India’s defence shares surge put up India-Pakistan ceasefire, China’s defence shares nosedive

India-Pakistan tensions: Defence shares in India and China inform an fascinating story after the India-Pakistan ceasefire. Submit the Pahalgam terror assault, India launched Operation Sindoor to focus on terrorist camps in Pakistan and Pakistan occupied Kashmir. The neighbouring nation’s ensuing drone assaults led to India placing a number of of their air bases.Pakistan extensively made use of Chinese language weapons, fighter plane and air defence programs in its try to cease India’s strikes. India then again used a whole lot of indigenous defence programs which helped it strike Pakistan’s belongings with precision.China Defence Shares PlungeIn Shenzhen, Avic Chengdu Plane Co., which manufactures the J-10C fighters utilized by Pakistan, has seen a major 9% decline over three buying and selling periods. Equally, Zhuzhou Hongda Electronics Corp, producer of PL-15 air-to-air missiles, suffered a ten% fall, in line with an ET report.Additionally Learn | India’s defence exports surge to file excessive of Rs 23,622 crore in FY25; 34-fold improve from 2013-14The downward pattern continued throughout different Chinese language defence companies as effectively. China Aerospace Instances Electronics recorded a 7% fall in two days, while Brilliant Laser Applied sciences, North Industries Group, China Spacesat and AVIC Plane witnessed declines between 5-10%. This occurred after satellite tv for pc imagery contradicted Pakistani claims about damaging Indian airbases while confirming Indian Air Pressure’s exact strikes on Pakistani amenities.India’s Defence Shares SurgeIn the meantime, traders are actively shopping for into Indian defence shares following India’s Operation Sindoor, which showcased the nation’s navy capabilities supported by indigenous weapons and superior home expertise.The Nifty India Defence Index has recorded a exceptional 10% improve over three days, while corporations like IdeaForge, GRSE, Cochin Shipyard, and Bharat Dynamics skilled substantial development of as much as 38% inside every week.

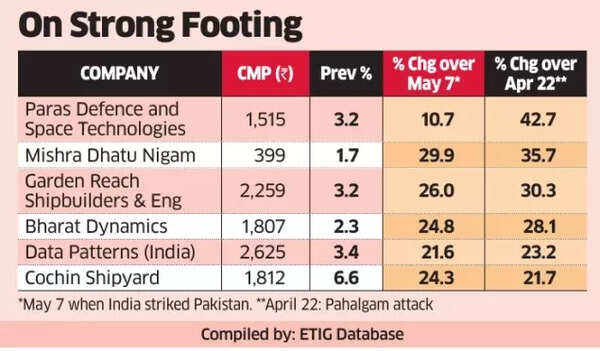

Defence shares on sturdy footing

“With India reaching all its avowed strategic goals, Operation Sindoor was an unequivocal success… a hit powered by home-grown weapons and cutting-edge home applied sciences,” stated Dr. Manoranjan Sharma, Chief Economist at Infomerics Valuation and Rankings Ltd. “The rally in defence shares is on,” he stated in line with an ET report. Defence sector shares haveexperienced vital features with Cochin Shipyard, Bharat Dynamics, Mazagon Dock Shipbuilders, and Paras Defence and Area Applied sciences recording will increase starting from 10% to 35% since April 22, following the Pahalgam terrorist incident that sparked navy tensions between India and Pakistan. The Nifty India Defence index registered a virtually 13% improve as market members anticipated potential will increase in authorities defence allocations.Additionally Learn | India-Pakistan ceasefire: How India’s punitive measures will proceed to hit Pakistan’s fragile economic system – defined“Submit the latest cross-border stress between India and Pakistan, defence shares moved in anticipation that India must not solely replenish its stock of kit but additionally order new ones to maintain up its technological edge,” stated Mahesh Patil, CIO, Aditya Birla Solar Life AMC.The heightened border scenario might probably speed up defence finances will increase within the forthcoming years. Moreover, this case presents alternatives for India to develop its defence tools exports to different nations.(Disclaimer: Suggestions and views on the inventory market and different asset courses given by specialists are their very own. These opinions don’t symbolize the views of The Instances of India)