UK inflation dips to 2.5% in December in enhance for Rachel Reeves

Getty Photos

Getty PhotosUK inflation unexpectedly dipped in December for the primary time in three months as resort costs fell and tobacco prices eased.

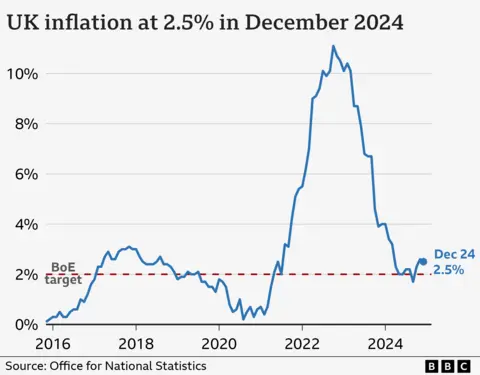

Costs rose 2.5% within the yr to December, down from 2.6% the month earlier than, the Workplace for Nationwide Statistics (ONS) stated.

Regardless of the speed of worth rises remaining above the Financial institution of England’s goal, expectations of an rates of interest lower subsequent month have grown.

The newest figures additionally ease strain on Chancellor Rachel Reeves, who has confronted criticism following a fall within the worth of the pound and authorities borrowing prices hitting the best stage for a number of years.

Borrowing prices fell again to final week’s ranges and the pound rose barely to face at $1.22 as merchants reacted to the surprising inflation drop.

Easing worth rises in eating places, falling resort costs, and smaller rises in airfares than regular final month helped the general inflation charge come down, the ONS stated.

Costs for tobacco merchandise, which embody cigarettes, pouches, vape refills and cigars, additionally elevated at a slower tempo.

However Grant Fitzner, chief economist of the ONS, stated this was offset by the rising price of gas and second-hand automobiles.

Inflation is way decrease than its peak in October 2022 when costs soared, pushing up the price of residing for households and resulting in larger rates of interest, which has made the price of loans, bank cards and mortgages, costlier.

Economists had anticipated inflation to stay unchanged final month, so the falling charge can be welcome information for Reeves.

The chancellor stated there was “nonetheless work to be achieved to assist households throughout the nation with the price of residing”, however added the federal government had “taken motion to guard working individuals’s payslips from larger taxes” and elevated the minimal wage.

However shadow chancellor Mel Stride stated financial development had been “killed stone lifeless by this authorities” and known as for Reeves to “urgently clarify how she is going to now obtain this”.

In response to turbulence within the markets, it’s understood the chancellor will carry ahead bulletins for Labour’s industrial technique.

Jane Sydenham, funding director at Rathbones Funding Administration, stated a weak pound tended to sign a “insecurity” within the UK economic system.

She informed the BBC’s At this time programme buyers wanted to “see some element” on the UK’s plans. “Are there going to be some tax breaks for sure industries? I feel specifics and motion is what the market needs to see,” she added.

Rising borrowing prices have a knock-on impact on the federal government’s tax and spending plans, as a result of it should pay extra curiosity to finance its current debt. That leaves much less to spend on public providers and funding.

Darren Jones, chief secretary to the Treasury, informed the BBC public providers would “should stay inside their means”.

When pressed on whether or not that sounded as if cuts had been on the best way, he replied: “It is nearly prioritisation.”

‘You’ll be able to solely cost a lot’

Jonny Gettings, director of operations at Italian restaurant and small resort Ennio’s in Southampton, informed the BBC the hospitality enterprise was being hit by rising prices from produce and components, to workers wages and utility payments.

He stated the outlook for the enterprise appeared “significantly worse” with will increase to the minimal wage and nationwide insurance coverage contributions and reductions to enterprise charges aid on the horizon.

Mr Gettings stated reducing workers working hours could be the “final situation”, however stated the restaurant may take a look at shrinking its menu measurement, evaluate its suppliers, or change opening hours.

“As quickly as you improve the costs, you have acquired one other bunch of issues to cope with, as a result of then the concern is the purchasers will vote with their toes and so they’ll go and eat elsewhere,” he added.

“You’ll be able to solely cost a lot for a menu merchandise earlier than the visitor goes to say, ‘effectively, hold on a minute’.”

‘Extra charge cuts’

Michael Saunders, a former member of the Financial institution of England’s financial coverage committee which units rates of interest, stated the most recent inflation determine could be “some assist” in making an attempt to ease a few of the worries over UK rates of interest.

“If it stays like this, we can be on path to barely extra rate of interest cuts,” he informed BBC’s At this time programme.

The Financial institution of England determined to carry rates of interest at 4.75% final month, after policymakers stated the UK economic system had carried out worse than anticipated, with no development in any respect between October and December.

It should subsequent set charges in February, however inflation stays above its 2% goal.

Nonetheless, Ruth Gregory, deputy chief UK economist at Capital Economics stated the lower-than-expected inflation determine for December “strengthens the case” for a 0.25 proportion level lower subsequent month. Traders have additionally elevated bets on a lower subsequent month.

Hire and payments rising

Some individuals have inflation-linked telephone and broadband contracts, which suggests their invoice will rise in April according to the most recent CPI information.

Comparability web site Uswitch stated these payments are set to extend by a median of £21.99 per yr for broadband and £15.90 a yr on common for mobiles.

Nonetheless, owing to new guidelines, plenty of contracts now present any anticipated rises in kilos and pence every year in the course of the course of the settlement.

Separate ONS figures launched on Wednesday confirmed common lease prices rose 9% in December in contrast with a yr earlier as UK home costs elevated by 3.3% within the 12 months to November, with the largest rise seen in Northern Eire.