Rupee plunges under 87, Sensex slumps over Trump’s tariff struggle

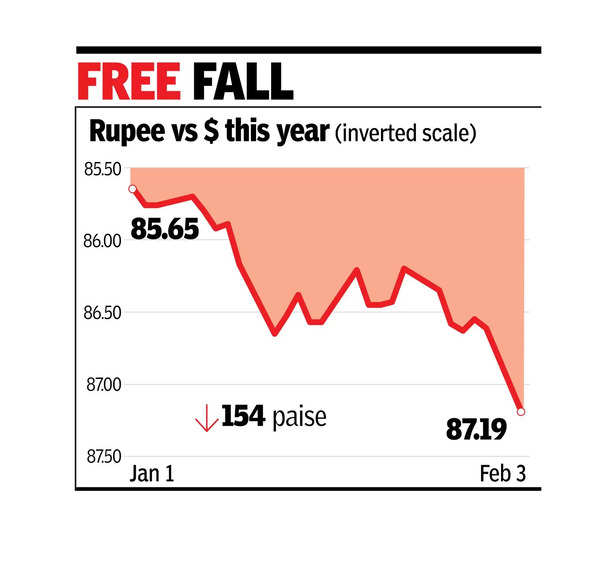

MUMBAI: Rupee hit a report low of 87.28 on Monday, following US President Donald Trump’s announcement of tariffs on imports from main commerce companions that has sparked fears of a commerce struggle. It closed at 87.19, down 58 paise from its earlier shut, marking its largest single-day drop in two weeks.

Rupee might need weakened additional had RBI not intervened via public sector banks. Some sellers speculate RBI is letting the rupee alter in keeping with different Asian currencies. Together with Asian currencies, the Mexican peso dropped greater than 2%, hitting a virtually three-year low.

Sensex dropped by 319.2 factors (0.41%) to 77,186.7, and the Nifty index fell by 121.1 factors (0.52%) to 23,361. US tariffs are anticipated to dominate foreign money market developments this week. Analysts see a detrimental bias for the rupee because of the sturdy greenback, worsened by overseas institutional buyers persevering with to promote equities.

FPI web gross sales amounted to Rs 1,327 crore. The greenback index rose 1.01% to 109.46, whereas Brent crude gained 1.41%, priced at $76.74 per barrel.

“Traders at the moment are frightened about how US tariffs will have an effect on world commerce, with international locations shifting in direction of extra bilateral offers. There’s additionally an opportunity that negotiations may result in decrease tariffs. As new info emerges, the greenback might oscillate, probably reaching 114 earlier than pulling again. Nonetheless, if buyers realise these tariffs may harm each different international locations and the US financial system, the greenback may weaken,” mentioned Ashhish Vaidya, head of treasury at DBS Financial institution.

“The query is how a lot decrease the rupee can go. It relies upon largely on what RBI will do. There may be already panic, with importers speeding to e-book {dollars}, thus growing demand. Will RBI promote {dollars} now, or let the market resolve?” mentioned Madan Sabnavis, chief economist at Financial institution of Baroda. Sabnavis famous that managing rupee actions with liquidity is hard, as promoting {dollars} would drain liquidity. “All eyes are on RBI now for financial motion,” he added.

In the meantime, the Canadian greenback dropped to its lowest stage since 2003, and the euro neared parity with the greenback. Trump additionally hinted at tariffs on European items, resulting in a worldwide inventory market downturn. Bitcoin costs fell, whereas crude oil costs gained, and industrial metals suffered losses.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me? https://accounts.binance.com/sk/register-person?ref=OMM3XK51