How a lot would a 100% ‘Made within the USA’ car value? It is difficult.

LOUISVILLE, Ky. — A white 2025 Ford Expedition SUV with bronze exterior trim rolled off the meeting line at Ford Motor’s Kentucky Truck Plant. It was assembled — from its body to completion — by American employees on the manufacturing facility. However it’s removed from being fully “Made within the USA.”

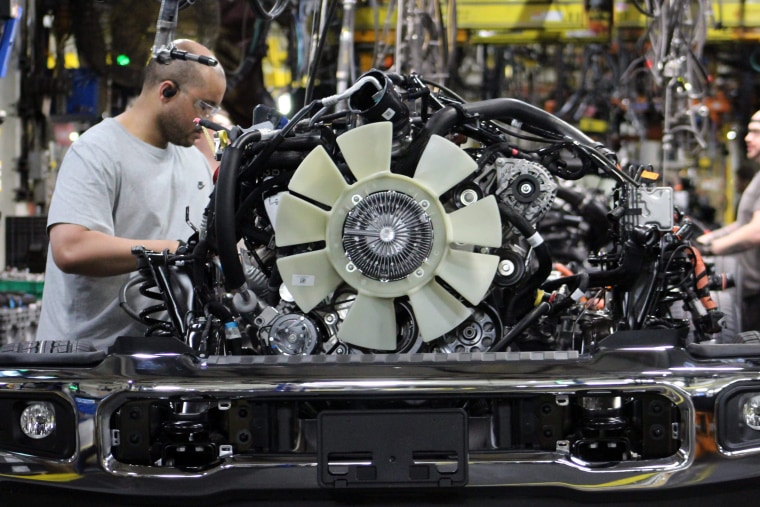

A majority of its primary components — not less than 58% as said on a window sticker — had been made outdoors the nation, together with 22% from Mexico. That features its Ford-engineered, 3.5-liter twin-turbocharged V-6 Ecoboost engine, the center of the car.

The favored giant SUV is a chief instance of how difficult the worldwide automotive provide chain is, and underscores the fact that even autos rolling off U.S. meeting strains from quintessentially American firms resembling Ford can rely closely on nondomestic content material.

The large Kentucky meeting plant, which has greater than 9,000 folks constructing the Expedition, F-Collection pickup vehicles and Lincoln Navigator SUV, is precisely the sort of facility President Donald Trump is pressuring automakers to construct within the U.S. by his use of aggressive tariffs.

After Trump put 25% tariffs on imported autos and lots of automotive components, automakers began scrambling to tout U.S. investments and localize provide chains as a lot as doable. However whereas the nation would profit from jobs and financial output if all auto components had been sourced and manufactured within the U.S., consultants say it’s simply not possible.

“Some components which have been offshored will nonetheless be cheaper to fabricate in these places somewhat than the USA at scale even with a few of the imposed tariffs,” stated Martin French, a longtime provider govt and accomplice at Berylls Technique Advisors USA.

Processing and manufacturing vegetation for issues resembling metal, aluminum and semiconductor chips, particularly older ones used for autos, in addition to uncooked supplies resembling platinum and palladium, aren’t prevalent sufficient within the U.S. with out establishing new vegetation or mines. These are processes consultants say would take a decade or extra to create at scale.

On prime of that, the elevated prices of a 100% U.S.-made car might worth many customers out of the brand new car market. That might in flip result in much less demand and sure decrease manufacturing.

“We are able to transfer all the pieces to the U.S., but when each Ford is $50,000, we’re not going to win as an organization,” Ford CEO Jim Farley stated final week on CNBC’s “Squawk Field.” “That’s a balancing act that each [automaker] must do, even probably the most American firm.”

Farley stated 15% to twenty% of commoditized car components are tough, if not inconceivable, to supply presently within the U.S. That features issues resembling small fasteners, labor-intensive wiring harnesses and virtually $5,000 in semiconductors per car, that are presently sourced largely from Asia.

