PwC wraps up IndusInd Financial institution’s accounting assessment; forensic probe by Grant Thornton underway, ETCFO

PwC, a prime skilled companies agency, has wrapped up its accounting assessment of IndusInd Financial institution’s derivatives portfolio and submitted draft findings to the lender’s administration, in keeping with two folks with direct data of the matter.

Financial institution officers had been learning the draft findings and will share their observations with PwC, stated the folks. The officers additionally met the agency’s consultants a while in the past.

The IndusInd administration had employed PwC in October 2024 to assessment the accounting of the portfolio after it first found discrepancies within the reserving of its foreign exchange derivatives transactions.

The draft report, nonetheless, has caught to a restricted accounting assessment and has not assigned accountability or examined the timing and historical past of the discrepancies, as these had been exterior the scope of its mandate, the supply added.

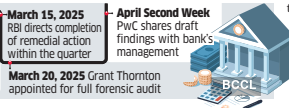

This comes at a time when Grant Thornton Bharat has already begun a forensic investigation to determine the basis explanation for financial institution’s mark-to-market spinoff losses, uncover lapses, and repair accountability.

Replying to ET’s questionnaire, IndusInd Financial institution stated it has not obtained the report from exterior companies conducting the assessment.

Influence of Rs 1,600 crore

Financial institution analysts have estimated that the discrepancies will affect the financial institution’s web price by Rs 1,600 crore – increased than Rs 1,401 crore web revenue earned within the quarter ending December 2024.

On March 10, throughout a name with analysts after the financial institution’s disclosure to the bourses, IndusInd MD and CEO Sumanth Kathpalia stated the financial institution has launched an inner assessment of a portion of its spinoff portfolio after discovering discrepancies in account balances.

The financial institution knowledgeable exchanges that it estimates discrepancies might lead to a monetary affect of roughly 2.35% of its web price as of December 2024.

The following day, the financial institution’s inventory fell 27%–the largest single-day fall–and is down 55% in a yr. On Friday, IndusInd closed at Rs 693 a share, up 2.1% over the day gone by.

The financial institution misplaced its place as India’s fifth most valued lender and now ranks behind even IDBI Financial institution and Sure Financial institution on the seventh rung of the market-capitalization leaderboard.

In lower than per week of the disclosures, on March 15, the RBI issued an announcement assuring depositors that the non-public lender stays well-capitalised and that its monetary well being is steady.

An announcement from the regulator, which may be very uncommon, stated the financial institution has already engaged an exterior audit group to comprehensively assessment its present methods.

It directed the financial institution to finish the remedial motion inside the March quarter “after making required disclosures to all stakeholders”.

Earlier in 2024, IndusInd Financial institution had additionally employed KPMG and EY for a couple of months to help inner groups with a assessment of its treasury insurance policies, procedures, and accounting processes-including these associated to foreign exchange spinoff contracts, ET first reported on April 4.