UK rates of interest will go down regularly, says Financial institution of England

Enterprise reporter, BBC Information

Getty Photos

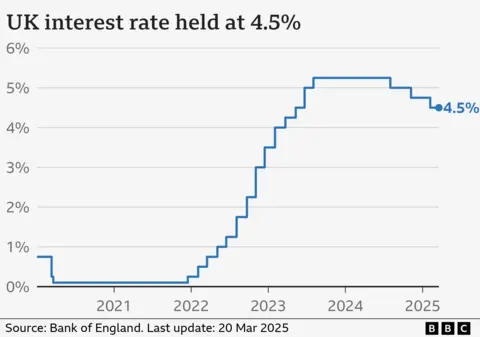

Getty PhotosThe Financial institution of England has warned financial and world commerce uncertainty has “intensified” because it held UK rates of interest at 4.5%.

US commerce tariffs and retaliation to the import taxes from the likes of the EU have created uncertainty for international locations, the Financial institution stated.

Its choice to carry charges was broadly anticipated, however governor Andrew Bailey stated the Financial institution nonetheless believed charges had been “on a regularly declining path”.

Economists are predicting two extra charge cuts by the tip of the yr, with many suggesting the subsequent may are available Could.

Mr Bailey reiterated it was the Financial institution’s job “to make it possible for inflation stays low and steady”. Inflation, which measures the speed at which costs rise, at the moment stays above the Financial institution’s 2% goal, at 3%.

The Financial institution’s Financial Coverage committee (MPC), which units charges, voted by a majority of eight to at least one in favour of holding at 4.5%.

The bottom rate of interest dictates the charges set by Excessive Road banks and lenders. The comparatively increased stage in recent times has meant individuals are paying extra to borrow cash for issues like mortgages and bank cards, however savers have additionally obtained higher returns.

About 600,000 owners have a mortgage that tracks the Financial institution’s charge, so the most recent choice is not going to have any quick affect on month-to-month repayments.

Greater than eight in 10 clients have fixed-rate offers, so that they face increased compensation prices when offers finish.

Mortgage charges have been edging down just lately. On Thursday, the common two-year fastened mortgage charge was 5.33%, whereas the common five-year repair was 5.18%.

‘I am petrified concerning the subsequent 5 years’

Louise Gibson, who lives in a one-bedroom flat in Epsom, Surrey, is going through a lot increased repayments when her five-year fastened charge mortgage at 1.52% ends in October.

The volunteering supervisor stated she was already chopping again her spending by going out much less with buddies and to the theatre.

“I am petrified about what the subsequent 5 years will appear like and I don’t know about how I’m going to seek out a whole lot of kilos further to pay for my mortgage,” the 46-year-old stated.

Ms Gibson stated she was contemplating extending her mortgage time period to cut back her month-to-month funds.

Whereas inflation is way decrease than in recent times, households are nonetheless feeling the ache of upper costs and are set to be hit by a bunch of upper payments for water, vitality and council tax from April.

Direct debit failures elevated by 2% in February in contrast with January, pushed partly by individuals lacking mortgage and mortgage repayments, based on the Workplace for Nationwide Statistics.

‘Exporters are nervous’

Commerce tariffs imposed by the US additionally threaten to push up costs for UK companies exporting throughout the Atlantic. The Financial institution stated most companies had been in “wait and see” mode, as additionally they face a hike in Nationwide Insurance coverage contributions (NICs) subsequent month.

The Financial institution stated UK exporters had been “nervous” of the potential affect of tariffs.

“We’ll be trying very intently at how the worldwide and home economies are evolving,” Mr Bailey stated.

US President Donald Trump has imposed a variety of tariffs on billions of {dollars} value of products coming into the US from a few of its high buying and selling companions, sparking a commerce battle with the likes of the EU and Canada.

Trump has argued the measures will enhance American business however with tariffs being paid by the home firm importing items, economists say the measures may result in value rises for shoppers.

The Financial institution stated extra companies had been pausing or freezing hiring within the wake of tax rises and a few had in the reduction of on funding plans. It added pay progress for employees was set to ease over the yr.

There have been three charge cuts since August 2024 after earlier hikes to attempt to fight excessive inflation, which was pushed by vitality and meals costs hovering within the aftermath of the Covid pandemic and the battle in Ukraine.

Mr Bailey stated the Financial institution anticipated a “little bit of a pick-up” in inflation this yr however added it could regularly fall over time.

“We’ve to be fairly cautious at this level,” he stated, when questioned why charges had not been minimize on Thursday.

The speculation behind growing rates of interest to sort out inflation is that by making borrowing costlier, extra individuals will in the reduction of on spending and that results in demand for items falling and value rises easing.

However it’s a balancing act as excessive rates of interest can hurt the financial system as companies maintain off on investing in manufacturing and jobs.

The Financial institution has forecast inflation to rise additional this yr to three.7%, and keep above its 2% goal till the tip of 2027.

It beforehand halved its financial progress estimate for the yr in a blow to the federal government, which has made rising the financial system its most important precedence.

Chancellor Rachel Reeves stated there was “nonetheless work to do to ease the price of residing”, including she was “decided to go additional and quicker” to kickstart financial progress.

However shadow chancellor Mel Stride stated Reeves’s Funds in October was accountable for inflation remaining above the Financial institution’s goal.

Liberal Democrat treasury spokesperson Daisy Cooper referred to as on Reeves to reverse her choice to extend NICs for employers, arguing financial progress was being “snuffed out”.