Suggestions from those that’ve made it on to the housing ladder

Enterprise reporter

Cameron Smith

Cameron SmithThe Financial institution of England has reduce rates of interest for the second time this yr – welcome information for first-time consumers after years of rising mortgage prices and spiralling home costs.

But it surely’s nonetheless robust. Greater than half of first-time consumers nonetheless depend on the so-called financial institution of mum and pa to get on the property ladder, with a mean of £55,572 given in loans and presents final yr, in keeping with property brokers Savills.

We have spoken to individuals on a variety of incomes who’ve managed to make it on to the ladder or are getting ready to shopping for.

They shared with us the ways they used to purchase.

‘We used a Lifetime ISA’

Cameron Smith and Georgia Pickford, each 26, every opened a Lifetime ISA (LISA) so as to purchase a three-bedroom flat in Hertfordshire collectively for £320,000 final yr.

The scheme permits 18 to 39-year-olds to avoid wasting as much as £4,000 a yr, with a 25% authorities bonus, so long as it is used to purchase a house underneath £450,000.

Cameron earns £40,000 and Georgia £37,000 they usually every arrange a direct debit to their respective LISA accounts.

“Each month, £200 got here out of my paycheque – no excuses, no distractions,” says Cameron.

Cameron elevated his contributions every month, and in slightly below three years, the couple saved £27,740, together with the federal government bonus from their LISAs and curiosity. Cameron saved £11,800 and Georgia saved £9,910. To achieve the complete deposit quantity, they topped this up with an additional £4,260 from their private financial savings.

However Cameron, who now shares private finance recommendation on-line, says the scheme hasn’t saved tempo with rising costs.

“The £450,000 cap was set again in 2017 – it hasn’t moved. In case your property is even £1 over that, you lose the bonus and get hit with a 25% penalty.”

Following calls from campaigners for the phrases to be up to date, the Treasury Committee is reviewing whether or not Lifetime ISAs are nonetheless match for function.

Brian Byrnes, head of private finance at Moneybox, a digital financial savings and funding platform, nonetheless thinks the scheme is a good possibility for first-time consumers.

“The Lifetime ISA works fantastically properly for the overwhelming majority of shoppers. Lower than 1% are impacted by the £450,000 cap,” he says.

‘I used an revenue booster mortgage’

Abas Rai, 26, used a sort of joint mortgage generally known as an “revenue booster mortgage” to purchase his first house – a £207,000 two-bedroom home in Suffolk.

It is a product supplied by some lenders that lets a member of the family’s revenue be added to yours, even when they are not residing within the property, to extend how a lot you’ll be able to borrow.

Even with a £30,000 deposit and a £33,000 wage, Abas struggled to get the mortgage he wanted. To spice up his affordability, he added his father, who earns £24,000, to the mortgage.

By combining their incomes, the financial institution was capable of provide an even bigger mortgage, although it meant his dad would even be liable if he defaults.

“The financial institution added our incomes collectively after which multiplied it by 4.5 – that is how they labored out the affordability.”

However involving a guardian comes with some challenges.

“As a result of the particular person added on to the mortgage can also be added on to the property, one of many dangers was my dad’s age – he is 55 and coming to retirement quickly, so I will not be capable to depend on his wage if I default on a fee.”

Abas plans to re-mortgage and take away his dad as soon as his revenue will increase, however says the scheme was value it.

“In the event you’re not incomes above, say £45,000, and you have got somebody within the household, I might suggest you go for it.”

‘We moved 150 miles to a less expensive space’

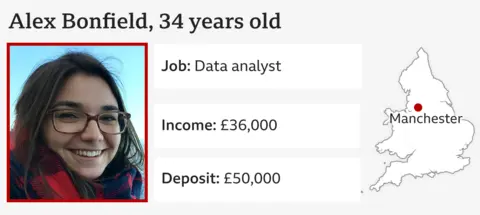

After years of renting in Oxfordshire, Alex Bonfield, 34, has relocated to Manchester to purchase her first house.

“My spouse is a instructor and she or he needed to discover a completely new job up right here. She actually liked her old fashioned, however this was extra necessary,” she says. “It wasn’t a straightforward determination. We do not know anybody right here.”

The couple have been priced out of shopping for close to household and pals in Oxfordshire, the place common home costs are £479,000, in contrast with £251,000 in Manchester.

They started saving 5 years in the past, and are actually house-hunting within the £300,000-325,000 vary with a deposit of £50,000.

