Price range 2025 earnings tax: Particular person taxpayers need FM Sitharaman to decrease tax charges, make new tax regime extra engaging, says survey

Price range 2025 earnings tax expectations: Particular person and salaried taxpayers need Finance Minister Nirmala Sitharaman to decrease the non-public tax charges, in response to a Grant Thornton Bharat pre-budget survey for Price range 2025.

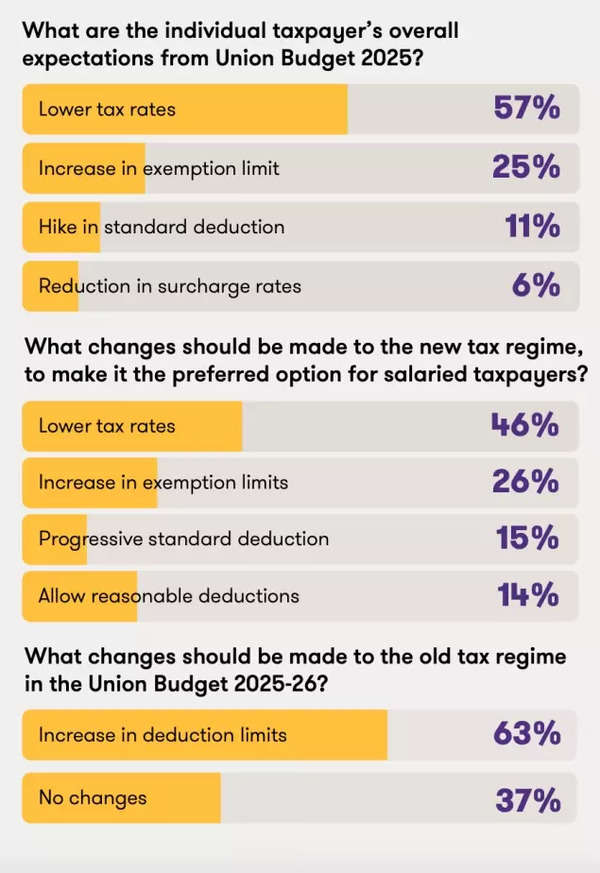

The survey findings point out that particular person taxpayers are looking for private tax concessions to spice up their disposable earnings. The findings present that 57% of contributors need decreased private earnings tax charges, while 25% help larger exemption thresholds.

In response to authorities information, the new earnings tax regime has gained substantial acceptance, with 72% of taxpayers selecting this feature, leaving solely 28% persevering with with the outdated tax regime.

To make the brand new tax earnings tax regime extra engaging, 46% of survey contributors recommend that Price range 2025 ought to look to decrease tax charges, while 26% help elevating exemption limits.

Price range 2025 Earnings Tax GT Bharat Survey

Though the federal government has indicated a possible discontinuation of the outdated tax regime, 63% of taxpayers proceed to request elevated advantages underneath it.

Moreover, respondents are requesting particular advantages, together with enhanced provisions for the Nationwide Pension Scheme (NPS) and larger tax benefits for electrical automobiles to advertise environmentally aware transport decisions.

Taxpayers are additionally advocating for a streamlined tax submitting and compliance framework. In response to Grant Thornton Bharat’s pre-budget survey, 38% of contributors help enabling tax funds by means of international banking establishments, which might simplify compliance procedures for NRIs.

Additionally Learn | Price range 2025 earnings tax: Elevate 30% earnings tax slab; present flat 30% deductions on gross earnings – right here’s why

Moreover, there are requires bettering tax refund processes to abroad banks and implementing e-verification techniques that ship OTPs to worldwide cellular numbers for taxpayers residing outdoors India.

Relating to home taxation, 56% of survey contributors advocate for elevating the earnings threshold for tax submitting obligations to ease the burden on smaller taxpayers. The survey additionally reveals that 32% of respondents favour decreasing further tax for up to date returns, while 12% request prolonged deadlines for submitting revised Earnings Tax Returns (ITRs).

Akhil Chandna, Companion and World Folks Options Chief, Grant Thornton Bharat stated, “The person taxpayers have huge hopes from Union Price range 2025 to supply extra tax saving choices when it comes to decreased tax charges and rising the usual deduction restrict underneath the brand new tax regime. A rise in NPS tax deduction limits and extra versatile NPS withdrawal guidelines would definitely promote retirement financial savings within the palms of taxpayers. Additional, to advertise a greener atmosphere by means of the usage of electrical automobiles (EV), readability is predicted from the Authorities on perquisite taxation guidelines for EV utilization, and the deduction for the acquisition of EVs needs to be reinstated underneath the regulation.”

Finance Minister Nirmala Sitharaman will current the Union Price range on February 1, 2025.