Rachel Reeves says UK financial system ‘starting to show a nook’

Enterprise reporter, BBC Information

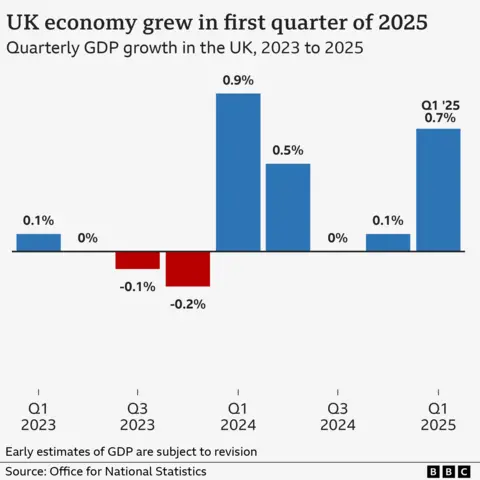

The UK financial system is “starting to show a nook”, the chancellor has mentioned, after it grew by greater than anticipated within the first three months of the 12 months.

Rachel Reeves instructed the BBC the 0.7% progress within the January-to-March interval was “very encouraging”, however shadow chancellor Mel Stride mentioned it was “a bit untimely to be popping the champagne corks”.

The expansion determine was stronger than the 0.6% that had been forecast, and was helped by will increase in shopper spending and enterprise funding.

The figures mark the interval simply earlier than the US imposed import tariffs and UK employer taxes elevated in April, and analysts warned the sturdy price of progress was unlikely to proceed.

The Labour authorities made boosting the financial system its prime precedence when it got here to energy final 12 months, however its choice to extend employers’ Nationwide Insurance coverage (NI) contributions was criticised by many companies who mentioned it may hit progress.

The US import tariffs are additionally anticipated to hit progress, with the Worldwide Financial Fund not too long ago downgrading its forecasts for the worldwide financial system and UK.

Final week, the UK struck a cope with the US that may scale back or take away tariffs on some UK exports, though the blanket 10% levy nonetheless applies to most items getting into the US.

Reeves instructed the BBC: “We’re set to be the quickest rising financial system within the G7 within the first three months of this 12 months.

“We nonetheless have extra to do,” she added. “I completely perceive that the price of residing disaster remains to be actual for a lot of households, however the numbers as we speak do present that the financial system is starting to show a nook.”

Mel Stride criticised the rise in employers’ NI funds, calling it a “jobs tax”.

“Labour inherited the fastest-growing financial system within the G7, however their choices have put that progress in danger,” he mentioned.

Liberal Democrat Treasury spokesperson Daisy Cooper mentioned the information was “optimistic information”, however there was “no time for complacency”.

Reform UK deputy chief Richard Tice MP mentioned: “We’re but to see the impression of Rachel Reeves’ April tax rises on progress, it will not be fairly.”

The Workplace for Nationwide Statistics (ONS) mentioned the UK’s dominant providers sector – which covers companies in sectors similar to retail, hospitality and finance – was the largest driver of progress within the first three months of the 12 months.

The ONS information additionally confirmed that actual GDP per head – which is a measure of the nation’s financial output per individual – rose by 0.5% in the identical interval, following two consecutive quarters of falls.

However analysts warned progress was anticipated to gradual within the months forward, with Paul Dales at Capital Economics saying the most recent figures “could be nearly as good because it will get for the 12 months”.

He mentioned the sturdy rise in GDP was “unlikely to be repeated as a whole lot of it was attributable to exercise being introduced ahead forward of US tariffs and the rise in home companies taxes”.

Mr Dales famous that export volumes within the first three months of the 12 months elevated by 3.5%, following three consecutive quarterly declines.

However Liz Martins, senior UK economist at HSBC, instructed the BBC’s In the present day programme she was “fairly cheered” by the figures.

“Enterprise funding is up almost 6% on the quarter and the service sector is doing properly as properly.

“So it isn’t simply producers promoting to the US to get forward of the tariffs.”

Annabel Thomas, chief government of the Nc’nean Whisky Distillery primarily based in Scotland, says she is “moderately assured” about prospects for the UK.

UK rates of interest are anticipated to fall additional this 12 months, “and that actually impacts the cash folks have of their pockets,” she says.

The enterprise is rising within the US, and so determined to “soak up the tariffs and maintain our costs secure within the US”.

John Inglis is the founding father of diamond software producer Exactaform, which employs 100 folks and has a manufacturing facility within the US. He says making choices over the enterprise’s future has grow to be very troublesome.

“We have tariffs. We do not know which manner we’re going – 10% off a margin is rather a lot.”

He says they’re reluctant to maneuver manufacturing to America as they’d be “placing UK individuals who have been very loyal to us out of labor”.

As for the rise in employers’ NI, he says he doesn’t thoughts “placing in further… nevertheless it’s all niggling away on the revenue you could broaden”.

“We’re holding hearth [on decisions] as a result of if you happen to make the fallacious choice now, everyone’s out of a job.”

Final week, the Financial institution of England lowered UK rates of interest to 4.25% from 4.5% and hinted extra cuts may observe within the coming months.

However the stronger-than-expected progress determine has tempered the markets’ view on additional rate of interest cuts this 12 months.

Analysts recommend doubtlessly fewer reductions will come than beforehand anticipated and that has affected so-called swap charges, which vastly affect fixed-rate mortgage pricing.

Mortgage charges may now tick again up, though predictions are extremely unstable. TSB has mentioned it would enhance its charges on Friday.