UK rates of interest held as Financial institution of England says financial system doing worse

Getty Photos

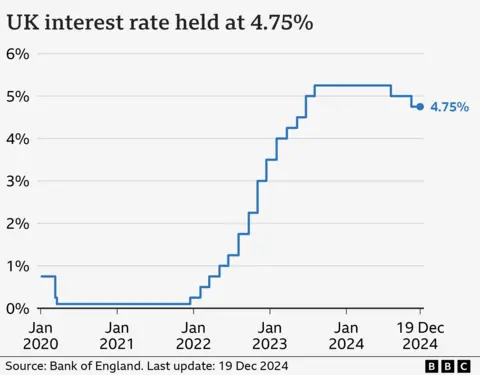

Getty PhotosUK rates of interest have been held at 4.75% after the Financial institution of England voted to maintain borrowing prices unchanged.

In an surprising cut up, three members of the nine-member rate-setting committee wished to chop charges to 4.5% to spice up progress.

The Financial institution stated it thought the financial system had carried out worse than anticipated, with no progress in any respect between October and December.

Charges are nonetheless anticipated to fall regularly subsequent yr, with the primary reduce probably coming in February.

Commenting on the choice, Financial institution governor Andrew Bailey stated: “We predict a gradual method to future rate of interest cuts stays proper however with the heightened uncertainty within the financial system we won’t decide to when or by how a lot we are going to reduce charges within the coming yr.”

Talking later to reporters, Mr Bailey stated he thought the trail for rates of interest was “downwards”, however added: “The world is just too unsure.”

“We are going to come again in February at our subsequent assembly and evaluation it [interest rates] once more.”

Figures this week confirmed that each inflation was larger than the Financial institution’s goal and wages had been rising quicker than anticipated.

However the financial system is struggling. Final month, the Financial institution forecast progress of 0.3% within the closing three months of the yr, nevertheless it now expects 0%.

The revisions will probably be a blow to Labour which has made boosting financial progress its high precedence.

It has promised to ship the very best sustained financial progress within the G7 group of wealthy nations.

Within the minutes from the assembly, the Financial institution stated there was uncertainty “round how the measures that had been introduced within the autumn Funds had been affecting progress”.

Within the Funds, Chancellor Rachel Reeves introduced £40bn price of tax rises, nearly all of which is able to come from a rise in Nationwide Insurance coverage contributions from employers.

By the point of the Financial institution’s subsequent determination in February, it is going to have extra information on the influence of the Funds modifications, in addition to Donald Trump’s incoming US commerce tariff insurance policies.

Following the Financial institution’s determination, Chancellor Rachel Reeves stated: “We need to put more cash within the pockets of working folks, however that’s solely doable if inflation is steady and I totally again the Financial institution of England to realize that.”

Liberal Democrat Treasury spokesperson Daisy Cooper MP stated: “The brand new authorities must work a lot more durable if it will flip the financial system round any time quickly.

“That should begin by scrapping the self-defeating jobs tax which guarantees to make the disaster in well being and care even worse.”

Ruth Gregory, deputy chief UK economist at Capital Economics, stated the Financial institution’s policymakers had appeared “to have been extra open to chopping rates of interest this month than we had anticipated”.

She stated the feedback advised “that the Financial institution will reduce charges faster than buyers anticipate”.

‘Home costs are extremely excessive’

Danny McGuire, who lives together with his dad and mom in Warrington, Cheshire, wish to get on the property ladder, however the deposit measurement and the shortage of properties inside his finances vary has made it tough for him.

“The concept of proudly owning your personal house is preferable to renting for myself,” stated the 33-year-old, who works for an area council, however added “common home costs are extremely excessive”.

Sarah Coles, head of non-public finance at Hargreaves Lansdown, stated for folks seeking to safe a fixed-rate mortgage deal, “the very fact the market is pricing in fewer cuts between now and the top of 2025 means we’re prone to see mortgage charges rise barely from right here”.

“Mortgage charges have fluctuated over the previous month, because the market struggled to make its thoughts up in regards to the path of future charge cuts. With a lot uncertainty round, it may be a good suggestion for anybody with a looming remortgage to safe a charge now,” she added.

&w=1200&resize=1200,0&ssl=1)