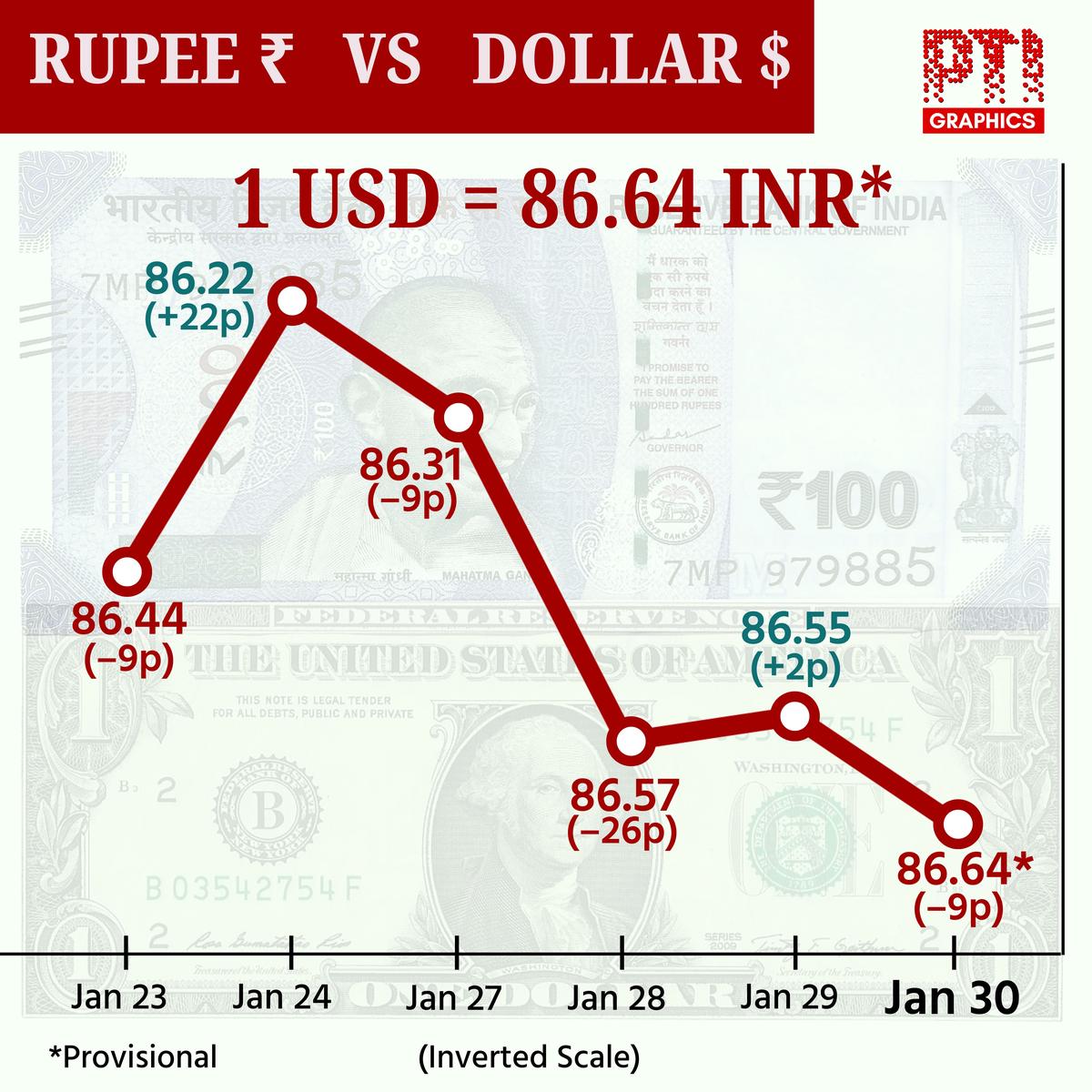

Rupee falls 9 paise to shut at 86.64 towards U.S. greenback

The native unit settled at 86.64 (provisional), registering a fall of 9 paise over its earlier shut. File

| Picture Credit score: V.V. Krishnan

The rupee depreciated 9 paise to shut at 86.64 (provisional) towards the U.S. greenback on Thursday (January 30, 2025), weighed down by a powerful U.S. greenback amid a hawkish tone of the U.S. Federal Reserve.

Foreign exchange merchants mentioned the rupee continued to face strain as a consequence of sustained international fund outflows and the broad energy of the American forex within the abroad markets.

On the interbank international trade, the rupee opened on a weak observe at 86.58 and touched a excessive of 86.56 and a low of 86.65 towards the American forex in the course of the session.

The native unit settled at 86.64 (provisional), registering a fall of 9 paise over its earlier shut.

