Inflation soars on meals and personal faculty charges

Enterprise reporter, BBC Information

Getty Photographs

Getty PhotographsUK inflation jumped sharply final month, pushed by rising meals costs and a rise in personal faculty charges.

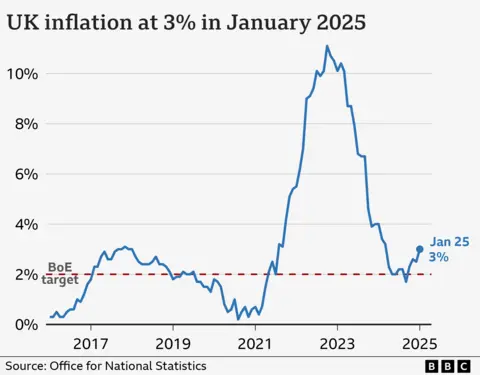

The upper-than-expected bounce to three% within the yr to January, from 2.5% in December, means costs rose on the quickest tempo for 10 months.

Meals staples akin to meat, bread, eggs and cereals had been all dearer than a yr in the past, whereas personal faculty charges grew by about 13% on account of VAT being added from 1 January after the federal government eliminated the tax exemption.

Airfares, which didn’t fall as a lot as they normally do originally of the yr, additionally fuelled inflation which is forecast to rise additional within the coming months, with vitality costs set to push up the price of dwelling for households.

Rising meals costs final month imply, on common, the price of shopping for groceries is 3.3% dearer than it was a yr in the past.

Many companies have additionally warned that tax rises coming into impact in April will end in costs for purchasers going up once more to cowl the elevated prices.

Sarah Coles, head of private finance at Hargreaves Lansdown, mentioned the specter of increased wage payments for supermarkets and meals producers meant there was a “each likelihood” the January spike in meals inflation wouldn’t be the final.

There are additionally future prices for households on the horizon, with home vitality costs forecast to rise by 5% from April, including £85 a yr to to a typical family invoice.

“That is on high of rises in all the pieces from water payments and council tax – which is why it has turn out to be often known as Terrible April,” mentioned Ms Coles.

Inflation is a measure used within the UK to offer a normal image of the price of dwelling and is calculated by evaluating costs of products and companies from a yr earlier.

The VAT cost on personal faculties got here into impact this January, so the affect on inflation was a “one-off”, in accordance with Grant Fitzner, chief economist on the Workplace for Nationwide Statistics.

The general inflation determine in January was additionally impacted by reductions being “a lot smaller” than regular originally of the yr, particularly for airfares, he added.

“We usually see fairly a big fall in January in costs, there may be lots of worth discounting,” he informed the BBC’s At present programme.

Airfares sometimes go up as demand for journey spikes round Christmas and New Yr, however the fall again this yr has been extra muted, he defined.

Whereas the sharpness of the rise in inflation got here as a shock – economists had anticipated a studying of two.8% – it’s a lot decrease than its peak of 11.1% in October 2022.

That led to increased rates of interest, which has made the price of loans, bank cards and mortgages, dearer.

As inflation has eased, the Financial institution of England has minimize rates of interest, together with 1 / 4 level discount to 4.5% this month.

Information on Tuesday estimated common wages within the UK additionally proceed to outpace inflation, with pay packets, after making an allowance for the tempo of worth rises, rising by 3.4% between October and December.

However with inflation remaining above the Financial institution’s 2% goal, January’s determine will likely be “uncomfortable” for policymakers, in accordance with Ruth Gregory, deputy chief UK economist at Capital Economics.

She mentioned the leap was “no shock, nevertheless it was bigger than everybody anticipated”, including that she doubted it will forestall additional curiosity cuts this yr.

“The danger is that the rise in inflation proves extra persistent and charges are minimize extra slowly than we count on, or not as far,” Ms Gregory added.

In response to the most recent figures, Chancellor Rachel Reeves reiterated that her “primary mission” was to get “extra kilos in pockets”.

However James Murray, exchequer secretary to the Treasury warned getting inflation again all the way down to the two% goal could be “bumpy”.

“The Financial institution of England has been clear that they anticipated inflation to be barely increased within the first half of this yr….however we’re assured in our plan for change to guarantee that we’re kick-starting financial development by making the reforms which are obligatory to spice up financial development proper throughout the nation,” he added.

Each the Conservatives and Liberal Democrats blamed Reeves’s Funds choices for the rise in inflation.