There’s an Esop fable in startup Inc’s IPO run, ETCFO

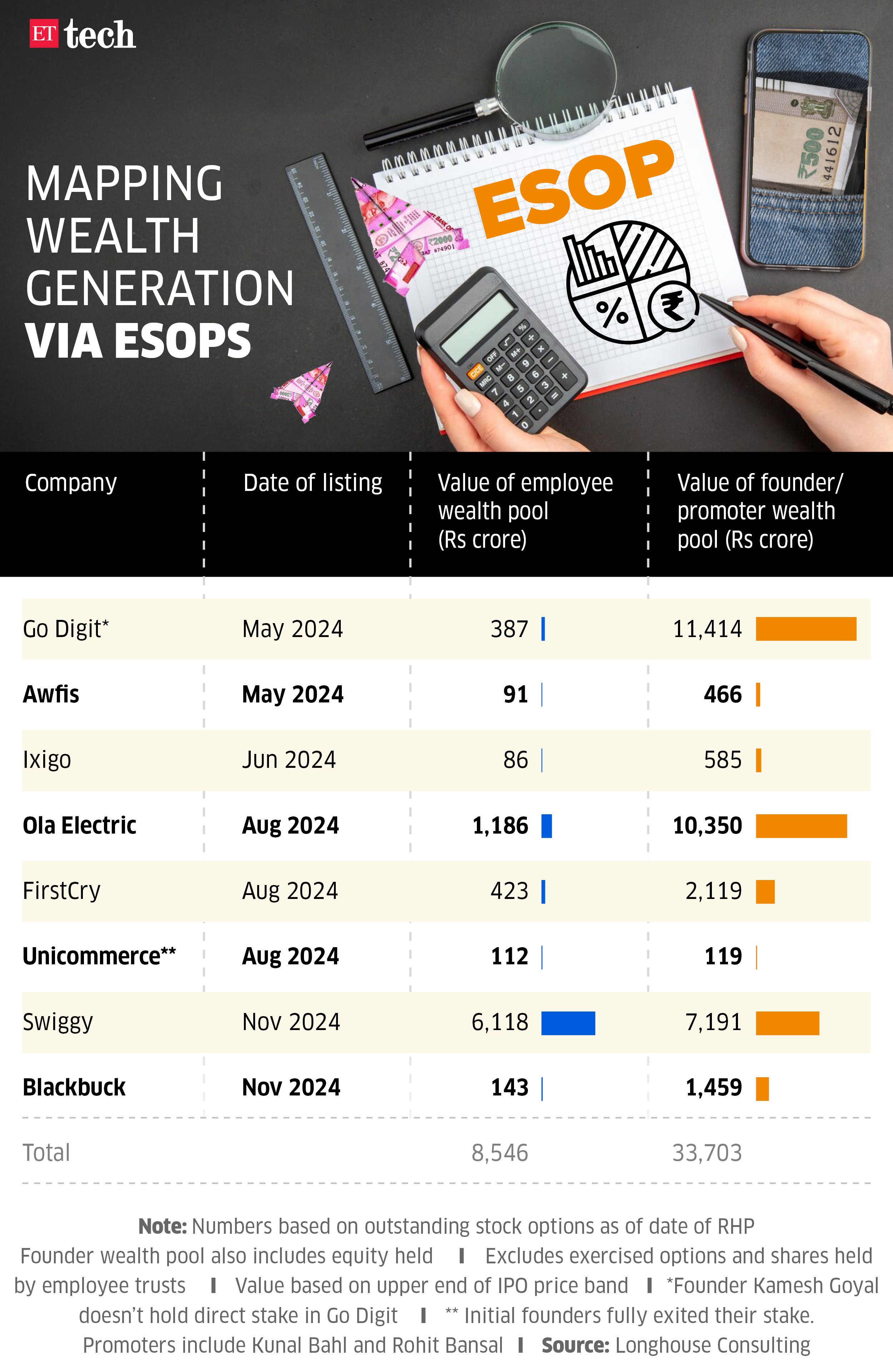

Preliminary public choices (IPOs) of eight new-age web corporations this yr unlocked over Rs 8,500 crore for workers from their excellent inventory choices. Spectacular as it’s, this pales compared to the practically Rs 34,000 crore in wealth amassed by founders and promoters by fairness and share choices, as revealed within the corporations’ purple herring prospectuses (RHPs) forward of the listings.

Information compiled by Longhouse Consulting completely for ET highlights the hole in wealth creation between startup founders and their general employees.

Startups usually concern Esops (worker inventory possession plans) as a device to incentivise folks to take the danger of becoming a member of fledgling startups.

