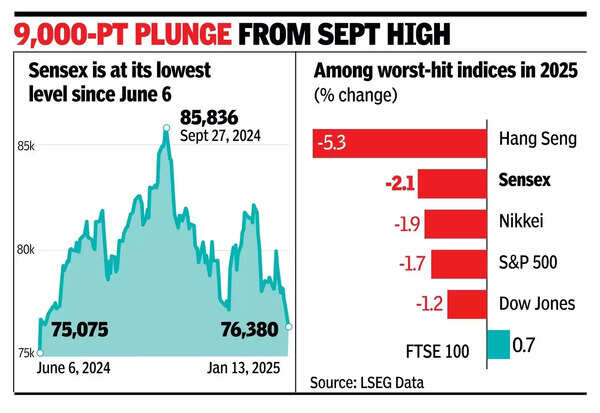

Sensex slumps to 7-month low, mcap falls under $5tn mark | India Information – Occasions of India

MUMBAI: India’s market capitalisation fell under the $5-trillion mark for the primary time in over seven months, due to a sliding market and a weakening rupee. India’s market cap was somewhat over $5.7 trillion at its peak on Sept 27, 2024. On Monday, it closed at $4.8 trillion.

Investor sentiment on Dalal Road was affected by a weak US market closing on Friday night time because of a powerful US jobs knowledge earlier within the day that additional dimmed probabilities of aggressive charge cuts within the coming months on this planet’s largest financial system. The day’s selloff shaved off 1,049 factors from the sensex that closed at 76,330 factors, an over 7-month closing low degree.

“The worldwide markets witnessed a major sell-off, prompting an identical response in home markets because of sturdy US payroll knowledge suggesting fewer charge cuts in 2025,” stated Vinod Nair of Geojit Monetary Providers. “This has strengthened the greenback, pushed up bond yields, and made rising markets much less enticing. Current GDP downgrades and slowing earnings amidst greater valuations are weighing closely on (home) market sentiment.”

On Monday, midcap and smallcap shares witnessed even stronger selloff than blue chips. The mixed impact led to a complete loss to traders’ wealth price about Rs 12.6 lakh crore with BSE’s market cap now at Rs 417 lakh crore. The day’s promoting was led by international funds that clocked a web outflow of almost Rs 4,900 crore whereas home funds have been web consumers at Rs 8,067 crore.

A spiking crude oil costs – after the US President expanded the ban on oil from Russian – additionally impacted investor sentiment on Dalal Road because the transfer additional weakened the rupee and will finally result in rise in inflation. “Rising crude oil costs would increase issues of a spike in home inflation, which may additional delay any charge minimize hopes from RBI within the close to to medium time period,” stated Prashanth Tapse of Mehta Equities.

In Monday’s market, of the 30 sensex shares, 26 ended within the crimson, BSE knowledge confirmed. HDFC Financial institution, ICICI Financial institution and Zomato contributed probably the most to the day’s slide. Larger closings in TCS, Axis Financial institution, HUL and IndusInd Financial institution cushioned the autumn, however solely marginally. Within the quick run, amongst others the rupee-dollar trade charge, buying and selling development by international funds and the crude oil costs would resolve the market’s development, sellers stated.