Will Trump’s tariffs usher in a recession?

Gantry cranes stand as containers stack under at Brani Terminal, operated by PSA (Port of Singapore Authority) Worldwide Pte, Singapore on April 12.

| Picture Credit score: Getty Pictures

The U.S. has been the best champion of free commerce and the chief architect of globalisation because the center of the twentieth century. Nonetheless, in a shocking reversal of roles, U.S. President Donald Trump unleashed a carpet bombing of the worldwide buying and selling system on April 2, which he declared as “Liberation Day”.

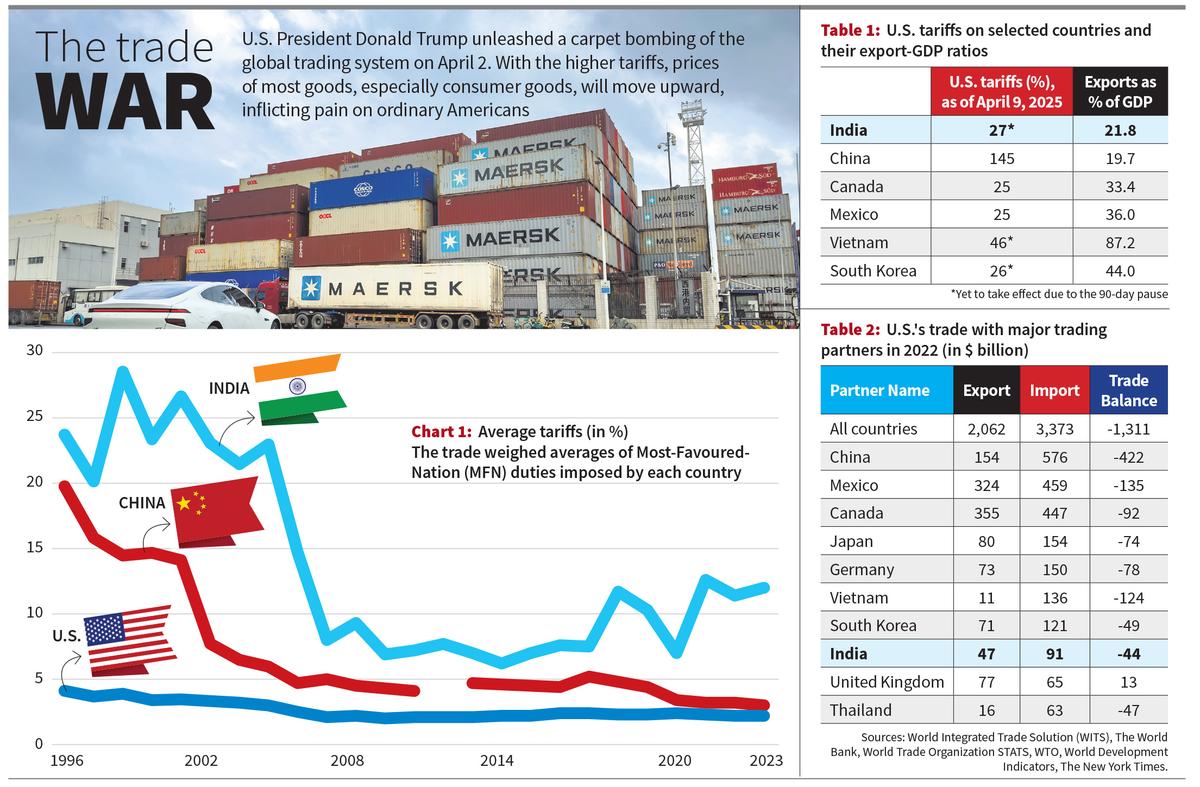

The U.S. tariff, or the tax America levies on imports from different nations, was 2 to three% for 20 years till 2024 (Chart 1). Nonetheless, President Trump declared on April 2 that the U.S. would henceforth be charging a minimal of 10% tariff on all its imports. Imports from about 60 nations could have a considerably higher-level tariff — which is being described as “reciprocal” tariffs. These embrace tariffs of 20% on the European Union (EU), 27% on India, and 46% on Vietnam.

Tariffs of 25% had been imposed in February itself on Mexico and Canada, the U.S.’s neighbours and two of its largest buying and selling companions. However the largest jolt has been the tariff imposed on China, which provides one-sixth of all international items the U.S. consumes. Imports from China to the U.S., as of April 11, will now face tariffs of 145% (Desk 1).