“We’re not on the very high of our affordability, however we’re fairly excessive up.”

They’re removed from alone. In line with Santander UK, 67% of first-time consumers over the previous two years have relocated to get on the property ladder.

‘I went for shared possession and a lodger’

Oliver Jones, 27, lives in London and used a shared possession scheme to purchase his first house – a two-bedroom flat value £500,000. He purchased a 25% share with a £40,000 deposit and sub-lets to a long-time pal whom he used to hire with.

“We have been bored with doing that dance yearly with the owner making an attempt to hike up hire by silly quantities,” Oliver says. “Now we’re saving round £1,000 a month in comparison with our outdated flat.”

Shared possession schemes let consumers buy a portion of a property and pay hire on the remainder. They’re typically extra accessible however include complexities, like service fees and restricted resale flexibility.

Oliver’s whole month-to-month prices come to round £1,550, together with £500 for the mortgage, £800 in hire on the 75% share he would not personal, and a £250 service cost. Whereas he and his lodger informally cut up prices, Oliver covers all of the housing funds.

“My mortgage price is 5.4%, however the hire on the unowned portion is barely about 2% of the property worth.

“It is cheaper to only personal a part of the property and pay hire than to purchase the entire thing with an enormous mortgage.”

‘The Assist to Purchase ISA labored for me’

Daniel Value, 27, purchased a three-bedroom house within the South Wales Valleys earlier this yr, not removed from the place he grew up.

He began saving 4 and a half years in the past utilizing a Assist to Purchase ISA – a authorities scheme that topped up financial savings by 25%, as much as a £3,000 most bonus. It has since been changed by the Lifetime ISA scheme.

“Initially, my mum informed me about it, so I simply put a pound in to open the account,” he says.

“I paid in £200 a month and ultimately saved £11,000, which received me a £2,500 authorities bonus.”

Home costs within the South Wales Valleys are typically decrease than in lots of different components of the UK, which may make house possession there extra achievable for first-time consumers.

Daniel purchased his home for £95,000, under the asking worth of £110,000, on account of some minor renovations the property wanted.

“Loads of homes have been out of my worth vary as a single particular person, so I began wanting additional afield.”

“My dad discovered the home on Rightmove and confirmed me it. Every thing was a bit outdated, however nonetheless habitable. It simply wants a bit of labor to modernise it.”

When he first utilized for a mortgage in October 2024, Daniel was incomes £18,000 a yr whereas doing a software program growth apprenticeship. By the point the sale went by in January this yr, his wage had risen to £24,000.

“I began saving once I was working in a manufacturing facility as a warehouse supervisor. I then took up a tech apprenticeship and have simply completed it. That helped with my affordability.”

‘I purchased a fixer-upper’

Camilla De Cesare, 32, is a method marketing consultant. She managed to purchase her first house in London alone, however says it took seven years of residing along with her dad and mom and being open to purchasing a property that wanted some work.

“My household helped me with the deposit, and I had a secure job, so I used to be ranging from a lucky place,” she says.

Camilla saved and invested a complete of £80,000 into the S&P 500, which tracks the efficiency of 500 main firms listed on the US inventory market. By steadily contributing over time and benefiting from market development, her funding pot ultimately grew to £150,000.

“I used to be actually fortunate that the S&P 500, was rising very well over time that I used to be investing in it, so it offered me with a very wholesome cushion.”

She spent £50,000 on her deposit, and the remaining £100,000 will go in direction of renovations on the property over the approaching years, like a brand new kitchen and loo.

She says saving for a deposit felt extra manageable realizing she might sort out renovations steadily, as and when she might afford them.

“I believe once you first get the keys you simply need to do it abruptly. However there’s one thing satisfying about wanting round and realizing you probably did a few of it your self.”

Tom Francis, head of digital recommendation at monetary advisers Octopus Cash, says most individuals would profit extra from “sluggish, regular saving”.

He encourages potential consumers to interrupt their spending into three buckets: necessities, desirables and indulgences.

“Consider your dream house because the vacation spot – you’ll be able to’t get there if you do not know the place you are beginning.”

Sarah Tucker, CEO of the monetary recommendation agency The Mortgage Mum, urges youthful individuals to not wait till they’ve saved for a deposit earlier than in search of monetary recommendation from mortgage brokers.

“There’s nothing higher than chatting with knowledgeable, even for those who’re years away from shopping for.”