‘I may lose £100K regardless of Woodford fund redress scheme’

Political correspondent

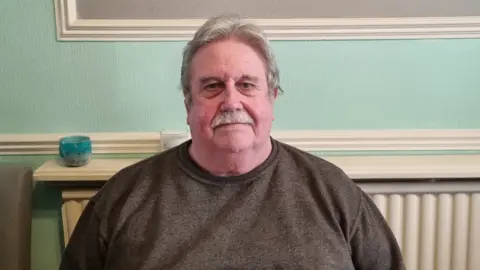

Ian Duffield

Ian DuffieldIndividuals who misplaced tens of 1000’s of kilos when a star stockpicker’s funding fund collapsed say they’ve been let down by the UK’s monetary regulator and are calling on MPs to research.

Round 300,000 individuals misplaced cash when Woodford Fairness Revenue Fund collapsed in 2019.

In 2023, the Monetary Conduct Authority (FCA) introduced a “redress scheme” that it stated would enable traders to recuperate round 77p within the pound.

However some traders say that determine was deceptive, and the scheme coming into power locked them out of different client protections.

The FCA says the scheme provides the “quickest and finest probability” of getting a “higher end result than is likely to be achieved by different means”.

When Ian Duffield and his spouse Linda, from Manchester, put £234,000 of their pension financial savings into Neil Woodford’s fund, they thought most of their cash could be protected.

Mr Woodford got here with a stellar status, and the fund marketed that it was protected beneath the Monetary Providers Compensation Scheme (FSCS), which pays compensation when a monetary agency fails.

After its collapse, the Duffields recovered a few of their cash when the fund’s belongings had been offered off, however this nonetheless left them with a lack of about £107,000.

Ian stated when the redress scheme was introduced, they initially thought they’d get most of that remaining sum again.

“Once I first heard it, I assumed… I will find yourself dropping, possibly £30-35K between us, which isn’t nice, however within the scheme of issues it could have been OK, a little bit of a sigh of reduction”.

On studying the element, he realised that was not the case, because the scheme took under consideration the cash they’d already acquired.

He really bought £7,600, leaving him and his spouse with a complete lack of almost £100,000.

“It has affected our lives. We needed to not take holidays for a couple of years…however we’re lucky,” he says.

“I do know individuals who’ve misplaced far lesser sums, however the impression has been a lot better”.

‘Shafted’

Traders within the fund voted to simply accept the scheme in December 2023, which means they’re not in a position to entry the Monetary Providers Compensation Scheme.

Paul King from Kingston-upon-Thames works in IT and invested slightly below £50,000 within the Woodford fund to assist save for his retirement.

He stated he had taken consolation in the truth that it gave the impression to be protected.

“On the finish of the day, I am only a client. You do your finest to provision for the longer term and you set plenty of weight behind the FSCS,” he says.

“I did not anticipate that if issues went mistaken that we might be shafted, to place it bluntly”.

“I really feel I’ve bought extra safety if I purchase a defective pair of sneakers costing £50 than if the regulator of this nation fails and I lose £50,000”.

‘Nuances and intricacies’

A gaggle of MPs and friends, the All-Celebration Parliamentary Group (APPG) for Funding Fraud and Fairer Monetary Providers, has now written to the Commons Treasury committee to ask for them to conduct an inquiry into how the FCA dealt with the fund’s collapse, together with the way it arrange the redress scheme.

In a report back to be revealed on Tuesday, the APPG will say the FCA did not correctly talk that its “77p within the pound” determine solely associated to a number of the belongings within the fund, somewhat than in its entirety.

“Solely a minute minority of traders had been sufficiently engaged to even start to grasp the nuances and intricacies of what was going down,” they may argue.

The Woodford Fairness Revenue Fund collapsed in 2019 after quite a lot of traders withdrew their cash over issues concerning the investments being made.

The redress scheme was proposed by Hyperlink Fund Options (LFS), the previous authorised company director of the fund.

It got here after the FCA investigated and three investor teams filed lawsuits over the way in which LFS had managed the fund.

A FCA spokesperson stated the dimensions of the redress scheme didn’t mirror funding losses as a result of underperformance of the fund.

“As an alternative, it covers the losses that flowed from Hyperlink Fund Options’ conduct, which we contemplate fell under the required requirements,” they added.

“The scheme supplied traders the quickest and finest probability to acquire a greater end result than is likely to be achieved by some other means. The scheme was accredited by greater than 90% of traders.”

Virtually 94% of traders backed the compensation scheme in a vote in December 2023, though solely 54,000 voted. It was accredited by a Excessive Courtroom decide final yr.