The markets recoiled with horror on the scale of the tariff will increase and their uncertainty. Inventory markets nosedived. China has retaliated, returning every tariff blow with equal ferocity. It has imposed 125% tariffs on imports from the U.S. There’s a distinct risk that the U.S. and the world are heading in the direction of a painful financial recession. On April 9, President Trump reversed a few of his choices, asserting a 90-day pause on “reciprocal” tariffs for many nations whereas insisting that the steep tariffs on China would take fast impact.

A commodity with a price ticket of $100 imported from (say, Vietnam) would have price $103 within the U.S. market if tariffs had been 3%. Nonetheless, the identical good should be bought for $146 when the newly introduced tariffs take impact. Tariffs shield home industries from international competitors however could result in value will increase.

‘Make America Nice Once more’

With its excessive per capita revenue and low tariffs, the U.S. has been the biggest export marketplace for items from automobiles to computer systems, aiding the creation of producing jobs in a number of nations. In 2022, China exported items price $576 billion to the U.S., however the U.S., in return, may promote solely $154 billion price of products to China (Desk 2). General, the U.S. had a commerce deficit of $1,311 billion, or 5% of its gross home product (GDP), in 2022. America has managed to proceed shopping for extra from the world than what it sells due to the greenback’s place because the dominant worldwide forex. That’s primarily because of China, which continues to again dollar-denominated property, storing vital parts of its massive export surpluses in U.S. treasury bonds. Such a mutually useful relationship between the 2 largest financial powers has been the important thing driver of the globalisation of commerce and finance because the 2000s.

Nonetheless, globalisation creates inequalities not solely within the growing but in addition within the developed world. Within the U.S., sectors reminiscent of metal and cars have been among the many most hit by import competitors.

The resentment of the employees in these sectors — a lot of whom are white, middle-aged males — has been one of many elements that helped propel Mr. Trump to the U.S. presidency in 2016 and once more in 2024. President Trump has promised to revive U.S. manufacturing, defending it from rivals who, in earlier years, had been allowed to “rip off” America with their imports.

Indisputably, President Trump is taking part in with hearth. With the upper tariffs, costs of most items, particularly shopper items, will transfer upward, inflicting ache on atypical Individuals. It’s uncertain if American companies can carry their manufacturing capabilities to serve at the very least part of the demand created for them by making imports costlier.

China’s gamble

China has vowed to “combat until the tip” in what could grow to be a protracted and bitter commerce battle. Such bravado is backed by the truth that China has been quietly making ready for such a showdown for over a decade, progressively decreasing its dependence on the U.S. financial system. The proportion of exports to GDP has declined steeply in China, from 35% in 2012 to 19.7% in 2023. As a proportion of its complete exports, China’s exports to the U.S. have fallen, too, from 21% in 2006 to 16.2% in 2022. China has invested massively in science, know-how, and innovation, significantly in synthetic intelligence and electrical automobiles. This has been completed partly in response to the U.S.’s restrictions on know-how switch to China. China bypassed U.S. tariffs earlier by shifting manufacturing to its East Asian neighbours (particularly Vietnam), with which it constructed deep financial networks.

India’s choices

President Trump calls India a ‘tariff king’, referring to the marked enhance in India’s tariffs since 2018 (Chart 1). The largest chunk of India’s exports is bought to the U.S. ($91 billion in 2022), and they’re important for assembly the nation’s massive import invoice. Due to this fact, any discount in India’s export earnings following tariff escalation will probably be keenly felt. On the similar time, as exports type a comparatively small share (21.8%) of its GDP, the impression of the tariff will increase could also be much less in India than in lots of different nations (Desk 1). Additionally, there was no enhance in tariffs on prescription drugs and companies, two of India’s main export gadgets to the U.S.

The narrowness of its manufacturing capabilities is the most important hurdle for India. Tariff safety and the Manufacturing Linked Incentive Scheme haven’t been adequate to revive this sector. India wants a clear-cut industrial coverage and a resurgence in investments to flee the unfolding international turmoil.

Jayan Jose Thomas is a Professor of Economics on the Indian Institute of Expertise (IIT) Delhi.

Revealed – April 14, 2025 08:30 am IST