Trump’s tariffs go away China’s neighbours with an unimaginable alternative

BBC Information

BBC Indonesian

Getty Photographs

Getty PhotographsWhen US President Donald Trump hit China with tariffs in his first time period, Vietnamese entrepreneur Hao Le noticed a possibility.

His firm is one in all lots of of companies which have emerged to compete with Chinese language exports which have more and more been going through restrictions from the West.

Le’s SHDC Electronics, which sits within the budding industrial hub of Hai Duong, sells $2m (£1.5m) price of cellphone and pc equipment each month to the USA.

However that income may dry up if Trump imposes 46% tariffs on Vietnamese items, a plan that’s at the moment on maintain till early July. That will be “catastrophic for our enterprise,” Le says.

And promoting to Vietnamese customers will not be an possibility, he provides: “We can’t compete with Chinese language merchandise. This isn’t simply our problem. Many Vietnamese firms are struggling in their very own dwelling market.”

Trump tariffs in 2016 despatched a glut of low-cost Chinese language imports, initially supposed for the US, into South East Asia, hurting many native producers. However in addition they opened new doorways for different companies, usually into international provide chains that needed to chop their dependence on China.

However Trump 2.0 threaten to close these doorways, which it it sees as an unacceptable loophole. And that is a blow for fast-growing economies like Vietnam and Indonesia which are gunning to be key gamers in industries from chips to electrical automobiles.

In addition they discover themselves caught between the world’s two greatest economies – China, a robust neighbour and their greatest buying and selling associate, and the US, a key export market, which might be seeking to strike a deal at Beijing’s expense.

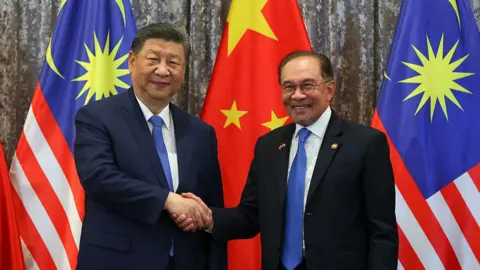

And so Xi Jinping’s long-planned journey to Vietnam, Malaysia and Cambodia this week took on recent urgency.

All three nations rolled out the the purple carpet for him, however Trump noticed it as extra proof of the them conspiring to “screw” the US.

Getty Photographs

Getty PhotographsThe White Home will use its upcoming negotiations with smaller nations to stress them into limiting their dealings with Beijing, based on experiences.

However that might be a whimsical ambition given the sum of money flowing between China and South East Asia.

In 2024, China earned a file $3.5tn from exports – 16% of these went to South East Asia, its greatest market. Beijing, in flip, has paid for railways in Vietnam, dams in Cambodia and ports in Malaysia as a part of its “Belt and Highway” infratructure programme that seeks to spice up ties overseas.

“We won’t select, and we are going to by no means select [between China and the US],” Malaysia’s commerce minister Tengku Zafrul Aziz instructed the BBC on Tuesday, forward of Xi’s go to.

“If the problem is about one thing that we really feel is in opposition to our curiosity, then we are going to defend [ourselves].”

A wake-up name

Within the days after Trump unveiled his sweeping tariffs, South East Asian governments scrambled into deal-making mode.

In what Trump described as a “very productive name” with Vietnamese chief To Lam, the latter provided to fully scrap tariffs on US items.

The US market is essential to Vietnam, an rising electronics powerhouse the place manufacturing giants like Samsung, Intel and Foxconn, the Taiwanese agency contracted to make iPhones, have arrange store.

In the meantime, Thai officers are headed to Washington with a plan that features greater US imports and investments. The US is their largest export market, so they’re hoping to keep away from the 36% levy on Thailand that Trump could reinstate.

“We are going to inform the US authorities that Thailand will not be solely an exporter but in addition an ally and financial associate that the US can depend on in the long run,” Prime Minister Paetongtarn Shinawatra mentioned.

The Affiliation of Southeast Asian Nations (Asean) has dominated out retaliation in opposition to Trump’s tariffs, as an alternative selecting to stress their financial and political significance to the US.

Getty Photographs

Getty Photographs“We perceive the considerations of the US,” Mr Zafrul instructed the BBC. “That is why we have to present that really we, Asean, particularly Malaysia, may be that bridge.”

It is a function that South East Asia’s export-driven economies have performed properly – they’ve benefitted from each Chinese language and US commerce and funding. However Trump’s paused levies may derail that.

Take Malaysia, as an example. In recent times, chip producers from the US and elsewhere have invested there, as Washington blocks the sale of superior tech to China. Final yr China imported $18bn price of chips from Malaysia. These chips are utilized in Chinese language-made electronics, equivalent to iPhones, usually certain for the US.

Trump’s proposed tariffs on Malaysia – 24% – may reduce off the multi-billion greenback US market. However that is not all.

“If this continues, then firms must rethink their funding commitments,” Mr Zafrul says. “This may have an effect not simply on Malaysia’s economic system, however on the worldwide economic system.”

Then there’s Indonesia, which may face 32% tariffs, and is dwelling to huge nickel reserves and has its sights set on the worldwide electrical car provide chain.

