Pound falls additional as borrowing prices soar

Getty Photographs

Getty PhotographsThe pound continued to fall on Thursday after UK authorities borrowing prices rose and considerations grew about public funds.

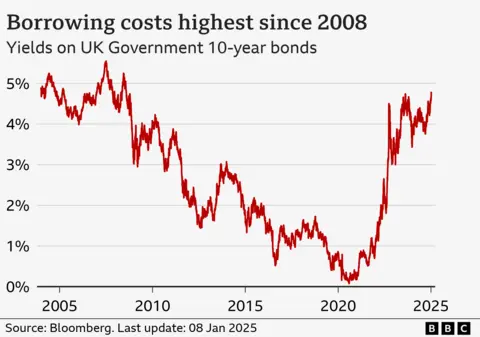

Sterling dropped as UK 10-year borrowing prices surged to their highest degree because the 2008 monetary disaster when the financial institution borrowing virtually floor to a halt.

Economists have warned the rising prices may result in additional tax rises or cuts to spending plans as the federal government tries to satisfy its self-imposed borrowing goal.

A spokesperson for the Treasury stated: “Nobody must be underneath any doubt that assembly the fiscal guidelines is non-negotiable and the federal government may have an iron grip on the general public funds.”

It added that the chancellor would “depart no stone unturned in her willpower to ship financial progress and battle for working folks”.

The federal government stated on Wednesday it might not say something forward of the official borrowing forecast from its impartial forecaster due in March.

“I am clearly not going to get forward… it is as much as the OBR (Workplace for Funds Accountability) to make their forecasts.”

“Having stability within the public funds is precursor to having financial stability and financial progress,” the Prime Minister’s official spokesman stated.

Shadow chancellor Mel Stride claimed that the chancellor’s vital spending and borrowing plans from the Funds are “making it costlier for the federal government to borrow”.

“We must be constructing a extra resilient financial system, not elevating taxes to pay for fiscal incompetence,” he stated in a put up on X.

The warning comes after the price of borrowing over 30 years hit its highest degree for 27 years on Tuesday.

In the meantime, the pound dropped by 0.9% to $1.226 in opposition to the greenback.

The pound sometimes rises when borrowing prices improve however economists stated wider considerations in regards to the power of the UK financial system had pushed it decrease.

The federal government usually spends greater than it raises in tax. To fill this hole it borrows cash, however that needs to be paid again – with curiosity.

One of many methods it might probably borrow cash is by promoting monetary merchandise known as bonds.

“It isn’t excellent news,” Mohamed El-Erian, chief financial advisor at asset supervisor Allianz informed the BBC’s In the present day programme.

He stated the rise in borrowing prices implies that how a lot curiosity the federal government pays on its debt goes up and “it eats up extra of the tax income, leaving much less for different issues”.

Mr El-Erian added that it might probably additionally decelerate financial progress “which additionally undermines income”.

“So the chancellor, if this continues, should take a look at both rising taxes or chopping spending much more – and that is going to influence everybody,” he stated.

Gabriel McKeown, head of macroeconomics at Unhappy Rabbit Investments, stated the rise in borrowing prices “has successfully eviscerated Reeves’ fiscal headroom, threatening to derail Labour’s funding guarantees and doubtlessly necessitate a painful re-calibration of spending plans.”

Globally, there was an increase in the price of authorities borrowing in current months sparked by investor considerations that US President-elect Donald Trump’s plans to impose new tariffs on items coming into the US from Canada, Mexico and China would push up inflation.

The prospect of these insurance policies is colliding with separate considerations about rising US debt and protracted inflation, which may additionally maintain borrowing prices excessive. Within the US, rates of interest on 10-year authorities bonds additionally surged on Wednesday, partially reflecting new knowledge on costs, earlier than dropping again at mid-day to greater than 4.7%, nonetheless the best degree since April.

As buyers reply to modifications within the US bond market, the results are being felt globally, together with within the UK.

Danni Hewson, head of monetary evaluation at AJ Bell, stated the UK rises had been just like these within the US.

“US Treasury 10-year yields have jumped to the best degree since April, while within the UK 10-year borrowing prices have soared to their highest ranges because the monetary disaster,” she stated.

Including: “It might be a worldwide sell-off, nevertheless it creates a singular headache for the UK chancellor seeking to spend extra on public companies with out elevating taxes once more or breaking her self-imposed fiscal guidelines.”

Ms Hewson stated that with lower than two weeks earlier than Donald Trump returns to the Oval Workplace, “uncertainty about his tariff plans are already rattling investor nerves.”

The OBR will begin the method of updating its forecast on authorities borrowing subsequent month to be offered to parliament in late March.