‘Tariffs pe tariffs’: Donald Trump imposes tariffs on Canada Mexico and China. They battle again – key takeaways – The Occasions of India

US President Donald Trump introduced sweeping new tariffs on imports from Mexico and China, a transfer that has triggered sharp reactions from world leaders and monetary markets. The tariffs, which Trump says are aimed toward defending American staff and industries, have sparked fears of financial retaliation from affected international locations.

Inventory markets responded with vital declines, whereas enterprise leaders warned of rising prices for shoppers. Trump stays defiant, insisting that the “ache” can be value it in the long term.

Whereas the tariffs are positioned as a way to guard American industries and staff, they’ve raised issues over potential financial retaliation, rising shopper costs, and the long-term affect on world commerce.

Listed below are 10 key takeaways from the newest developments:

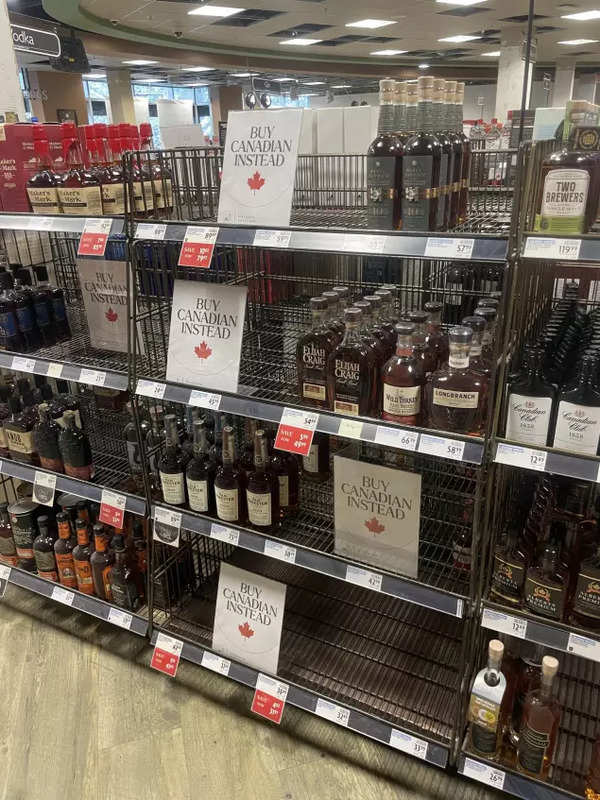

Canada, Mexico, China announce counter-measures

Retaliation has already begun, with Canada, Mexico, and China all saying counter-measures in opposition to US items. Mexico has focused American-made metal, bourbon, and dairy merchandise.

Beginning February 4, Canada will impose 25% tariffs on $30 billion of US imports. The tariffs will apply to items originating from the US, with particular pointers outlined below the CUSMA rules.

Trump speaks to Trudeau

In response to the tariffs, Trump held a name with Canadian Prime Minister Justin Trudeau. The dialog reportedly targeted on potential exemptions for Canada, given its financial ties to the US. Nonetheless, no assurances got. Trudeau expressed issues over how these tariffs may affect North American commerce and warned that Canada might need to reply. Trump, in flip, reiterated his stance that the tariffs are essential to fight what he referred to as “unfair” commerce practices.

Inventory markets slide

Following the announcement, world inventory markets noticed a pointy decline, with US indices dropping considerably. Buyers are apprehensive in regards to the broader financial affect, fearing a commerce conflict may sluggish world progress. The Dow Jones Industrial Common plummeted, whereas European and Asian markets additionally took a success. Analysts recommend that companies closely reliant on imports may undergo probably the most, resulting in job losses and elevated shopper costs.

Additionally learn: Canada, Mexico, China bear the brunt; greenback surges whereas world currencies see excessive lows

What’s going to be costlier?

A variety of merchandise is predicted to see worth hikes because of the tariffs. Shopper electronics, autos, and agricultural merchandise prime the listing. Items sourced from China, similar to smartphones, laptops, and family home equipment, may see vital worth will increase. Equally, Mexican imports, together with vehicles and meals merchandise like avocados, are prone to turn out to be costlier. Retailers have warned that these tariffs will in the end be handed on to shoppers, resulting in larger prices for on a regular basis items.

Additionally learn: Trump imposes sweeping tariffs on Canada, Mexico and China

Peso, Yuan Canadian greenback weaken in opposition to USD

The greenback index rose 0.11% to 109.65, reaching a three-week excessive. Tariff information precipitated merchants to scale back expectations for Federal Reserve charge cuts, now pricing in solely 41 foundation factors of easing this 12 months. The US greenback climbed 0.7% to 7.2552 yuan, whereas the Mexican peso surged 2.7% to 21.40. The Canadian greenback weakened 1.4%, and the euro fell 2.3%. Cryptocurrencies dropped, with Bitcoin falling 4.4% and Ether dropping 15%.

‘Ache can be value it’: Trump

In an announcement, Trump acknowledged that the tariffs may trigger short-term ache however argued they had been essential to safe long-term financial advantages. “Will there be some ache? Sure, possibly (and possibly not!)” Trump mentioned in a submit. “However we’ll Make America Nice Once more, and it’ll all be well worth the worth that should be paid,” the submit added.

Trump has framed the tariffs as a part of his broader effort to scale back America’s commerce deficit and produce manufacturing jobs again to the US. He has urged firms to maneuver manufacturing again to American soil to keep away from the extra prices.

US producers elevate issues

American producers are among the many hardest hit by the tariffs, significantly people who depend on imported supplies from Mexico and China. Automotive producers and electronics firms have warned that the extra prices may drive them to chop jobs or transfer manufacturing abroad. Enterprise teams have urged the Trump administration to rethink, arguing that whereas tariffs could supply short-term safety, they may weaken the broader economic system in the long term. Many trade leaders have referred to as for negotiations reasonably than unilateral motion.

EU subsequent? Britain spared?

On Sunday, President Donald Trump instructed he wouldn’t instantly impose tariffs on Britain, although he hinted that the European Union may face tariffs just like these on Canada, Mexico, and China. Trump has waged a commerce conflict aiming to deal with migration and drug points and to deal with commerce deficits. He criticized the EU for its $300 billion commerce surplus with the US, mentioning the shortage of reciprocal commerce in vehicles and farm merchandise. Trump indicated a possible decision with the UK, praising Prime Minister Keir Starmer and their productive discussions on balancing commerce.

Enterprise teams name for repeal

Main enterprise organisations, together with the US Chamber of Commerce, have strongly opposed the tariffs. They argue that protectionist insurance policies may backfire, resulting in larger prices and financial instability. Some commerce associations have instructed that tariffs may hinder progress and drive companies to downsize. Economists have identified that whereas the technique could enchantment to Trump’s base, it may alienate allies and harm America’s world financial standing. There’s rising strain from enterprise leaders for the administration to pursue negotiations as a substitute.

What occurs subsequent?

Some analysts consider negotiations between the US and its commerce companions may result in modifications or exemptions. Others concern a chronic commerce dispute that would disrupt world markets for years. Trump has indicated he’s keen to barter however has additionally threatened additional tariffs if China and Mexico don’t adjust to US calls for.

(With inputs from companies)