Treasury sells last NatWest shares 17 years after bailout

BBC

BBCThe Treasury has introduced the sale of its last shares within the NatWest Group. It means the financial institution will likely be below full personal possession, nearly 20 years after it was bailed out by the taxpayer amid the 2008 monetary disaster.

This marks a symbolic finish to a dramatic chapter in British banking historical past.

It was gone midnight – the early hours of Monday 13 October 2008 – when Chancellor Alistair Darling turned in for the evening, leaving a staff of officers, surrounded by curries and pizza containers, finalising the element of the largest state intervention within the personal sector since World Struggle Two.

The subsequent morning he introduced the primary instalment of a rescue that may value the taxpayer greater than the complete defence finances.

In whole the federal government spent £45bn (£73bn in right now’s cash), shopping for an 84% stake within the Royal Financial institution of Scotland (RBS), which now trades as a part of the NatWest Group.

Luke MacGregor/PA Wire

Luke MacGregor/PA WireOn the time, RBS’s steadiness sheet (excellent loans) was greater than the complete UK economic system. Its collapse would have devastated it.

The query is, why has it taken some 17 years for the Treasury to promote the final of its stake?

And on condition that within the many years since recent dangers have emerged – together with the specter of a cyber assault from a hostile state – how susceptible does that go away UK banks right now? Are they nonetheless “too large to fail”, as they had been broadly described in 2008 – and had been Britain to face one other monetary disaster, would the taxpayer need to step in as soon as once more to ship a bailout?

‘It was by no means about saving the banks’

The present chair of NatWest group, Rick Haythornthwaite, has advised the BBC that the financial institution and its staff stay grateful for that intervention in 2008.

“The primary message to the taxpayer is one among deep gratitude,” he says. “They rescued this financial institution. They protected the hundreds of thousands of companies and home-owners and savers.”

Quite a bit has modified since 2008. Gone are £1.5 trillion in excellent loans, gone are tens of hundreds of staff in job cuts, and gone is round £10bn of taxpayers’ cash – by no means to be recouped.

The quantity spent by the federal government seems like a poor funding, however as Baroness Shriti Vadera – former senior adviser to the federal government and chair of asset supervisor Prudential – advised the BBC, this wasn’t an funding, it was a rescue.

“Nationalising RBS was hardly a voluntary funding,” she says. “What was necessary then was assessing the affect of RBS and different banks on the general economic system and specifically the flexibility to maintain functioning – lending, placing money in ATMs.

“It was by no means about saving the banks, it was about saving the economic system from the banks.”

The results of a banking collapse would have been severe. The prime minister, Gordon Brown, even talked about placing troopers on the streets.

In a ebook by ex-Labour spin physician Damian McBride, Brown is quoted as saying: “If the banks are shutting their doorways, and the money factors aren’t working, and folks go to Tesco and their playing cards aren’t being accepted, the entire thing will simply explode.

“If you cannot purchase meals or petrol or medication in your youngsters, individuals will simply begin breaking the home windows and serving to themselves.”

Dangerous mortgages and unhealthy loans

RBS was in fact not the one financial institution that confronted collapse. A tsunami of unhealthy loans had been triggered by an earthquake within the US mortgage market. Dangerous loans to debtors with low credit score scores had been packaged up and offered to banks world wide.

By 2007, no-one knew precisely the place these grenades had been hidden in financial institution steadiness sheets, so all of them stopped lending to one another – which noticed the entire world monetary system seize up.

Northern Rock relied on borrowing funds to finance its personal dangerous mortgages and in 2007, the BBC reported that it had turned to the Financial institution of England for assist. This prompted a “run on the financial institution”, which lastly noticed it absolutely nationalised in February 2008.

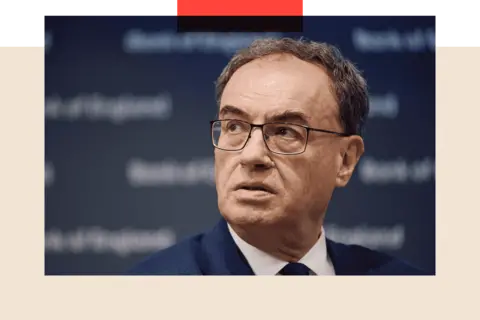

Andrew Bailey, the governor of the Financial institution of England, labored because the Financial institution’s Chief Cashier throughout these turbulent months. He says if the state hadn’t nationalised RBS, the prices would have been “incalculable”.

“It might have been enormous, as a result of we had been speaking in regards to the collapse of the banking system as we knew it at the moment,” recounts Bailey.

Benjamin Cremel/ PA Wire

Benjamin Cremel/ PA WireUS Banks had been additionally in deep misery. In March 2008, Bear Stearns was absorbed by Wall Road rival JP Morgan. In September of that 12 months, US mortgage giants Fannie Mae and Freddie Mac had been nationalised. Right here within the UK, HBOS was absorbed by Lloyds after which in fact, Lehman Brothers failed – defying expectations that the US authorities would step in to reserve it.

However for the UK economic system, RBS was the massive one. The UK had a big banking sector, in comparison with the dimensions of its economic system; and inside that blend, RBS was a very necessary financial institution.

The as soon as sedate RBS had turn out to be in some measure the largest financial institution on the earth. In 2000, it purchased NatWest and only a 12 months earlier than the crash, it had purchased Dutch financial institution ABN Amro.

