UK inflation falls greater than anticipated as clothes costs drop

Enterprise reporter, BBC Information

Getty Pictures

Getty PicturesUK inflation fell by greater than anticipated in February, pushed by a drop in clothes and shoe costs attributable to an unusually excessive variety of gross sales.

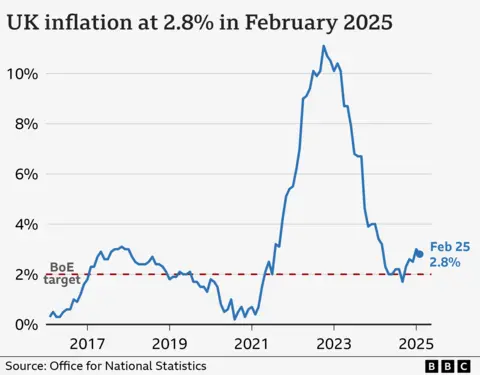

Inflation decreased to 2.8%, down from a fee of three% in January, in line with the Workplace for Nationwide Statistics (ONS).

The most recent figures come forward of Chancellor Rachel Reeves’ Spring Assertion, the place she’s going to set out her financial plans.

Grant Fitzner, chief economist on the ONS, mentioned ladies’s clothes “was the most important driver for this month’s fall”.

“This was solely partially offset by small will increase, for instance, from alcoholic drinks”, he added.

General costs for clothes and footwear fell within the 12 months to February for the primary time since 2021, with youngsters’s clothes and accessories reminiscent of hats and scarves additionally having an impression.

The ONS mentioned one other issue was an unseasonably excessive variety of clothes gross sales. Discounting normally drops off in February as January gross sales finish and spring ranges enter the retailers, however that didn’t occur this 12 months.

Economists polled by Reuters had anticipated that inflation – which measures the speed at which costs rise – would dip to 2.9% in February. Nonetheless, regardless of the larger than anticipated fall, the determine continues to be above the Financial institution of England’s goal of two%.

The speed of worth rises can be anticipated to extend within the months forward, with council tax and vitality and water payments all set to rise in April.

As well as, a latest survey from the ONS discovered that nearly a half of companies are contemplating worth rises as they brace for subsequent month’s tax rises and improve within the Nationwide Residing Wage.

Susannah Streeter, head of cash and markets at Hargreaves Lansdown, mentioned the Financial institution of England was unlikely to chop charges at its subsequent assembly as a result of February’s fall was “not an unlimited change” and inflation “continues to be considerably above goal”,

“Though policymakers will not wish to hold charges too excessive for too lengthy given the stagnation within the economic system, they’re set to remain cautious with a fee reduce trying extra prone to are available June and one other later within the 12 months”, she mentioned.

‘Stagflation’ fears

Reeves will tackle Parliament together with her Spring Assertion in Parliament on Wednesday afternoon, with additional cuts to welfare spending anticipated.

She can be anticipated to verify a downgrade to official financial development predictions.

Some economists have raised considerations about the potential of ‘stagflation’, the place costs rise quicker than the central financial institution’s goal however the economic system fails to develop.

“Financial development is miniscule and dangers going backwards, however ought to inflation proceed to refuse to get again close to the two% goal, it’s tough to see what the Financial institution of England can do with rates of interest,” mentioned Lindsay James from wealth supervisor Quilter.

Chief Secretary to the Treasury Darren Jones mentioned the federal government’s “primary mission is kickstarting development” and pledged to go “additional and quicker on development by means of our plan for change”.

Shadow chancellor Mel Stride mentioned the Conservatives left authorities in July “with inflation bang heading in the right direction” and urged Reeves take “pressing motion” in her Spring Assertion or “working households will proceed to pay the value”.

The Liberal Democrats mentioned the inflation determine “will likely be of no consolation to the hundreds of thousands of households throughout the nation who’re struggling”.