UK financial progress slows however beats forecasts

BBC enterprise reporter

Getty Photos

Getty PhotosUK financial progress slowed between April and June, in response to official figures, however was higher than anticipated.

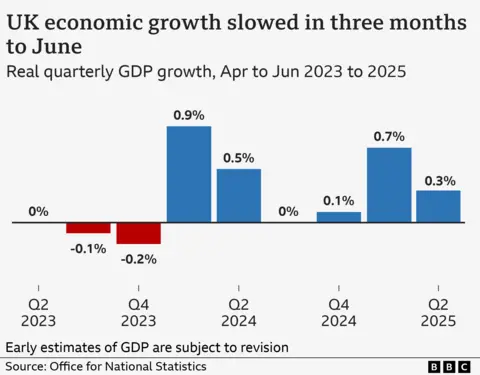

The financial system expanded by 0.3%, down from 0.7% within the first three months of the yr, the Workplace for Nationwide Statistics mentioned.

The largest contribution got here from companies whereas the development trade additionally grew.

The UK authorities has made boosting financial progress a key precedence and the newest knowledge beat forecasts of 0.1% enlargement.

Chancellor Rachel Reeves mentioned the figures have been “optimistic” for an financial system that “has felt caught for too lengthy”.

However she added: “There may be extra to do to ship an financial system that works for working individuals.”

Nonetheless, Conservative shadow chancellor Mel Stride accused her of “financial vandalism” whereas Liberal Democrat MP Daisy Cooper mentioned: “Snails would scoff on the tempo that our financial system is rising.

“The Conservative Celebration led us into this financial quagmire however this Labour authorities has failed to interrupt from the years of mismanagement.”

The financial system carried out higher than anticipated in June, in response to ONS figures, whereas earlier estimates for April have been revised upwards.

The ONS had initially mentioned that gross home product (GDP) – a key measure of financial exercise – had shrunk by 0.3% in April however now mentioned it contracted by 0.1%.

However Ruth Gregory, deputy chief UK economist at Capital Economics, mentioned it was uncertain the nation “will preserve this tempo of progress” between July and September.

“The weak world financial system will stay a drag on UK GDP progress for some time but,” she mentioned.

“The complete drag on enterprise funding from April’s tax rises has but to be felt. And the continued hypothesis about additional tax rises within the Autumn Funds will in all probability hold customers in a cautious temper.”

James Smith, an economist at ING Financial institution, informed the BBC’s As we speak programme that the determine for the April-to-June interval was “not dangerous”.

Within the first three months of the yr, financial progress was “boosted by companies attempting to get forward of Donald Trump’s tariffs”, he mentioned, in addition to homebuyers speeding to finish earlier than a change in stamp obligation thresholds in April.

“These components have been at all times going to be a drag, so the truth that we have ended up with 0.3% progress in an setting of worldwide uncertainty is not actually a nasty consequence,” he mentioned.

Consultants urged that sizzling, dry climate helped increase the development sector which expanded by 1.2% between April and June.

‘Surprising sunshine’

Iain Hoskins, who owns a number of venues in Liverpool, mentioned he was “very frightened” after the final Funds, with improve Nationwide Insurance coverage Contributions including £100,000 to his prices.

Nonetheless, he mentioned he was “feeling extra optimistic than we’ve achieved for the previous couple of years,” thanks largely to higher climate and client confidence.

“The quarter that we’re speaking about, we had a really early summer time and sometimes that interval could be a full washout,” he mentioned. “Surprising sunshine actually did carry individuals out in drive.

“Rates of interest taking place has actually helped: more cash in peoples’ pockets. That’s elementary.”

The Financial institution of England has reduce rates of interest 5 occasions over the previous 12 months, taking borrowing to 4%.