Pay progress jumps for first time in additional than a yr

Getty Photographs

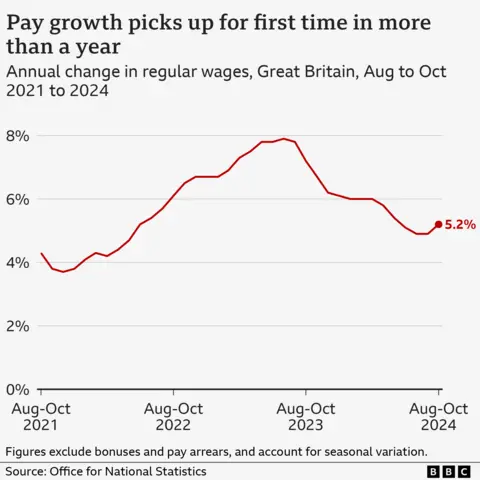

Getty PhotographsPay progress has picked up for the primary time in additional than a yr, the newest official figures present.

Common pay grew at a faster-than-expected annual tempo of 5.2% between August and October, the Workplace for Nationwide Statistics (ONS) mentioned, with wages persevering with to develop quicker than costs.

Analysts say the newest figures imply the Financial institution of England will nearly actually not reduce rates of interest when it meets this week.

The ONS information additionally urged the roles market is weakening, with job vacancies falling once more and a drop within the variety of individuals on payrolls.

The unemployment price was unchanged at 4.3%, though there are questions over the reliability of the roles figures from the ONS because of issues with gathering the info.

“After slowing steadily for over a yr, progress in pay excluding bonuses elevated barely within the newest interval pushed by stronger progress in personal sector pay,” mentioned Liz McKeown, director of statistics on the ONS.

Personal sector pay grew at an annual tempo of 5.4%, the ONS mentioned, whereas within the public sector it was 4.3%.

The Financial institution of England watches the pay and jobs information intently when making selections on rates of interest.

It has reduce charges twice this yr as inflation – which measures the speed at which costs are growing – has fallen.

The Financial institution meets to debate charges once more this week, however it’s not anticipated to make an extra reduce given the energy in pay progress.

“The most recent UK jobs report gives but extra justification, if any had been wanted, for the Financial institution of England to maintain charges on maintain at its assembly this week,” mentioned James Smith, developed markets economist at ING.

Mr Smith famous that the leap in wage progress was fully all the way down to the personal sector.

“This issues for the Financial institution, as a result of personal sector pay traits are usually extra reflective of the broader state of affairs within the jobs market than within the public sector,” he mentioned.

Monica George Michail, affiliate economist on the Nationwide Institute of Financial and Social Analysis, mentioned: “With low inflation, staff have been making actual earnings good points.

“Nonetheless, given the slowdown in recruitment exercise and rising unemployment, we anticipate wage progress to gradual within the coming months, though the rise in Nationwide Residing Wage in April would exert some upward strain.”

‘By no means reached it’

“I take it with a pinch of salt, this common wage enhance. I’ve by no means reached it,” says 61-year-old Nigel Wildgust, who lives in Nottingham.

He works in constructing supplies provide, and says for the final two years, his common pay rise has been about 1%.

He thinks some individuals have to be getting very giant wage rises for the typical enhance to be 5.2%.

“If I had been to get something over 2%, I might suppose it was a mistake,” he says.

Even with a small Christmas bonus final yr his common wage rises have “at all times been under” the typical.

The variety of job vacancies fell by 31,000 to 818,000 within the September-to-November interval, the ONS mentioned, though the whole stays above pre-pandemic figures.

Liz McKeown from the ONS mentioned the whereas the variety of individuals on payrolls grew barely in October, the annual progress charges “proceed to gradual”.

The ONS additionally mentioned provisional information indicated that the variety of employees on payrolls fell by 35,000 final month, though analysts mentioned this determine is unstable and could be topic to giant revisions.

Many corporations have argued the rise in Nationwide Insurance coverage Contributions for employers that was introduced within the Price range will cause them to reduce on hiring.

On the weekend, the boss of Reed, one of many UK’s largest recruitment corporations, instructed the BBC the financial system was “cooling”, suggesting a recession could also be “across the nook”.

A separate survey launched on Monday indicated that personal sector employment December had fallen on the quickest price for almost 4 years.

Work and Pensions Secretary Liz Kendall mentioned the newest figures had been “a stark reminder of the work that must be completed”.

“To get Britain rising once more, we have to get Britain working once more – so individuals have good jobs which pay respectable wages and provide the prospect to progress.”

Liberal Democrat Treasury spokesperson Daisy Cooper MP mentioned: “Over the Christmas interval nobody ought to have to fret in regards to the impression that an impending tax rise might have on their employment.

“The brand new authorities should see sense and realise that their self-defeating hike in Nationwide Insurance coverage will solely make the state of affairs worse for well being companies and excessive streets.”

Labour has made boosting progress within the financial system certainly one of its key goals.

Nonetheless, figures launched final week confirmed the financial system shrank by 0.1% in October, the second month in a row it has contracted.