S&P International Mobility experiences there are on common 20,000 components in a car when it’s torn all the way down to its nuts and bolts. Elements could originate in anyplace from 50 to 120 international locations.

For instance, the Ford F-150, which shares a platform and a few components with the Expedition, is completely assembled within the U.S. however has roughly 2,700 primary billable components, which exclude many small items, in keeping with Caresoft, an engineering benchmarking and consulting agency.

The Trump administration might ease increased costs for an American-made car by providing tax breaks or client incentives, very similar to the electrical car credit score of as much as $7,500 that Trump beforehand promised to remove.

However the prices of a 100% American-made car are far larger and extra advanced than they may appear at first blush. It’s even exhausting to trace what comes from the U.S., as automakers are required to report a mixed proportion of Canadian and U.S. content material in a car, not simply U.S. content material.

The fabric prices alone, excluding manufacturing investments, would add hundreds of {dollars} to a car’s worth level, which might wipe out income for automakers and power worth will increase for customers, a number of automotive analysts and executives instructed CNBC.

The folks, who got anonymity so they may converse freely, estimated it will add hundreds of {dollars} with every step you took to get nearer to 100% U.S. and Canadian components.

100% U.S.-made car

Mark Wakefield, a accomplice and world automotive market lead at consulting agency AlixPartners, stated nothing’s inconceivable with time, however the funding wanted for U.S. and Canadian sourcing and added prices would enhance exponentially the nearer an organization got here to a 100% “Made within the USA” car.

“The associated fee will get quantumly extra … the nearer you get to 100%,” Wakefield stated. “Getting above 90% will get costly, and getting about 95% would get actually costly, and also you simply begin moving into issues that you just’d need to take a very long time [to do].”

To get that final 5% to 10%, if, or when, you could possibly, Wakefield stated, would begin “getting actually costly” and sure take a decade or extra to arrange uncooked materials sourcing and reshore manufacturing of some components.

“I don’t assume you could possibly do it greater than about 95% on common, at any value, in the intervening time, simply because it’s good to construct quite a lot of stuff that’s going to take a very long time,” he stated. “The processing and the uncooked materials stuff, it takes a very very long time, as a result of these are multibillion-dollar services that course of it.”

Two executives at auto suppliers instructed CNBC it will be “unrealistic,” if not inconceivable, for a corporation to profitably construct a 100% U.S.-made car at the moment. One other govt at an automaker estimated the common value enhance for an American-assembled U.S. full-size pickup would leap not less than $7,000 to supply as many parts as presently doable from the U.S. and Canada.

One knowledgeable, generalizing the prices, stated it might value $5,000 extra to get a car that’s presently underneath 70% U.S./Canadian components to 75% or 80%; one other $5,000 to $10,000 to hit 90%; and hundreds extra to a better proportion than that.

The common transaction worth of a brand new car within the U.S. is presently round $48,000, in keeping with Cox Automotive. Say that car is product of $30,000 in supplies and components. Including the above prices, it will come out to roughly $10,000 to $20,000 extra for firms.

Vehicles.com experiences the U.S. is by far the costliest nation to fabricate a car in. The common new-car worth of a U.S.-assembled car is greater than $53,200, in keeping with its knowledge. That compares with roughly $40,700 in Mexico, $46,148 in Canada and roughly $51,000 in China.

Excluding uncooked supplies, somebody might theoretically begin a brand new automotive firm — let’s name it U.S. Motors — from scratch. U.S. Motors might spend billions of {dollars} to construct new factories and set up an completely American provide chain, however the car it will produce would seemingly be low-volume and excessively costly, consultants say.

Consider Ferrari: Each automotive from the long-lasting automaker comes from Italy, with as many parts as doable sourced from the corporate’s homeland.

