Larger payments push inflation to highest in additional than a yr

Enterprise reporter, BBC Information

Getty Photographs

Getty PhotographsAn increase in the price of family payments has pushed UK inflation to its highest fee in additional than a yr, in accordance with official knowledge.

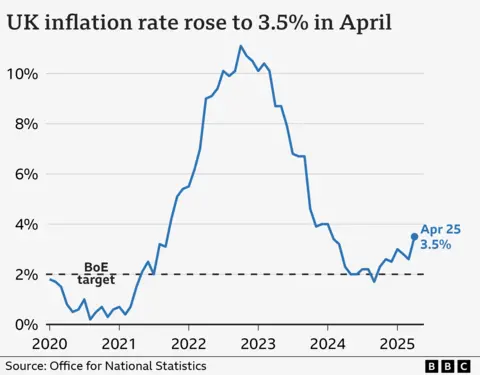

Inflation was 3.5% in April, up from 2.6% in March and better than economists had anticipated.

Water, fuel and electrical energy costs all went up on 1 April together with a number of different payments, pushing inflation additional above the Financial institution of England’s goal of two%.

The biggest upward contributors to the rise had been from “housing and family companies, transport, and recreation and tradition,” the Workplace for Nationwide Statistics mentioned.

The tempo of worth rises was forecast to be round 3.3% for April.

The Financial institution of England has beforehand mentioned it expects inflation to spike at 3.7% between July and September 2025 earlier than dropping again to its 2% goal.

Analysts beforehand predicted two extra rate of interest cuts this yr, however the newest inflation knowledge now throws that into doubt, with some economists pondering there might solely be one.

Huw Tablet, chief economist and government director for financial evaluation on the Financial institution of England, mentioned he feared the Financial institution was decreasing charges too quickly and that the momentum behind falling inflation was “stuttering”.

One of many Financial institution’s key duties is to maintain inflation at 2% and it cuts or raises rates of interest to attain that.

In April, households had been hit by sharp rises in power and water payments, and – to a lesser extent – greater meals costs. Corporations had been additionally hit by greater prices – an increase in employer Nationwide Insurance coverage contributions and a better minimal wage.

The ONS says costs of water and sewerage rose by 26.1% in April, which it mentioned is the biggest rise since no less than February 1988.

Rising prices of airfares additionally contributed to the shock inflation determine.

The timing of Easter is assumed to have contributed to the rise in flight prices and package deal holidays, which economists suppose will likely be a one off.

In the meantime, the price of companies particularly rose 5.4% within the yr to April, which economists mentioned was on account of adjustments to Nationwide Insurance coverage Contributions for employers and better minimal wage coming into pressure.

Providers inflation refers to rises in costs for companies like consuming at a restaurant, getting a haircut, or going to the cinema.

Britain is a services-led financial system which signifies that extra of our jobs come from offering a service quite than making a product.

Analysts additionally pointed to different inflation figures which they mentioned are regarding.

Core inflation which strips out unstable costs resembling power and meals – and companies inflation – each rose greater than anticipated.

Grant Fitzner, performing director basic of the ONS, mentioned: “Vital will increase in family payments precipitated inflation to climb steeply.

“Gasoline and electrical energy payments rose [in April] in contrast with sharp falls concurrently final yr on account of adjustments to the Ofgem power worth cap.”

Chancellor Rachel Reeves mentioned she was “disenchanted” with the figures and cited April’s minimal wage rises and the choice to freeze gasoline responsibility as serving to pepole with the price of dwelling strain.

Mel Stride, shadow chancellor, mentioned the determine “is worrying for households”.

“We left Labour with inflation bang on course, however Labour’s financial mismanagement is pushing up the price of dwelling for households,” he added.

‘Grocery store store is getting an increasing number of costly’

Tracy McGuigan-Haigh, 47, lives along with her 11-year-old daughter Ruby in Dewsbury and works in retail.

She has to suit her working hours round taking care of Ruby and receives common credit score on high of her wage. She says her month-to-month revenue is not stretching far sufficient.

“Even on a price range, the grocery store store is getting an increasing number of costly. I am not popping out with rather a lot in my arms.

“Earlier than, I would have wanted a trolley for £40 price of meals. Now it would not even fill a basket – you’ll be able to carry that a lot in your arms.”

She says the price of on a regular basis gadgets is “killing” her and would not imagine any future fall in rates of interest will make a distinction.

“It is gone too far. I’ve juggled a lot that I’ve dropped balls, and any person’s going ‘it’s going to get higher’. However, even when it does enhance now, what is the help for the people who find themselves down there, who’re on the ground?”