Financial institution of England anticipated to carry rates of interest

Price of dwelling correspondent

Getty Photos

Getty PhotosThe Financial institution of England is predicted to maintain rates of interest on maintain when its policymakers announce their subsequent determination later.

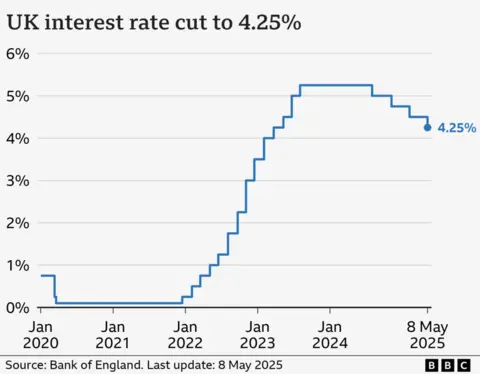

The Financial institution lower the speed to 4.25% in early Might, when its Financial Coverage Committee (MPC) additionally hinted at extra reductions to come back.

However analysts assume these cuts won’t arrive till later within the 12 months, as the speed of worth rises stays above goal.

The Financial institution price is the important thing benchmark for lenders setting the price of borrowing, and for banks and constructing societies deciding what returns to pay to savers.

The choice can be introduced by the MPC at 12:00 BST.

When rates of interest have been lower in Might from 4.5% to 4.25%, it was the fourth discount in a 12 months.

Whereas the downward staircase of rates of interest is predicted to proceed, there are some sophisticated and conflicting points for the nine-member committee to think about.

Development within the UK financial system stays considerably sluggish, placing strain on policymakers to chop charges to spice up funding and progress.

The financial system unexpectedly shrank by 0.3% in April after taxes elevated for companies, family payments jumped, and exports to the US plunged.

Nonetheless, the speed of inflation remained at its highest stage for greater than a 12 months in Might, at 3.4%.

Meals costs, particularly, jumped. As a necessary for any family price range, that creates an extra squeeze on private funds.

The Financial institution makes use of rates of interest as its major device for bringing inflation to its goal stage of two%. An increase in charges can restrict demand and subsequently cut back inflation, though that has an affect on the financial system.

Policymakers will even be intently monitoring the affect of worldwide tensions. The battle between Israel and Iran may properly push up the worth of oil.

In addition to affecting the worth paid by drivers on the pumps, any sustained enhance would have a major impact on inflation.

In the meantime, the fall-out from the US coverage on tariffs will even must be factored into their calculations.

Many economists consider there can be two extra rate of interest cuts by the Financial institution this 12 months. Nonetheless, some others solely anticipate one.

“We forecast inflation to stay above 3% for the rest of the 12 months amidst persistent wage progress and the inflationary results from greater authorities spending,” mentioned Monica George Michail, affiliate economist on the Nationwide Institute of Financial and Social Analysis.

“Moreover, the present tensions within the Center East are inflicting larger financial uncertainty. We subsequently anticipate the Financial institution of England to maintain charges on maintain this Thursday and implement only one additional lower this 12 months.”

The way it impacts you

Expectations for the Financial institution’s base price are influential in what Excessive Avenue banks and lenders cost clients to borrow cash or what they provide to savers.

The upper stage lately has meant individuals are paying extra to borrow cash for issues like mortgages and different loans, however savers have additionally obtained higher returns.

Greater than eight in 10 clients have fixed-rate offers, and have been seeing elevated payments when renewing lately.

Mounted mortgage charges have been comparatively static in latest weeks. The most recent figures present the common price on a two-year mounted mortgage was 5.12% whereas, for a five-year deal, it was 5.10%, in accordance with monetary data service Moneyfacts.

About 600,000 householders have a mortgage that tracks the Financial institution’s price, so any price lower would have a right away affect on month-to-month repayments.