Why are bond yields rising and the way does it have an effect on me?

Getty Photos

Getty PhotosWhat’s taking place within the bond markets?

A bond is a bit like an IOU that may be traded within the monetary markets.

Governments usually spend greater than they elevate in tax so that they borrow cash to fill the hole, normally by promoting bonds to traders.

In addition to ultimately paying again the worth of the bond, governments pay curiosity at common intervals so traders obtain a stream of future funds.

UK authorities bonds – often known as “gilts” – are usually thought-about very protected, with little danger the cash won’t be repaid. They’re primarily purchased by monetary establishments, corresponding to pension funds.

Rates of interest – often known as the yield – on authorities bonds have been going up since round August.

The yield on a 10-year bond has surged to its highest stage since 2008, whereas the yield on a 30-year bond is at its highest since 1998, that means it prices the federal government extra to borrow over the long run.

The pound has additionally fallen in worth towards the greenback over the previous couple of days. On Tuesday it was value $1.25 however is presently buying and selling at $1.23.

Why are bond yields rising?

Yields are rising not simply within the UK. Borrowing prices have additionally been going up within the US, Japan, Germany and France, as an example.

There’s an excessive amount of uncertainty round what is going to occur when President-elect Donald Trump returns to the White Home later this month. He has pledged to usher in tariffs on items getting into the US and to chop taxes.

Traders fear that this can result in inflation being extra persistent than beforehand thought and subsequently rates of interest won’t come down as rapidly as they’d anticipated.

However within the UK there are additionally issues concerning the economic system underperforming.

Inflation is at its highest for eight months – hitting 2.6% in November – above the Financial institution of England’s 2% goal – whereas the economic system has shrunk for 2 months in a row.

Analysts say it’s these wider issues concerning the energy of the economic system that’s driving down the pound, which generally rises when borrowing prices enhance.

How does it have an effect on me?

Chancellor Rachel Reeves has pledged that every one day-to-day spending ought to be funded from taxes, not from borrowing.

But when she wants extra money to pay again larger borrowing prices, that makes use of up extra tax income, leaving much less cash to spend on different issues.

Economists have warned that this might imply spending cuts which might have an effect on public companies, and tax rises that might hit folks’s pay or companies’ potential to develop and rent extra folks.

The federal government has dedicated to having just one fiscal occasion a yr, the place it might elevate taxes, and this isn’t anticipated till the autumn.

So if larger borrowing prices persist, we could also be extra more likely to see cuts to spending earlier than that or not less than decrease spending will increase than would in any other case occur.

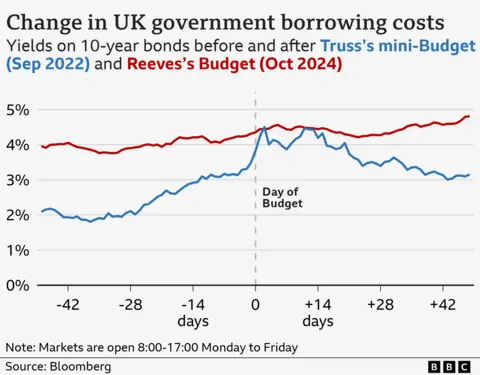

Some folks could also be questioning concerning the impression of upper gilt yields on the mortgage market, significantly after what occurred after Liz Truss’s mini-Funds in September 2022.

Though yields are larger now than they have been then, they’ve been creeping up slowly over a interval of months, whereas in 2022 they shot up over a few days.

That speedy rise led to lenders rapidly pulling offers whereas they tried to work out what rate of interest to cost.

Analysts and brokers say the present unease within the markets is having some impact on the pricing of mortgages. Many have been anticipating to see some falls in charges initially of the yr however as an alternative lenders are holding off from cuts to see what occurs.

Nonetheless, the market is beneficial to anybody presently shopping for an annuity – a retirement earnings for the remainder of their life, purchased solely as soon as.

One annuity knowledgeable instructed the BBC many individuals would get a greater deal now than at any time since 2008.

What occurs subsequent?

The Treasury has mentioned there is no such thing as a want for an emergency intervention within the monetary markets.

It has mentioned it won’t make any spending or tax bulletins forward of the official borrowing forecast from its impartial watchdog, the Workplace for Funds Duty (OBR), due on 26 March.

If the OBR says the chancellor remains to be on observe to satisfy her self-imposed fiscal guidelines then that may settle the markets.

Nonetheless, if the OBR have been to say due to slower progress and higher-than-expected rates of interest, the chancellor have been more likely to break her fiscal guidelines then that may probably be an issue for Reeves.

&w=1200&resize=1200,0&ssl=1)