RBI Panel Advocates Retaining 4% Inflation Goal in Upcoming Evaluate, ETCFO

An inner committee of the Reserve Financial institution of India is in favor of retaining the present inflation goal in an upcoming authorities evaluate, in accordance with individuals acquainted with the matter, giving buyers some reassurance concerning the continuity of financial coverage.

The panel will doubtless suggest the RBI ask the federal government to maintain the goal at 4%, with a tolerance band of two%-6%, the individuals mentioned, asking to not be recognized as a result of the discussions are personal. The panel can also be in favor of retaining the patron value index because the goal, they mentioned, as an alternative of utilizing a measure that excludes meals, as some authorities officers have argued.

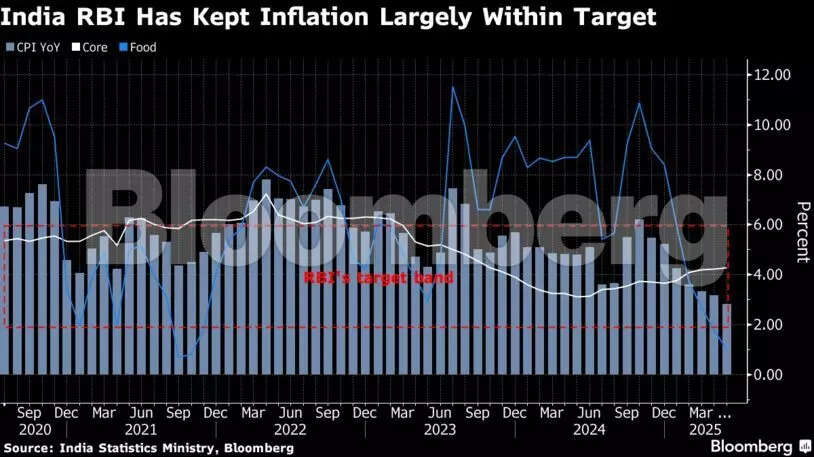

The inflation concentrating on framework, which has been in place since 2016, has been efficient in managing volatility in value positive factors even during times of provide shocks triggered by geopolitical occasions, the individuals mentioned. The coverage is reviewed each 5 years, with the present framework legitimate till March 2026.

The RBI and Ministry of Finance didn’t instantly reply to emailed requests for remark. An official from the Ministry of Finance mentioned final month the federal government will maintain talks with the central financial institution on the inflation concentrating on coverage within the coming months. The ministry can also be looking for info on attainable adjustments to the patron value basket earlier than finalizing the brand new framework, the official mentioned, asking to not be recognized as a result of the discussions are personal.

The RBI has lengthy mentioned the coverage framework has labored in holding inflation underneath management. The central financial institution has principally managed to maintain inflation throughout the goal band, though surging vitality and meals prices in 2022 brought about it to overlook its goal for 3 consecutive quarters. That triggered a situation that required a proof from the governor.

Retaining the inflation goal would take away some uncertainty concerning the course of and reassure market members about coverage continuity underneath Governor Sanjay Malhotra — who took workplace in December — and a comparatively new set of members on the Financial Coverage Committee. The governor stunned economists final month by chopping rates of interest greater than anticipated, with some saying he despatched conflicting indicators about financial coverage on the time.

The RBI’s inner committee will finalize its suggestions by September and submit them to the central financial institution’s management, the individuals mentioned. The proposals will then be mentioned with the Ministry of Finance earlier than a choice is taken on the inflation goal and the framework for the following 5 years, they added. The federal government, in session with the RBI, units the goal.

The central financial institution and a few authorities officers differ over whether or not headline CPI is an applicable measure to attain the 4% goal in a rustic like India, the place unstable meals costs account for 46% of the index.

India’s Chief Financial Adviser V Anantha Nageswaran, a high official within the Ministry of Finance, final yr argued the RBI ought to use an inflation measure that excluded meals, since meals costs are sometimes pushed by provide shocks which can be outdoors the management of the central financial institution. Former RBI Governor Shaktikanta Das rejected that view.

The RBI’s inner committee sees meals as an vital family expenditure merchandise, indicating it will probably’t be unnoticed of the inflation goal, individuals acquainted with the matter mentioned. A separate evaluate of the CPI will doubtless see the weighting of meals objects within the CPI come down solely marginally, they mentioned.

The RBI panel’s reasoning is that meals is a vital enter into different items and the central financial institution can forestall a secondary spherical of shocks by a financial coverage response.

India adopted an inflation concentrating on regime nearly a decade in the past, becoming a member of international central banks just like the Financial institution of England and the Reserve Financial institution of New Zealand.

&w=1200&resize=1200,0&ssl=1)