Its buccaneering boss Fred Goodwin had been knighted for his providers to banking. However Mr Goodwin grew to become a lightning rod for public outrage on the dangers banks had taken and the bonuses their executives had collected.

He left with an annual pension of £700,000 however was later stripped of his knighthood.

Reuters

ReutersThe years following the rescue noticed hundreds of corporations complain that the bankers RBS appointed to assist them out of the disaster had been driving them to the wall, forcing them into chapter 11 or promoting their companies at knock-down costs.

RBS was the poster little one for banking recklessness, hubris, greed and cruelty.

Why then did it take so lengthy for the federal government to promote out of RBS – at a lack of £10bn?

A mistake to carry on for thus lengthy?

On the similar time the federal government took a stake in RBS, it additionally took a stake in Lloyds. However that was offered in Might 2017, yielding a revenue of £900m.

RBS was infinitely extra sophisticated than Lloyds because it had a big US enterprise which was the topic of prolonged investigations by the US Division of Justice. The prospect of heavy fines hung over the financial institution for a few years and proved well-founded when it was fined $4.9bn (£3.6bn) in 2018 for its function within the US mortgage disaster.

RBS was additionally a reasonably unattractive funding. It introduced a £24bn loss for 2008 – the largest loss in UK company historical past. It made losses yearly till 2017.

With the shares depressed by these considerations, the federal government was reluctant to promote its stake at low costs as it will crystallise a politically uncomfortable loss for the taxpayer.

Reuters

ReutersIn any case, following 2010, austerity was the secret and the then-Chancellor George Osborne may unwell afford to be seen to be chalking up losses by promoting RBS shares when he was making cuts elsewhere.

However many suppose that was a mistake as – hen and egg-like – it extended the reluctance of personal shareholders to purchase stakes in an organization majority-owned by the federal government.

As Baroness Vadera places it: “I am unsure it was essential to take 17 years to reverse out of the shares.”

Collapses ‘much less seemingly – however not unimaginable’

Mr Haythornthwaite, who took on the function of NatWest Group chairman in April final 12 months, describes the sale of the ultimate shares as a “symbolic” second for the financial institution, its staff, traders – but additionally on a wider scale.

“I hope it is a symbolic second for our nation [too],” he says. “That we are able to put this behind us. It permits us to really look to the long run.”

However how precisely does that future look – and have classes from the previous actually been learnt?

Andrew Bailey actually thinks so. He says that if a financial institution faces collapse now, it is much less seemingly the taxpayer must step in.

There at the moment are different strategies of rescuing a failing financial institution, he says, together with shopping for property and offering emergency money.

“The massive distinction is that we expect we are able to deal with [bank crises] with out utilizing public cash,” Bailey says. “The crucial factor is that we’ve to protect the continuity of their actions, as a result of they’re crucial to the economic system … crucial to individuals.

“Once we say we have solved ‘too large to fail’, to be exact, I believe what we imply is we do not want public cash.”

It’s true that the Financial institution of England now stress-tests banks way more rigorously to see how they’d cope below pressures like a collapse in home costs, rocketing unemployment or rampant inflation.

Sir Philip Augar, a veteran of the Metropolis of London and writer of a number of books on banking, agrees that British banks are in a extra resilient place now than they had been in 2008 – basically as a result of they maintain additional cash of their coffers, moderately than simply counting on debt.

“What’s occurred to enhance issues since then is that the quantity of leverage within the system has come proper down, and the capital cushion that banks have to carry […] has elevated considerably. So it is much less seemingly now {that a} financial institution would collapse – nevertheless it’s not unimaginable.”

Cyber danger won’t ever go away

Right this moment, there are additionally new dangers to think about.

Take the collection of cyber assaults that not too long ago hit the methods of family names like Marks and Spencer, Co-op and Harrods. Ought to an assault take out crucial banking features like enterprise lending, firm payrolls and ATMs, it will be way more damaging.

Certainly, in what he calls the “league desk” of economic dangers, Andrew Bailey identifies the specter of a cyber assault as a quickly rising one.

“In fact it’s a must to mitigate it, however [cyber] is a danger that may by no means go away, as a result of it regularly evolves,” he says.

“We’re coping with unhealthy actors who will regularly refine the traces of assault. And I all the time need to say to establishments, ‘You have to proceed to work at this’.”

Current financial institution collapses within the US – like Signature Financial institution and Silicon Valley Financial institution – have highlighted one other main danger. Prospects do not need to queue spherical a block to get their cash out; it may be performed with the stroke of a key on a laptop computer or cellular in seconds.

Banks are constructed on belief: clients put cash in, believing they’ll get it out once more each time they need. And old style financial institution run is now a contemporary digital financial institution run.

However banks are nonetheless not like regular corporations. They aren’t standalone entities however interconnected, and collectively they kind the bloodstream of the economic system.

They’re the arteries by way of which credit score is prolonged, wages are paid, financial savings are stashed or withdrawn. And when these arteries get blocked, unhealthy issues occur.

That’s as true right now because it was in 2008.

BBC InDepth is the house on the web site and app for the most effective evaluation, with recent views that problem assumptions and deep reporting on the largest problems with the day. And we showcase thought-provoking content material from throughout BBC Sounds and iPlayer too. You possibly can ship us your suggestions on the InDepth part by clicking on the button beneath.