Financial institution of England cuts rates of interest however halves development forecast

Enterprise reporter, BBC Information

Getty Photos

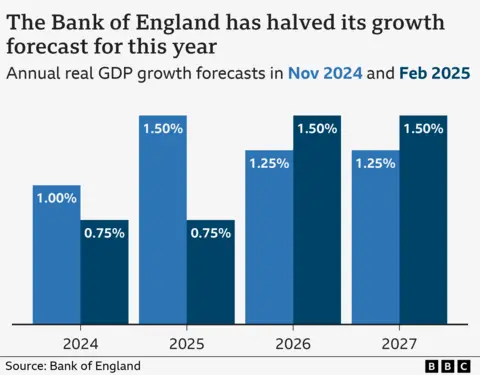

Getty PhotosThe Financial institution of England has halved its development forecast for this yr in a blow to the federal government.

The economic system is now anticipated to develop by 0.75% this yr, the Financial institution stated, down from its earlier estimate of 1.5%.

The federal government has made rising the economic system one in every of its key insurance policies and final week the chancellor introduced quite a few measures to attempt to enhance the UK’s efficiency.

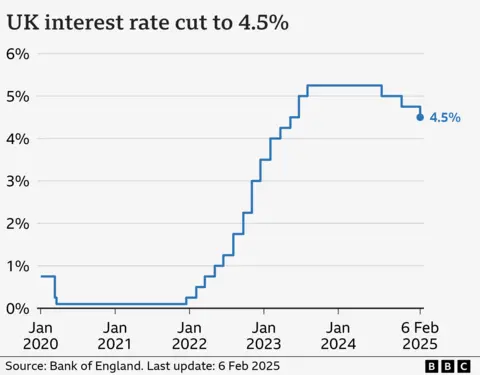

The Financial institution’s new development forecast got here because it minimize rates of interest to 4.5% from 4.75% in a transfer that had been broadly anticipated.

Whereas it minimize its forecast for 2025, the Financial institution elevated its prediction for development in each 2026 and 2027.

The economic system is now anticipated to develop by 1.5% in each of these years, the Financial institution stated, up from 1.25%.

It additionally predicted that larger power and water payments would push up inflation “fairly sharply” later this yr.

Inflation – the speed at which costs rise – is now anticipated to rise to three.7% and take till the top of 2027 to fall again to its 2% goal.

The Financial institution stated it will take a cautious method to future rate of interest cuts because it weighs up quite a few elements that would have an effect on inflation, together with threats of commerce tariffs from US President Donald Trump.

“We’ll be monitoring the UK economic system and world developments very intently and taking a gradual and cautious method to lowering charges additional,” stated Financial institution of England governor Andrew Bailey.

“Low and steady inflation is the muse of a wholesome economic system and it is the Financial institution of England’s job to make sure that.”

Chancellor Rachel Reeves stated the rate of interest minimize was “welcome information”.

“Nevertheless, I’m nonetheless not happy with the expansion price. Our promise in our Plan for Change is to go additional and quicker to kickstart financial development to place more cash in working folks’s pockets.”

Shadow chancellor Mel Stride stated whereas the speed minimize would excellent news for a lot of households and companies, he added the federal government’s “disastrous Price range” was more likely to imply fewer price cuts this yr than anticipated.

Mortgage impression

The speed minimize implies that for the 629,000 householders on mortgage tracker offers that transfer according to the bottom price, there’ll usually be a £29 fall in month-to-month repayments, in keeping with figures from banking commerce physique UK Finance.

The close to 700,000 folks on normal variable price mortgages must wait to see if their lender responds.

These on a hard and fast mortgage deal will see no rapid change, however there is perhaps cheaper offers for accessible for brand new and renewing clients.

Nevertheless, the speed minimize is more likely to result in decrease returns for savers.

Nicola Worth/BBC

Nicola Worth/BBCNicola Worth and her husband John have nonetheless acquired 18 months remaining on their present mortgage deal, and welcome decrease rates of interest because it means they may pay much less curiosity on their subsequent mortgage – if charges stay low.

Nicola needs for “actually no extra will increase” and thinks the candy spot for her might be a price of round 3%.

Her husband John says that falling rates of interest are going to be robust for others although.

“Our mother and father rely closely on a greater rate of interest, so we see the flip aspect for the following technology.”

In its quarterly inflation report, the Financial institution stated financial development had been “broadly flat since March final yr”.

The UK economic system confirmed zero development between July and September.

For the next three months, the Financial institution of England now expects it to shrink by 0.1% in opposition to a earlier forecast for 0.3% development.

A recession is outlined as two consecutive three-month intervals of financial contraction.

The Financial institution now expects the economic system to develop by simply 0.1% between January and March, down from its 0.3% forecast revealed final November.

The newest official development figures for the UK economic system might be revealed subsequent Thursday.