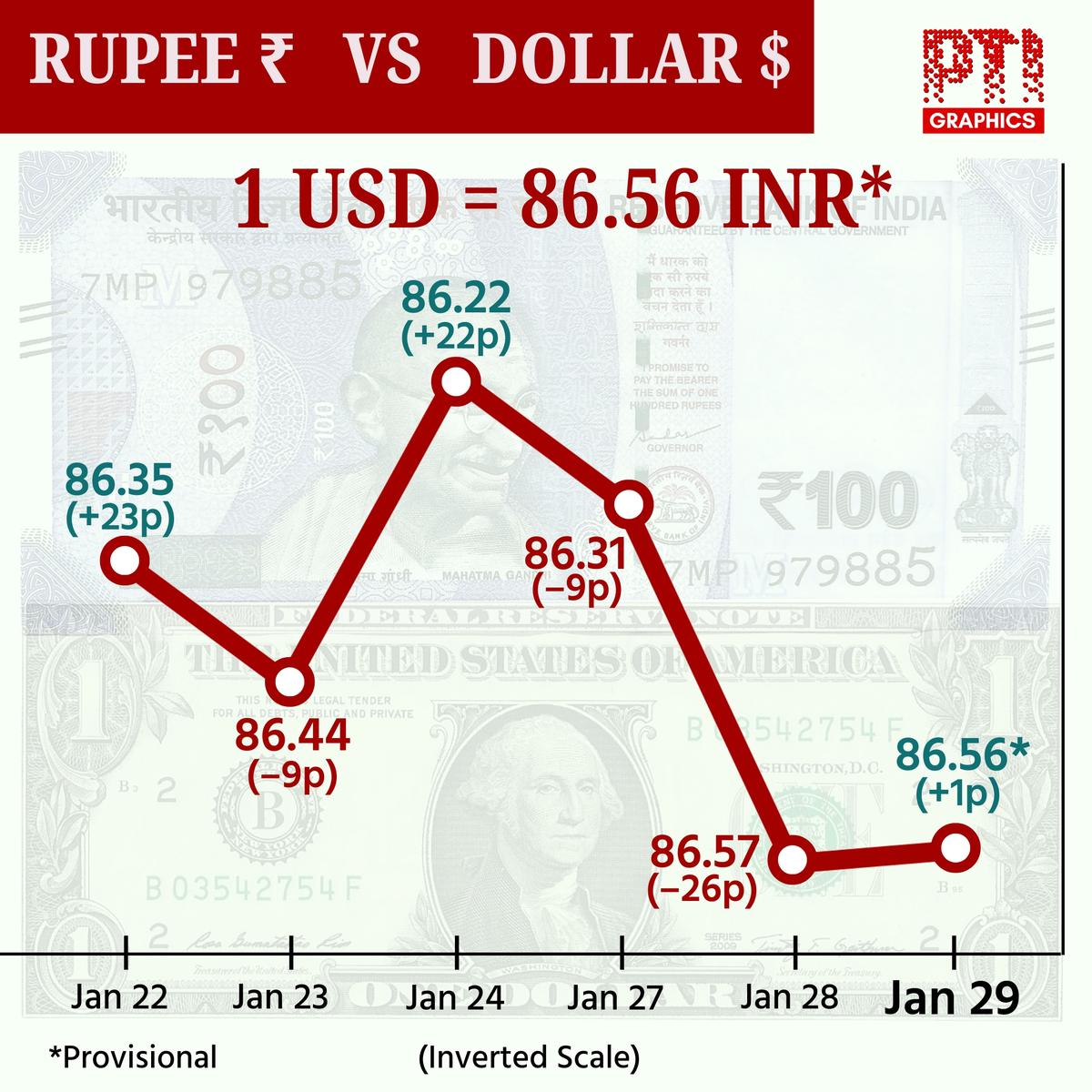

On Wednesday (Jan. 29), the rupee pared its preliminary losses to choose a optimistic observe, larger by 2 paise to shut at 86.55 towards the U.S. greenback.

In the meantime, the greenback index, which gauges the buck’s energy towards a basket of six currencies, was buying and selling 0.02% decrease at 107.98.

“U.S. Greenback gained on the hawkish tone of the U.S. Federal Reserve. Fed saved rates of interest unchanged at 4.25-4.5% at its Federal Open Market Committee [FOMC] assembly on Wednesday [Jan. 29],” mentioned Anuj Choudhary – Analysis Analyst at Mirae Asset Sharekhan.

The U.S. Fed saved charges on maintain however was hawkish in its outlook because it mentioned charges could be held larger for an extended interval, downplaying expectations for future price cuts.

“We count on the rupee to commerce with destructive bias on energy within the U.S. Greenback and promoting strain from FIIs. Month-end Greenback demand from importers may weigh on the rupee,” Choudhary added.

There may be uncertainty over tariffs by the U.S. administration, which can additional strain the rupee. Nonetheless, any central financial institution intervention might assist the rupee.

Merchants might take cues from GDP and weekly unemployment claims knowledge from the U.S.. Traders might stay cautious forward of the Union Finances of February 1 and the RBI’s bond shopping for on Friday, which can result in volatility, Mr. Choudhary added.

Brent crude, the worldwide oil benchmark, fell 0.64% to $76.09 per barrel in futures commerce.

Within the home fairness market, the 30-share BSE Sensex settled 226.85 factors, or 0.30%, up at 76,759.81 factors, whereas the Nifty rose 86.40 factors, or 0.37%, to shut at 23,249.50 factors.

International Institutional Traders (FIIs) offloaded equities price ₹2,586.43 crore within the capital markets on a web foundation on Wednesday, in response to trade knowledge.

Printed – January 30, 2025 05:26 pm IST