within the media which appeared unfair meant ministers, typically underneath strain from their very own backbench MPs, in the end ordered the eligibility guidelines to be relaxed.

Official choices to not award PIP and incapacity profit to claimants are nonetheless typically challenged and round a 3rd of these challenges are in the end upheld at an unbiased tribunal.

“Britain’s chequered historical past of profit reform reveals that the federal government ought to proceed cautiously, moderately than rush forward to search out financial savings which might backfire,” says Louise Murphy of the Decision Basis.

Encourage work

One other approach for the federal government to attempt to obtain financial savings is by encouraging extra folks to come back off these advantages and enter work.

Round 93% of incapacity profit claimants usually are not in work and the identical is true of 80% of PIP claimants.

One potential route to extend employment charges may very well be common reassessments of individuals in receipt of incapacity profit and a requirement for them to start out searching for jobs if they’re discovered to be match for work.

The autumn within the variety of folks claiming incapacity profit within the early 2010s has been attributed by the OBR to reassessments of a lot of folks in receipt of an older type of the profit.

Nonetheless, an aggressive or onerous reassessment regime might danger imposing misery on people who find themselves unable to work and will additionally create sudden distortions within the system.

The OBR has advised the sanctions launched to the broader advantages system by the final authorities, requiring folks judged match to work to be actively searching for employment or danger shedding their advantages, had the counterproductive impact of accelerating the inducement for folks to attempt to declare incapacity advantages (for which these work-searching necessities didn’t apply).

One other potential coverage avenue to spice up employment charges is thru offering a lot better assist to search out jobs.

Some advocate growing authorities funding in official schemes, working with employers, to assist folks to enter the office.

There have been numerous schemes designed to realize this over the previous 15 years, although they haven’t been on a big scale.

Evaluations have proven some constructive employment results from them.

Nonetheless, the OBR concluded final 12 months that the proof base was nonetheless restricted and didn’t recommend such programmes have, to date, made a “vital contribution” to getting folks into work.

That means the official forecaster might hesitate to imagine better state funding in these schemes pays for itself by means of increased employment and tax revenues, and lead to internet financial savings in public expenditure.

Nonetheless, some specialists argue it will make sense for the federal government to re-assess extra frequently whether or not folks in receipt of well being and incapacity advantages are nonetheless unable to work and – if their circumstances are discovered to have modified – to supply them with further assist to get into the workforce.

“Not doing reassessments and work-focused interviews positively makes issues worse,” says Jonathan Portes, a former chief economist on the Division for Work & Pensions.