Mortgage charges beneath 5% for first time since Truss finances

BBC enterprise reporter

Getty Photographs

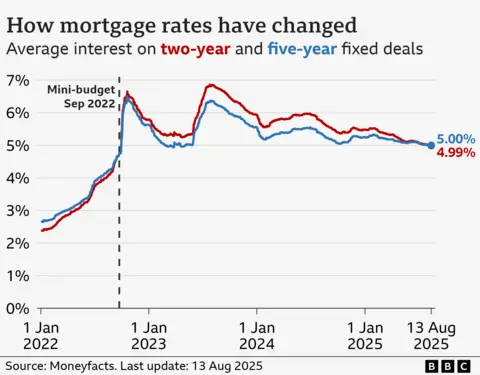

Getty PhotographsThe typical two-year mortgage price has dipped beneath 5% for the primary time since former Prime Minister Liz Truss’s mini-budget in September 2022, figures present.

The speed has dropped to 4.99%, in accordance with Moneyfacts, which described it as a “symbolic turning level” for homebuyers and exhibits lenders are “competing extra aggressively”.

Rates of interest have been lower 5 instances since final August however on the Financial institution of England’s final assembly, a break up vote between policymakers raised questions on whether or not there could be one other discount this 12 months.

A Moneyfacts spokesperson mentioned that though mortgages are following the “temper music” set by the Financial institution’s price cuts, they’re unlikely to fall considerably.

A whole bunch of 1000’s of debtors are because of re-mortgage this 12 months.

UK Finance, the banking business group mentioned 900,000 fastened price offers are because of expire within the second half of 2025, whereas the full for the 12 months is 1.6 million.

Mortgage charges are nonetheless “nicely above the rock-bottom charges of the years instantly previous” the mini-budget, in accordance with Moneyfacts.

Unveiled by Truss’s short-lived chancellor Kwasi Kwarteng, the so-called mini-budget set out £45bn in unfunded tax cuts, inflicting UK market turmoil.

It pushed up the price of UK authorities borrowing, which fed via into mortgage charges. By July 2023, the borrowing price of mortgages had soared to the very best degree because the 2008 monetary disaster.

Rates of interest have been already rising as central banks world wide, together with the Financial institution of England, tried to cope with inflation which was being made worse by power worth shocks after Russia’s full-scale invasion of Ukraine.

Final week, the Financial institution of England revealed that inflation is forecast to spike greater than anticipated this 12 months – at 4% in September – earlier than falling again to its 2% in 2027.

Moneyfacts mentioned this “is prone to imply the bottom price will maintain round its present degree for longer” which, after the final lower, is 4%.

Common home costs ticked up by greater than £1,000 in July to £298,237, mortgage lender Halifax mentioned final week.

Though that is near a file excessive, Halifax’s head of mortgages, Amanda Bryden, mentioned: “With mortgage charges persevering with to ease and wages nonetheless rising, the image on affordability is steadily bettering.”

She added: “Mixed with the extra versatile affordability assessments now in place, the result’s a housing market that continues to indicate resilience, with exercise ranges holding up nicely.

“We count on home costs to observe a gradual path of modest features via the remainder of the 12 months.”