UK inflation falls as worth of petrol drops

BBC Enterprise reporter

Getty Photos

Getty PhotosFalling petrol costs drove UK inflation down by greater than anticipated within the 12 months to March.

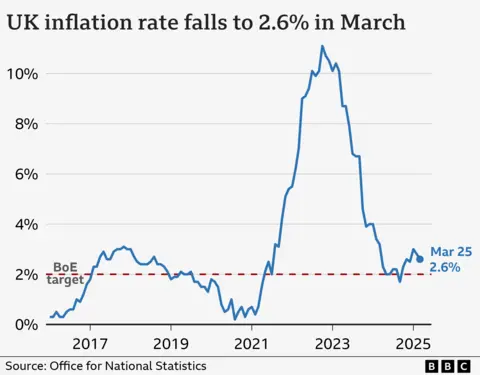

Inflation was 2.6%, down from a fee of two.8% in February, in accordance with official information.

However the fall could solely be non permanent as analysts say it is anticipated to spike from April as rising payments and better enterprise prices take maintain.

“The one important offset got here from the value of garments which rose strongly this month,” stated Grant Fitzner, chief economist on the Workplace for Nationwide Statistics (ONS).

The typical worth of petrol fell by 1.6p per litre between February and March to 137.5p per litre.

The inflation lower was additionally pushed by a drop in recreation and tradition costs, with toys, video games, and hobbies falling significantly sharply.

The autumn in inflation implies that, though costs proceed to rise, the tempo is slowing. Value rises have slowed from highs seen lately.

Wages proceed to outpace inflation with wage raises for public sector employees rising greater than these within the non-public sector.

The typical rise in wages was 5.9%, information launched by the ONS on Tuesday confirmed.

In Could, the inflation determine for April will doubtless be pushed to round 3% on account of will increase in fuel costs, electrical energy costs, and water costs, stated Michael Saunders, senior advisor at Oxford Economics.

The previous member of the Financial institution of England’s rate of interest setting Financial Coverage Committee instructed Radio 4’s At present Programme the impact of Trump’s commerce wars may also be felt in exports and funding within the UK.

“We could get a diversion of low-cost exports which could have in any other case gone to the US, will begin to come to Europe and the UK,” he stated.

“Maybe not as excessive because the Financial institution of England had feared just a few months in the past, however the economic system might be weaker, with exports and funding and client spending all hit and unemployment beginning to rise”.

He added that one other side-effect of Trump’s commerce battle is hitting international development, which causes oil costs to fall, which is able to feed by to decrease petrol costs right here within the UK.

‘It is getting greater and better’

Sonja Skelton says the largest value for her enterprise is staffing – and that is about to get greater with minimal wage will increase.

The latest improve in Nationwide Insurance coverage has value her over £60,000.

“And it is getting greater and better,” she says, however she provides she’s completely satisfied to pay as she says it would assist to enhance the UK’s infrastructure.

Her agency, West Particular Fasteners, makes nuts and bolts, and has been doing since 1999.

The agency has over 65 workers and provides offshore defence and specialist building companies with non-standard fasteners, made with chrome steel and unique metals.

“We’re making an attempt to be just a little bit extra environment friendly, so we’re making an attempt to enhance all our processes, as a result of that may assist claw a few of that cash again.”

However, she provides, if she is not in a position to take up additional prices, the costs of her merchandise should go up.

“So there is a specialist materials we name that is known as Hastelloy C-276. I would most likely say round 5 years in the past, which may have been, say, £30 per kilo.

“We’re now taking a look at round about £50 per kilo. So, as you’ll be able to inform, it is a large, large improve”.

As her agency is a excessive power consumer, the rising value of power has additionally “actually impacted” her.

On prime of that, she says that working in engineering, “you at all times have ups and downs, as a result of it actually relies upon what’s occurring everywhere in the world, and conflicts can have a knock-on impact on what we do”.

Rate of interest minimize

As inflation comes down, it might put stress on the Financial institution of England to chop its key rate of interest, at the moment 4.5%.

Vacancies at their lowest level in 4 years and financial stress predicted from Donald Trump’s tariffs might also encourage the Financial institution to chop when it meets subsequent month.

However the Financial institution faces a dilemma, as wage development stays robust and this might usually discourage a minimize in charges.

Consultants and analysts predict inflation to fall to close its 2% goal by 2026.

The drop in inflation might be welcome information to the federal government, stated Lindsay James, funding strategist at Quilter.

“With the roles market weakening considerably, and really actual and current tariff threats nonetheless in play, any downward stress on inflation might be hailed,” she stated.

She added the forecast for inflation “stays very unsure” due to a “risky” international economic system, and rising Nationwide Insurance coverage which she stated will elevate costs from April onwards.

Chancellor Rachel Reeves stated the drop was “encouraging” however that “there’s extra to be accomplished.

“I do know many households are nonetheless battling the price of residing and that is an anxious time due to a altering world,” she stated.

Nonetheless, shadow chancellor Mel Stride says Reeves’ “reckless union payouts, tax hikes and borrowing binge is driving up the price of residing”.

He stated inflation stays above the official goal of two% on account of her selections.

Extra reporting by Adam Woods.

&w=1200&resize=1200,0&ssl=1)