Trump’s tariff blitz on China might have an sudden winner: India

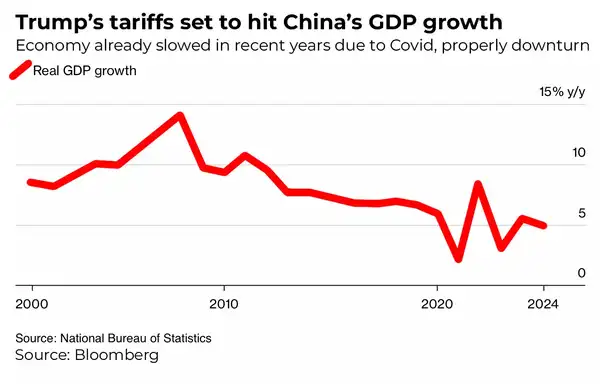

US President Donald Trump has escalated his financial battle with Beijing, slapping as much as 245% in cumulative tariffs on Chinese language imports – essentially the most aggressive US commerce motion in years.

Whereas these tariffs hit China’s key industries onerous – together with tech, vital minerals, and shopper items – Trump has paused or minimized duties on most different nations, giving nations like India a uncommon alternative to shine.

The most recent salvo: An April 15 govt order investigating whether or not Chinese language exports of uncommon earth metals and demanding minerals threaten US nationwide safety – an inquiry prone to lead to extra tariffs. In the meantime, China has retaliated with personal duties on US items and tightened controls over exports of key supplies like gallium, germanium, and uncommon earths.

Why it issues

- The world’s two largest economies are deep right into a tit-for-tat showdown that’s disrupting international provide chains and investor confidence. However on this chaos, India is gaining floor – as a impartial, secure, and scalable manufacturing various.

- Whereas Beijing accuses the US of “threatening and blackmailing,” and analysts warn of looming recessionary dangers, India is being recast as a uncommon haven within the storm. From tech giants rerouting manufacturing to overseas capital discovering firmer footing, the nation is rising as a central determine in a reshaping of world commerce.

- Corporations like Apple Inc are already shifting manufacturing. The iPhone maker assembled $22 billion value of iPhones in India within the 12 months ending March, a 60% leap over the earlier 12 months, Bloomberg reported. Meaning 1 in each 5 iPhones is now made in India.

- Apple’s provide chain pivot isn’t simply symbolic – it’s operational. In March alone, the corporate airlifted almost $2 billion in iPhones from India to the US to preempt Trump’s tariffs, in line with Reuters. Customs information exhibits Foxconn shipped $1.31 billion and Tata Electronics exported $612 million value of units.

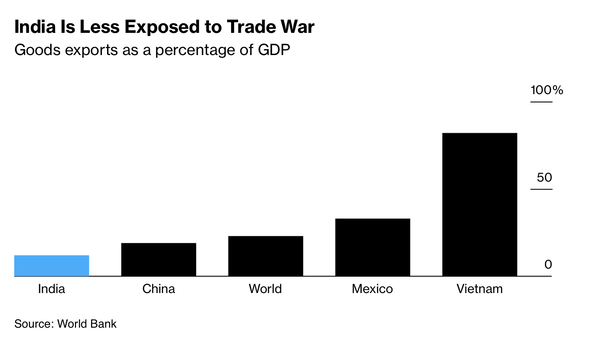

- India’s low publicity to US commerce—simply 2.7% of American imports in comparison with 14% for China—shields it from a lot of the direct fallout.

Zoom in: India’s tariff-free edge

- India-made iPhones are at present exempt from Trump’s tech tariffs, not like these made in China.

- Apple now assembles all iPhone fashions in India, together with top-end titanium Professional variations.

- $17.4 billion value of iPhones had been exported from India in FY25, per India’s know-how ministry.

- India’s share of Apple’s international iPhone manufacturing may quickly hit 30%, Bloomberg reported.

- Trump’s 145% tariff wall on China consists of stacked duties on fentanyl-related items (20%), unfair commerce practices (125%), and a worldwide 10% baseline levy. However he’s made clear: China is the primary goal.

