Tata Capital board to have a look at potential fund-raise

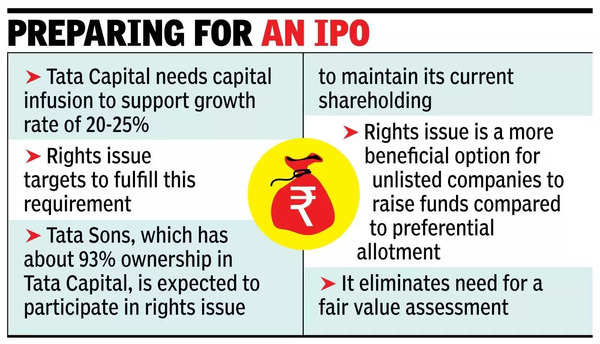

MUMBAI: The board of Tata Capital, which is getting ready for an preliminary public providing (IPO), will meet on Tuesday to debate a possible fund-raise by means of a rights difficulty. The Reserve Financial institution of India has categorised Tata Capital as an upper-layer non-banking monetary companies firm (NBFC) and has directed the agency to listing its shares by September. Tata Sons, which has about 93% possession in Tata Capital, is predicted to take part within the rights difficulty to keep up its present shareholding within the NBFC.

Tata Capital requires constant capital infusion to assist its progress charge of 20-25%, and the rights difficulty goals to satisfy this requirement, stated an individual aware of the matter. The remaining 7% possession in Tata Capital is distributed amongst numerous Tata Group entities, choose executives from each Tata Group and exterior organisations, and the Washington-based Worldwide Finance Company.

A rights difficulty is a extra useful choice for unlisted corporations to lift funds in comparison with preferential allotment, because it eliminates the requirement for truthful worth evaluation. The primary benefit lies in its uniform pricing construction, the place all present shareholders should subscribe to new shares on the identical value, stated Katalyst advisors’ government director Binoy Parikh.

Tata Capital’s proposed fund-raise by means of a rights difficulty follows current modifications to its memorandum of affiliation (MoA) and articles of affiliation (AoA). The corporate, in its January communication to shareholders requesting approval for MoA and AoA amendments, disclosed having round 29,000 shareholders.

To adjust to sections 25 and 42 of the Corporations Act and forestall additional growth of its shareholder base by means of company actions, Tata Capital stated it has launched a brand new provision in its AoA to limit shareholders from renouncing their rights in rights points till the corporate’s fairness shares are listed on the inventory exchanges. It clarified that this restriction doesn’t forestall present shareholders from taking part in or subscribing to further fairness shares by means of rights points.

Tata Capital is the biggest monetary companies entity inside the Tata Group and is recognized as a vital factor for progress by the conglomerate. The proposed IPO, which might contain the issuance of latest shares, might end in a discount of Tata Sons’ possession by about 5%. In line with itemizing rules, corporations should preserve a 25% public shareholding inside three years post-listing.

In a word dated February 5, Fitch Rankings stated that Tata Sons’ possession in Tata Capital is unlikely to fall beneath 75% after the proposed public itemizing. The IPO will strengthen Tata Capital’s capital base and reduce its leverage additional, Fitch stated, including that the NBFC’s debt-to-tangible fairness ratio has proven enchancment, declining to six.3x by the conclusion of 1HFY25, in comparison with 7.2x on the finish of FY22.