Cambodia, a Chinese language ally, faces the steepest levies: 49%. One of many poorest nations within the area, it has thrived as a trans-shipment hub for Chinese language companies searching for to skirt US tariffs. Chinese language companies at the moment personal or function 90% of the garments factories, which primarily export to the US.

Trump could have hit pause on these tariffs however “the harm is finished,” says Doris Liew, an economist at Malaysia’s Institute for Democracy and Financial Affairs.

“This serves as a wake-up name for the area, not solely to cut back reliance on the US, but in addition to re-balance overdependence on any single commerce and export associate.”

China’s loss and South East Asia’s acquire

In these unsure occasions , Xi Jinping is attempting to ship a steadfast message: Let’s be a part of fingers and resist “bullying” from the US.

That’s no simple activity as a result of South East Asia additionally has commerce tensions with Beijing.

In Indonesia, enterprise proprietor Isma Savitri is nervous that Trump’s 145% tariffs on China means extra competitors from Chinese language rivals who can not export to the US.

“Small companies like us really feel squeezed,” says the proprietor of sleepwear model Helopopy. “We’re struggling to outlive in opposition to an onslaught of ultra-cheap Chinese language merchandise.”

Getty Photographs

Getty PhotographsConsidered one of Helopopy’s in style pyjamas sells for $7.10 (119,000 Indonesian rupiah). Isma says she has seen comparable designs from China going for round half that worth.

“South East Asia, being shut by, with open commerce regimes and fast-growing markets, naturally turned the dumping floor,” says Nguyen Khac Giang, visiting fellow on the ISEAS Yusof-Ishak Institute in Singapore. “Politically, many nations are reluctant to confront Beijing, which provides one other layer of vulnerability.”

Whereas customers have welcomed competitively-priced Chinese language merchandise – from garments to footwear to telephones – 1000’s of native companies haven’t been capable of match such low costs.

Greater than 100 factories in Thailand have closed each month for the final two years, based on an estimate from a Thai assume tank. Throughout the identical interval in Indonesia, round 250,000 textile employees have been laid off after some 60 garment producers shut, native commerce associations say – together with Sritex, as soon as the area’s largest textile maker.

“Once we see the information, there are many imported merchandise flooding the home market, which messes up our personal market,” Mujiati, a employee who was laid off from Sritex in February after 30 years, tells the BBC.

“Possibly it simply wasn’t our luck,” says the 50-year-old, who remains to be trying to find work. “Who can we complain to? There is no-one.”

Getty Photographs

Getty PhotographsSouth East Asian governments responded with a wave of protectionism, as native companies demanded to be shielded from the influence of Chinese language imports.

Final yr Indonesia thought-about 200% tariffs on a variety of Chinese language items and blocked e-commerce web site Temu, in style amongst Chinese language retailers. Thailand tightened inspections of imports and imposed extra tax on items price lower than 1,500 Thai baht ($45; £34).

This yr Vietnam has twice imposed momentary anti-dumping duties on Chinese language metal merchandise. And after Trump’s newest tariffs announcement, Vietnam is reportedly set to crack down on Chinese language items being trans-shipped by way of its territory to the US.

Allaying these fears would have been on Xi’s agenda this week.

China is worried that channelling its US-bound exports to the remainder of the world would “find yourself actually alienating and aggravating” its buying and selling companions, David Rennie, the previous Beijing bureau chief for the Economist newspaper, instructed BBC’s Newshour.

“If a tidal wave of Chinese language exports finally ends up swamping these markets and damaging employment and jobs … that is an enormous diplomatic and geopolitical headache for the Chinese language management.”

China has not all the time had a simple relationship with this area. Barring Laos, Cambodia and a war-torn Myanmar, the others are cautious of Beijing’s ambitions. Territorial disputes within the South China have soured ties with the Philippines. That is additionally a difficulty with others equivalent to Vietnam and Malaysia, however commerce has been a balancing issue.

However which may change now, consultants say.

Getty Photographs

Getty Photographs“South East Asia had to consider whether or not they actually needed to offend China. Now this complicates issues,” says Chong Ja-Ian, affiliate professor on the Nationwide College of Singapore.

China’s loss might be South East Asia’s acquire.

Hao Le, in Vietnam, says he has seen a surge in enquiries from American clients scouting for brand spanking new electronics suppliers, outdoors of China: “Up to now, US consumers would take months to change suppliers. As we speak, such choices are made inside days.”

Malaysia, with sprawling rubber plantations and the world’s largest medical rubber glove maker, has almost half the world’s marketplace for rubber gloves. However it’s poised to seize a much bigger share from its important competitor, China.

The area nonetheless faces a ten% baseline tariff, like a lot of the world. And that’s dangerous information, says Oon Kim Hung, president of the Malaysian Rubber Glove Producers Affiliation.

However even when the paused tariffs kick in, he says, clients will discover paying a further 24% on Malaysian gloves vastly preferable to the 145% levy they must cough up for Chinese language-made gloves.

“We’re not precisely leaping with pleasure, however this will properly profit our producers, in addition to these in Thailand, Vietnam and Cambodia.”

Further reporting by Abhiram V Subramaniam