“The ball is in China’s courtroom,” mentioned press secretary Karoline Leavitt, studying Trump’s message. “China must make a cope with us. We don’t need to make a cope with them.”

The massive image: India’s manufacturing second

India is seizing a novel window created by:

- Trump’s China-only commerce assault

- A 90-day exemption from reciprocal tariffs

- A conciliatory commerce stance, avoiding retaliation

- PM Narendra Modi’s multi-billion-dollar ‘Make in India’ incentives

The Modi authorities has pumped $26 billion into manufacturing subsidies, together with recent $2.7 billion incentives for electronics and semiconductors. That, plus tax breaks and infrastructure upgrades, is drawing firms desperate to de-risk from China.

In distinction to China’s defiance, India’s strategy has been conciliatory. Prime Minister Narendra Modi’s administration has actively sought a provisional commerce cope with the US and averted any retaliatory countermeasures. That diplomatic restraint, mixed with sturdy home demand and focused industrial incentives, has made India a much more engaging vacation spot for firms seeking to diversify manufacturing.

“India’s non-retaliatory stance and lively negotiation strategy has positioned it on stronger footing,” mentioned Sneha Tulsyan of Tokio Marine Asset Administration.

Apple’s shift has additionally confirmed that India’s industrial ecosystem can scale – shortly. Simply earlier than Trump’s tariffs hit, Apple requested Indian authorities to chop customs clearance occasions from 30 hours to six hours at Chennai Airport. The objective: Fly out 600 tons of iPhones earlier than penalties kicked in.

What they’re saying

“We stay chubby India in our portfolios,” mentioned Gary Dugan, CEO of The International CIO Workplace.

“India ought to emerge as a relative outperformer,” wrote Mahesh Nandurkar of Jefferies, who upgraded India to “chubby” within the agency’s Asia ex-Japan mannequin.

“There’s a clear case for buyers to guess on India’s resilience,” mentioned Harshad Patwardhan, CIO at Union Asset Administration.

International funds have responded quick:

- Indian bonds rallied whereas US and Chinese language belongings took hits.

- India’s Nifty 50 erased all tariff-driven losses, making it the primary main international market to rebound.

- International establishments have poured $25 billion into Indian markets this 12 months.

Sure, however: Hurdles stay

As per a New York Occasions report, India’s breakout second is actual – however not with out friction.

Regardless of 10 years of Modi authorities’s “Make in India” marketing campaign, manufacturing nonetheless accounts for lower than 13% of India’s economic system, down from 15%. China’s share is round 25%.

“What we don’t have is the expert employees to make use of the tools,” Vikram Bathla, founding father of Indian battery maker LiKraft, advised the NYT. Most of his inputs – and equipment – are nonetheless imported from China.

Challenges embrace:

- Scarcity of expert technical labor

- Dependence on overseas inputs, particularly for high-tech items

- Costly land and restricted credit score for small companies

- Sluggish courts and pink tape, which discourage scale

- At the same time as factories rise, many depend on Chinese language uncooked supplies and European equipment. As Anil Bhardwaj of an area commerce physique put it: “There may be concern of massive corporations – and a dysfunctional justice system.”

What’s subsequent: India’s take a look at of readiness

Analysts say India is healthier positioned than friends like Vietnam or Mexico to soak up international provide chain shifts. However with out structural reforms – from training to land use – India might battle to ship on its potential.

Nonetheless, the sentiment is robust. As Trump’s tariffs chunk into Chinese language exports, Apple is just the start. India is drawing new curiosity in auto elements, textiles, chemical substances, and semiconductors.

“India is just not insulated,” Rajat Agarwal, strategist at SocGen, advised Bloomberg. “However it’s comparatively higher positioned.”

Bloomberg Economics sees only a 0.3–0.4% potential GDP hit from the worldwide commerce struggle – a light affect that may very well be offset by new US commerce agreements at present below dialogue.

The underside line

Trump’s commerce struggle is shaking up the worldwide economic system – and whereas China feels the warmth, India is standing within the highlight.

With Apple main the best way, India’s ascent as a producing energy is now not hypothetical. If policymakers can clean the highway forward, this may very well be India’s breakout second on the world’s manufacturing facility ground.

(With inputs from companies)