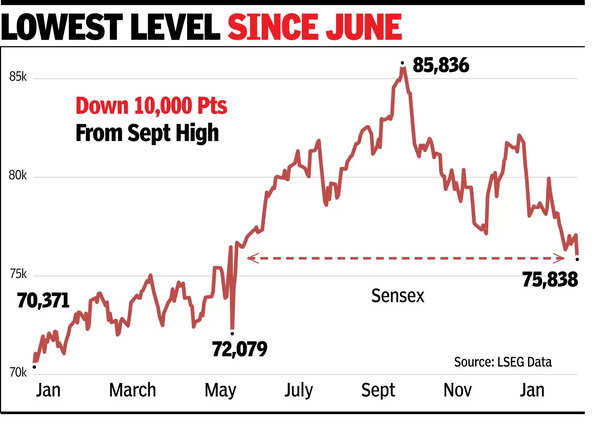

Sensex sinks over 1,200 pts as Trump spooks Dalal Road bulls

MUMBAI: The sensex closed 1,235 factors or 1.6% decrease at 75,838 factors — the bottom stage since June — in a unstable session as buyers on Dalal Road have been left guessing about US President Donald Trump’s strikes that might damage India’s financial pursuits. The not-so-encouraging outcomes from a lot of the main corporations and fears of a price hike by the Financial institution of Japan in its assembly on Friday additionally affected investor sentiment, market gamers mentioned.

Overseas funds have been main sellers on Tuesday with a internet outflow of Rs 5,920 crore, BSE knowledge confirmed. Thus far in Jan, international portfolio buyers have internet offered shares price practically Rs 57,000 crore, mixed knowledge from BSE and NSDL confirmed.

The day’s session noticed the sensex open about 200 factors up at 77,262 however rapidly misplaced over 700 factors to a low of 76,261 factors after which rallied over 950 factors to a excessive of 77,337 factors. Later, promoting bouts pulled the index right down to an intraday low of 75,642 factors to lastly settle close to the day’s low stage. Nifty too adopted an identical path to shut at 23,025 factors, down 320 factors or 1.4%. The day’s session left buyers poorer by Rs 7.3 lakh crore with BSE’s market capitalisation now at 432.8 lakh crore.

In response to Vinod Nair of Geojit Monetary Companies, home markets skilled a major decline on Tuesday, accompanied by excessive volatility on the again of Trump’s announcement of commerce tariffs on neighbouring international locations on his inauguration day. This added uncertainty to world markets. The weak restoration within the ongoing (third quarter) earnings bulletins, coupled with a depreciating rupee are prone to immediate additional outflows by international funds, Nair mentioned.

Traders globally are intently watching what the brand new US President does. “Trump’s remarks concentrating on BRICS nations, reiterating his intention to impose 100% tariffs on international locations lowering their reliance on the US greenback for world commerce, induced destructive sentiments within the Indian market,” mentioned Siddhartha Khemka of Motilal Oswal Monetary Companies. “World markets are additionally intimidated by expectation of an rate of interest hike by the Financial institution of Japan in its upcoming resolution on Friday which might affect borrowing prices globally. We anticipate markets to stay beneath stress within the close to time period amid combined quarterly earnings and heavy FPI promoting.”

In the meantime, Jio Monetary mentioned it has integrated Jio Blackrock Broking to enter the inventory broking area.