However even Ferrari’s multimillion-dollar sports activities automobiles have components or uncooked supplies for issues resembling airbags, brakes, tires, batteries and extra that come from non-Italian suppliers and services.

“For those who did it at actually low quantity and also you’re extraordinarily modern and totally different with the car, you could possibly make $300,000-$400,000 autos which can be all-American,” Wakefield stated. “To do it at scale, it will be 10-15 [years] and $100 billion to do this.”

What’s extra real looking?

Getting autos to 75% U.S. and Canadian components and last meeting within the U.S. is a much more achievable goal that “doesn’t actually power you to do uneconomic issues,” Wakefield stated, noting that a couple of autos meet that normal at the moment.

However even reaching that threshold on a bigger scale would seemingly take billions of {dollars} in new investments from automakers and suppliers to localize manufacturing. Some automakers might make the transfer extra simply, whereas others would require large shifts in sourcing and manufacturing.

Autos that meet the 75% U.S./Canada components normal for the 2025 mannequin 12 months embrace the Kia EV6, two variations of the Tesla Mannequin 3 and the Honda Ridgeline AWD Path Sport, in keeping with the most recent car content material knowledge required by the Nationwide Freeway Visitors Security Administration. Practically 20 others are at 70% or increased, whereas some autos nonetheless must be added to the information.

That compares with 2007 model-year NHTSA knowledge, the place the highest 16 autos — all from GM and Ford — had 90% or extra U.S. and Canadian content material. Ford’s Expedition at the moment was among the many highest at 95%, however that was earlier than the expanded globalization of the auto business provide chain after the Nice Recession — and earlier than a number of main technological advances in automobiles made new components and supplies extra vital.

For many years, there was a pattern for much less U.S./Canadian content material due to the globalization of provide chains and the rise in the usage of Mexico as a supply of components and parts, in keeping with American College’s Kogod College of Enterprise.

The highest 10 autos with probably the most U.S. and Canadian components on common have 63.6% to 69.2% components content material from these international locations from the 2019 by 2024 mannequin years, in keeping with Vehicles.com.

Imported autos from many luxurious manufacturers, particularly German producers in addition to Toyota’s Lexus, function little U.S.-sourced content material. Many have none or 1%, in keeping with the federal knowledge.

The U.S./Canada percentages, underneath the American Car Labeling Act of 1992, are calculated on a “carline” foundation somewhat than for every particular person car and could also be rounded to the closest 5%. They’re calculated by automakers and reported to the federal government.

Nonetheless, a excessive threshold of North American components doesn’t imply the autos are produced within the U.S. The 2024 Toyota RAV4, for instance, was reported to have 70% U.S./Canadian components and is inbuilt Canada.

“You can have a car, theoretically, that’s made within the U.S., however solely has 1% components, content material,” stated Patrick Masterson, lead researcher for Vehicles.com’s “American-Made Index.”

Vehicles.com’s annual index of the highest U.S. autos takes car meeting, components and different components into consideration. No autos from Ford or Basic Motors made the highest 10, whereas two Teslas, two Hondas and a Volkswagen took the highest 5 spots.

The examine ranks 100 autos judged by the identical 5 standards it’s used for the reason that 2020 version: meeting location, components content material, engine origin, transmission origin and U.S. manufacturing workforce. Greater than 400 autos of model-year 2024 classic had been analyzed to qualify the 100 autos on the record.

The white 2025 Ford Expedition that not too long ago rolled off the meeting line in Kentucky is predicted to attain increased than the prior mannequin 12 months, which ranked 78th, due to a rise in home content material.

Masterson stated there’s been elevated curiosity and recognition for the “American-Made Index” this 12 months amid Trump’s tariff insurance policies and nationalism.

“Visitors on the ‘American-Made Index’ this 12 months is manner, manner up. … Persons are involved about this, maybe greater than ever,” Masterson stated, later including “it will be extraordinarily tough to make a 100% U.S.-made [vehicle].”