Esop buybacks

Whereas the info set for 2024 accounts for excellent inventory choices talked about within the corporations’ preliminary public providing (IPO) prospectuses on the time of going public, these don’t characterize all the wealth technology facilitated by the corporations over their whole life cycle. Usually, privately held startups conduct Esop buybacks whereas elevating funding to award their employees.

In a number of instances, founders additionally encash partial stakes by secondary share gross sales.

“Whenever you have a look at the numbers in absolute quantities, the disproportionality strikes you,” mentioned Amit Tandon, founder and managing director of proxy advisory agency Institutional Investor Advisory Providers (IIAS). “There are situations the place a big a part of Esops go to a really slender set of individuals, and solely a small half is distributed among the many bigger set. That’s one thing the businesses want to protect in opposition to.”

IPOs and wealth creation

This yr, meals and grocery supply agency Swiggy, which went public in November, allotted 7.01% of its shareholding to excellent choices for workers, whereas its founders held choices and fairness totalling 8.68%.

Equally, ecommerce software program agency Unicommerce’s excellent Esop pool had 10.16% shares on the time of the corporate’s IPO, and its promoter holding was at 10.75%. To make certain, the agency’s promoters together with ecommerce market Snapdeal and its founders Kunal Bahl and Rohit Bansal acquired stake in Unicommerce by secondary transactions.

Excellent choices check with the whole variety of inventory choices which have been granted, however not but exercised or expired, inside an organization’s capital construction.

ET had reported in November that Swiggy’s public itemizing unlocked Rs 9,000 crore in Esop wealth for its over 5,000 previous and current employees. This included the founders and its senior administration. Swiggy’s $1.4-billion IPO, which was one of many largest wealth creation workouts by an Indian startup, additionally minted 70 greenback millionaires.

For electrical two-wheeler maker Ola Electrical, founder Bhavish Aggarwal’s holding was practically 37% versus a 3.5% excellent Esop pool for the agency’s workers. The Bangalore-based firm’s worker belief held one other 7.7% stake on the time of its public concern in August this yr.

Most corporations supply a four-year vesting interval to workers—the inventory choices agreed upon on the time of becoming a member of of an worker flip into tradable shares on the finish of this era.

“The query arises whether or not the four-year Esop playbook is honest or not,” Anshuman Das, CEO of Longhouse Consulting, mentioned. “Corporations are taking no less than 10-12 years to get in-built India… Traders ought to presumably take into consideration having longer fund cycles, leaving extra for the founders and workers… The staff must also purpose to remain longer versus making a fast buck inside 4 years,” he added.

Mails and messages despatched to Go Digit, Ola Electrical, Swiggy, Firstcry, Ixigo and Awfis didn’t elicit a response until press time Thursday.

Blackbuck founder and CEO Rajesh Yabaji mentioned the corporate’s Esop pool, together with granted and exercised choices, stood at 5.2% of the general shareholding.

Unicommerce CEO Kapil Makhija mentioned in response to a question, “It has change into necessary for know-how corporations to leverage Esops as an instrument for expertise retention and development.”

Esop impact

Esop allocations gained traction in India when software program companies corporations like Infosys started deploying them. Corporations grant extra inventory choices to founders and key administration personnel forward of a public itemizing to make sure they proceed pushing for higher efficiency.

Whereas the disparity between worker wealth pool and founder or promoter wealth was additionally excessive for legacy IT companies corporations, the founder shares ended up being excessive as a result of they didn’t dilute excessive quantum of stakes to boost exterior capital.

Along with the distinction in inventory wealth for workers and promoters, IT corporations have additionally been flagged for disparity in payouts to their high administration and junior employees members.

Over the previous decade of India’s web economic system, Walmart-owned ecommerce market Flipkart has emerged among the many greatest wealth creators, having carried out Esop buybacks aggregating to $1.5 billion throughout numerous tranches up to now six to seven years.

Zomato, which was one of many first giant home client web startups to go public in July 2021, created 18 greenback millionaires by its Rs 9,375 crore IPO. On the time of Paytm’s IPO in November 2021, round 350 workers (each current and former) turned crorepatis.

Das of Longhouse Consulting identified that the hole between founder fairness and Esop swimming pools will usually enhance as corporations faucet the general public markets, provided that founders are allotted inventory choices in preparation of an inventory. “There can be no distinction between personal and public corporations (by way of the delta between founder fairness and worker Esops)… however the founder’s fairness is elevated (whereas) Esop pool is not going to change. So, from that perspective, the hole between the founder and Esop will enhance,” he mentioned.

The wealth creation alternative by Esops additionally tends to have second-order results with senior workers constructing a capital consolation to doubtlessly begin up on their very own, a development that’s unfolded throughout the Indian startup ecosystem.